Introduction

After two consecutive years of decline — the longest stretch in over a decade — private equity (PE) experienced a sizable rebound in 2024. Despite a complex political and macroeconomic landscape, the mergers and acquisitions (M&A) market exhibited robust dealmaking momentum, which spanned across various sectors.

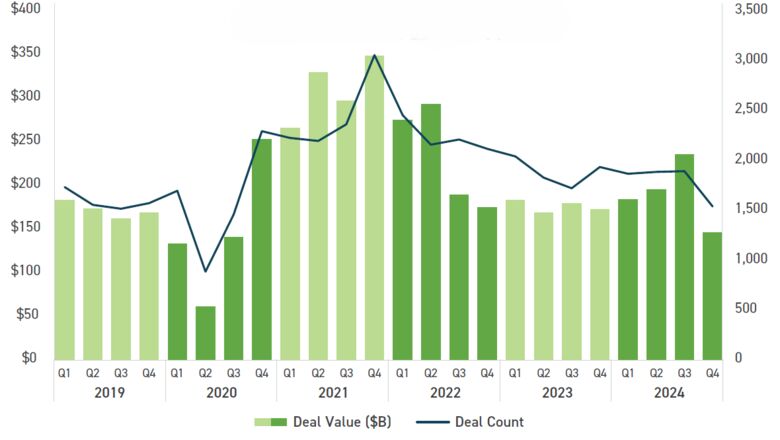

Growth in Deal Counts & Values

In 2024, U.S. private equity activity was significantly higher than the previous year, when deal activity shrunk 16% by count and a whopping 25% in aggregate value. This is a remarkable reversal of fortunes on a year-over-year (YoY) basis when there were concerns about the health and resiliency of the industry.

Those concerns have quieted in light of the industry’s strong performance and palpable optimism about a possible surge in deals and exits in the near term. YoY, deal value increased 19.3% from 2023, reaching $838.5 billion, while deal count grew by 12.8% to 8,473, encompassing growth equity transactions, add-on acquisitions and platform buyouts. Just as noteworthy, deal activity, both in terms of the number of deals completed and their aggregate value, also surpassed 2019 levels, which is widely viewed as a watershed year for the industry just before the onset of the global COVID-19 pandemic.

U.S. Private Equity Deal Activity

As of 12/31/2024

Megadeals Resurge

As a percentage of total deals, add-on deals experienced a slight downward movement. This points to a greater number of large deals being completed. In fact, megadeals made a comeback in 2024 as firms took advantage of the improving M&A market to put the industry’s massive undeployed capital to work.

Private equity firms announced or completed 18 megadeals valued at $5 billion or above in 2024, more than double the prior-year total and the fourth-highest annual tally since 2000, according to S&P Global. The challenging macro environment of the past few cycles made larger deals increasingly more difficult to execute, especially with respect to financing. With improving conditions, megadeals were executed at a near-record pace in 2024 which had a strong impact on overall aggregate deal value.

Industry Sector Growth

Increased deal activity was also observed across many major industries, including technology, healthcare, professional services and industrials (which outpaced much of the market before cratering in Q4). Technology, particularly software-as-a-service (SaaS), played a pivotal role in the overall resurgence, as software deal value surged 32.4% YoY, and 27.5% by deal count. This reflects a broader flight to quality as general partners (GPs) pursued assets offering strong cash flows, high-margin profiles and superior growth trajectories.

Similarly, the healthcare sector showed resilience after several years of decline due to a combination of macroeconomic and regulatory factors. In 2024, healthcare deal value rose 17.7% YoY, and aggregate deal value grew 3.7%, reversing the double-digit annual losses experienced since peaking in 2022.

2025 Is Ripe With Opportunity

The broad-based nature of the recovery, when coupled with a potentially strong economic tailwind, could signal that the worst of the downturn and the most destabilizing period in private equity since the great financial crisis is likely behind us. That leads to optimistic views that private equity might be readying for a prolonged stretch of growth and expansion.

“The private equity landscape is poised for continued growth and opportunity in 2025, fueled by innovation, strategic investments and dynamic market conditions. Funds that embrace the challenges and seize the opportunities, will likely be rewarded.”

2024 Private Equity Report: Key Findings

- Private equity deal value grew 19% YoY, hitting the highest mark in two years.

- Valuation gaps are closing, leading to the completion of more deals, which suggests improved exit activity on the horizon.

- The exit market is improving but is not yet at the levels anticipated or necessary to trigger a full recovery. All signs point to a potential exit volume explosion in 2025.

- Megadeals are back and rivaling the record levels experienced in 2021.

- The technology sector drew significant PE interest in 2024, accounting for more than 20% of total buyout value.

- Healthcare private equity surged in 2024, spurred by healthcare information technology and biopharma megadeals, proliferation of add-ons to support platforms and investments in strategic carve-out acquisitions.

- Markedly improved financing conditions played a key role in increased deployment activity, as both traditional lenders and private credit funds actively competed for deals amid a widening risk appetite.

- With 100 basis points of rate cuts already in place, and more anticipated, private equity dealmakers are eyeing improved financing conditions, stronger portfolio company cash flows and a narrowing bid-ask spread, setting the stage for a more robust M&A rebound in 2025.

Private Equity Trends Across M&A Landscape

Easing Macroeconomic Conditions Spurred Deal Activity

After several cycles of ballooning interest rates in response to record-high inflation, the Federal Reserve (Fed) cut interest rates in 2024 for the first time since March 2022 when the Effective Federal Funds Rate (EFFR) was 0.33%. The EFFR climbed quickly over the succeeding 12 months, peaking at 5.33% in 2023, creating significant challenges for private equity investors over that period.

As 2024 approached, the consensus was that private equity could adapt to the new macroeconomic normal as long as the contours of that environment became clearer. In theory, Fed action to lower rates after a prolonged period of unusually high rates would create that needed clarity and deals would consequently skyrocket.

However, the higher-for-longer sentiment remained in place for much of 2024 as rate cuts arrived later than hoped, leaving the first half of 2024 looking more like an extension of 2023. The EFFR stayed at the 5% mark for most of the year until the Fed lowered the interest rate in September. The agency has since made back-to-back reductions, bringing the EFFR to 4.33%, the lowest level in over two years.

U.S. Private Equity Deal Activity by Quarter

As of 12/31/2024

Despite the delayed Fed action on interest rates, the market gained momentum in the latter half of the year as financing conditions eased, bolstered by private equity’s focus on add-on strategies and sector-specific growth trends. In the lower middle market, where roll-ups accounted for over 80% of all deals, PE drove deal volumes by consolidating fragmented markets and targeting family-owned and founder-led businesses. Lower rates also made it cheaper for firms to borrow money, which led to increased deal volume, higher valuations and greater appetite for leveraged buyouts, essentially creating a more favorable environment for firms to pursue acquisitions.

Exits

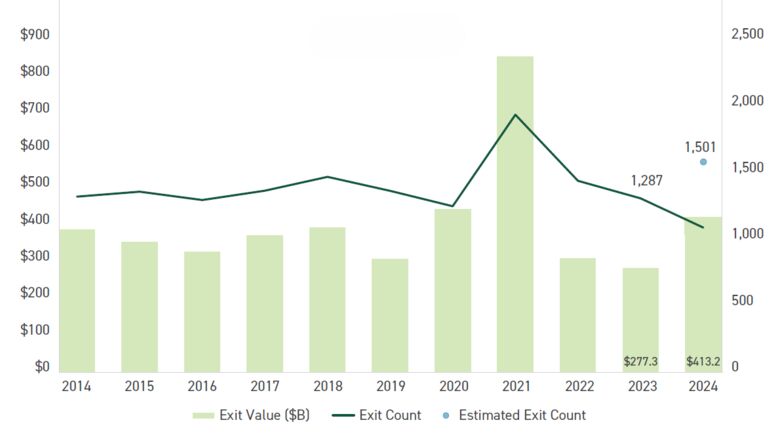

Exit Activity Rose Significantly Despite a Challenging Environment

After a two-year lull in exit activity, private equity exits increased considerably in 2024. However, they remained well below the record levels of 2021, when exit value approached the trillion-dollar territory. Exit activity is the lifeblood of fund succession and sustainability as proceeds from exits lead to recycled capital from limited partners (LPs) into next-generation funds.

While 2024 exit value was less than half of what it was in 2021, the $413 billion in exits nevertheless represented an 82% increase YoY. While traditional exits, such as initial public offerings (IPO), virtually disappeared over the past few years, sponsors successfully utilized alternative exits, such as sponsor-to-sponsor sales, minority investments and continuation funds, as well as other liquidity events, like leveraged dividends, to meet their strategic divestment objectives.

U.S. Private Equity Exit Activity

As of 12/31/2024

U.S. Private Equity Exit Activity by Quarter

As of 12/31/2024

Rather than growing consecutively, quarterly exit activity bounced up and down throughout 2024, reflecting a still-shaky exit environment. However, two consecutive quarters of strong exit activity to close out the year resulted in a substantial 49% increase by value YoY. The aggregate exit value in Q4 was the strongest single quarter in three years. The rebound may be reflective of the broader trend of private equity sellers bringing their highest-quality assets to market to secure favorable exits while holding off on the rest of their portfolios during a strained market period.

Additionally, this is an indication that PE investments over the past two years into portfolio transformation and optimization strategies can, in fact, contribute to improved valuations at exit.

Despite the much-welcome increase in exit activity, U.S. private equity inventory remains at an all-time high, swelling from nearly 3,000 companies in 2018 to a total of 11,808 by Q4 2024. This translates to almost an eight-year inventory at the currently observed pace of 1,500 exits per year. While the rebound in exit activity is encouraging, significant acceleration is needed to compensate for lost time.

The median holding period for a private equity-backed company reached an all-time high of seven years in 2023 but experienced a dramatic decline in 2024 to 5.9 years, according to Pitchbook data. The cumulative median exit hold time of 5.4 years was flat YoY, but still well above the historic average. Longer hold times have resulted in a sluggish exit market with a disproportionate amount of value left on the table, especially for GPs retaining less mature assets.

The challenging exit market and elongated holding periods have also slowed the return of cash to investors and hobbled private equity’s ability to raise new funds. According to Pitchbook, private equity firms hold more than 28,000 assets, 40% of which have been held for longer than four years. Amid the macro turbulence of the last two years, firms were highly focused on managing liquidity, implementing transformation and optimization programs, and undertaking cost reduction initiatives. While those areas remain high on firms’ agendas, top-line growth has moved to the top of the priority stack.

Median Private Equity Company Hold Times in Years

As of 12/31/2024

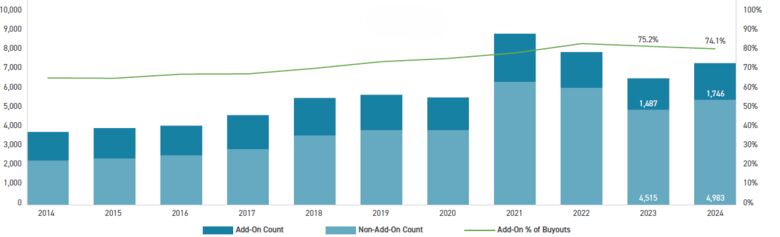

Add-ons as a Share of All U.S. Private Equity Buyouts

As of 12/31/2024

Add-Ons

Add-Ons Dipped Slightly, Remaining Vital to Optimization Strategy

While the total value of U.S. private equity M&A has declined significantly since 2021, the overall number of deals has remained relatively steady. Much of this can be attributed to the growing trend of increasing add-on deals over the last decade.

Smaller add-on deals have become a primary driver of private equity M&A in the past 10 years. In 2014, add-ons represented roughly 59% of total private equity deal count. By 2022, that number ballooned to nearly 80%. Since then, add-on deals have moderated slightly, accounting for a still significant 74% of all deals. The elevated activity indicates that GPs continue to focus on consolidation and operational synergies.

As deal volume picks up due to improving macro conditions, it is anticipated that add-on deals will make up a declining share of deals, gradually reverting to historical averages.

Technology and healthcare continue to be the top two industries seeing the most add-on deal activity, with 616 and 550 deals, respectively. In healthcare, add-ons are usually roll-ups of smaller entities, like individual facilities and centers, that are easy to integrate into a larger network.

Technology add-ons typically take the form of tuck-in deals, which involve small companies with products or services that the buyer can seamlessly integrate into its larger offerings. The consumer residential services sector is the newest entrant into private equity’s tried-and-true roll-up strategy to consolidate businesses operating within a highly fragmented market.

Add-on acquisitions also made up a significant share of deal activity in the highly fragmented professional services sector, including CPA, wealth management and consulting firms, and continues to be an industry to watch in 2025 and beyond.

Carve-Outs

Carve-Outs Provided PE Access to Undervalued Assets

Private equity funds have increasingly embraced carve-out transactions as a strategic maneuver to unleash untapped value within their portfolio companies. These transactions involve sellers divesting non-core business units, allowing PE funds to reshape and revitalize their portfolio companies with an eye toward a more profitable exit in the future.

While private equity deal activity was up overall in 2024, the M&A ecosystem remains fragile. Examining the recovery on a count basis suggests that the rebound was mostly driven by transactions from top-tier assets and outsized technology deals. This indicates continued weakness elsewhere in the deal market. As such, many private equity funds were compelled to evaluate their investments and focus on enhancing the fundamental operations of their portfolio companies by pursuing corporate carve-outs and divestitures to sure up core assets, particularly as traditional exit channels remained clogged.

Carve-outs accounted for 11.8% of all U.S. private equity buyouts in Q4 2024, a sequential quarterly increase. This quarterly percentage of carve-outs as a share of buyouts is now at its highest point since Q4 2016, according to Pitchbook, cementing itself as a more prominent source of private equity deals in 2024. Moreover, this rise in quarterly carve-out deal activity saw the deal type sitting nearly 200 basis points above the 10-year quarterly average.

Carve-outs and Divestitures as a Share of All Private Equity Buyouts by Quarter

As of 12/31/2024

For 2025, it remains to be seen if improving economic conditions may cause corporate sellers to be less focused on balance sheet stabilization, thereby reducing the level of non-core business divestitures in comparison to the past two years.

Fundraising

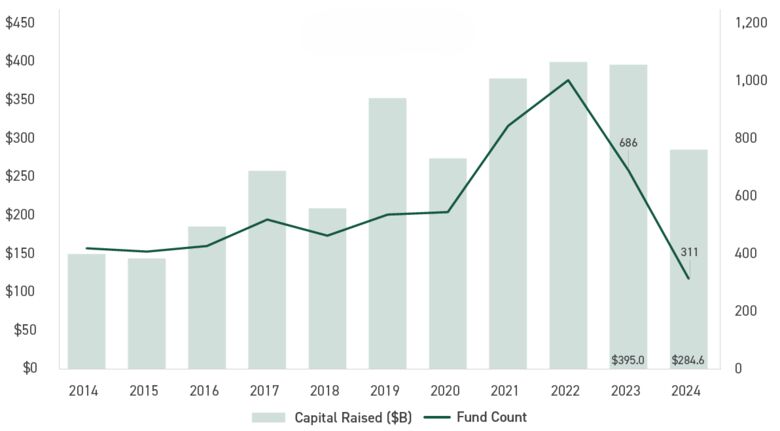

Experienced Managers Fared Well Amidst Record-Low Fundraising

The fundraising environment remains difficult, and 2024 produced the fewest number of closed funds since 2016. The year started out strong but fizzled in Q4, the weakest period of the year.

Again, much of the sluggishness of Q4 could be tied to uncertainty around the U.S. presidential election. However, broader liquidity issues and weak exit activity weighed heavily on fundraising throughout the year. In the end, private equity fundraising finished the year at $284.6 billion, significantly below the $395 billion mark set in 2023, experiencing one of its most lackluster years in over a decade.

U.S. Private Equity Fundraising Activity

As of 12/31/2024

While the number of funds raising capital fell significantly, the average amount raised by active funds was significantly higher YoY. It took nearly twice as many funds in 2023 to raise the equivalent value in 2024, and nearly three times as much in 2022. Overwhelmingly, experienced fund managers are benefiting from this trend. In fact, over 80% of PE funds closed at a larger size than their predecessor fund, the highest rate ever seen for the asset class and surpassing the five-year average of 73.1%.

Megafunds, or funds that raise $5 billion or more, continue to support private equity fundraising, accounting for 43.7% of all capital raised in 2024, while representing only 3.5% of fund count. Throughout the year, 10 megafunds closed on a combined $124.4 billion. Smaller funds, on the other hand, struggled to raise capital or did not return to the market in 2024. As consolidation among funds has intensified over the last decade, LPs are pledging more capital but tending to do so with fewer managers.

Amid this rocky environment, funds also spent much more time on the road. It took the average fund more than 16.2 months to close a fund through the end of 2024, up from 13.8 months in 2023 and 11 months in 2022, a trend that has persisted over the past few cycles.

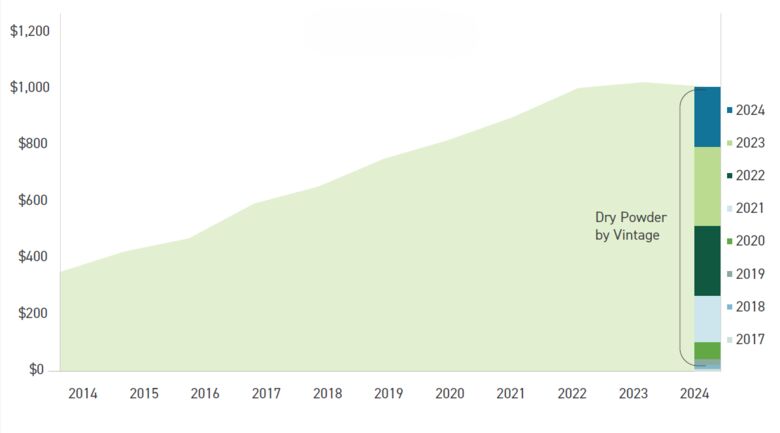

U.S. Private Equity Dry Powder ($B)

As of 6/30/2024

Technology Sector

Technology Sector Saw Sharp Recovery After Losing 50% of Value in 2023

The technology sector experienced a strong year in 2024, fueled by the rise of artificial intelligence (AI) and growing demand for automation. SaaS companies remained highly attractive to investors, particularly those with strong annual recurring revenue, high customer retention and scalable solutions.

Technology deals accounted for 23% of private equity deployment by value in 2024, up from 21% in 2023. In fact, technology accounted for the second-greatest share of total U.S. PE deal activity, behind only business-to-business (B2B). Technology investments also solidly outperformed the averages seen in the pre-pandemic era by over $50 billion in transaction value.

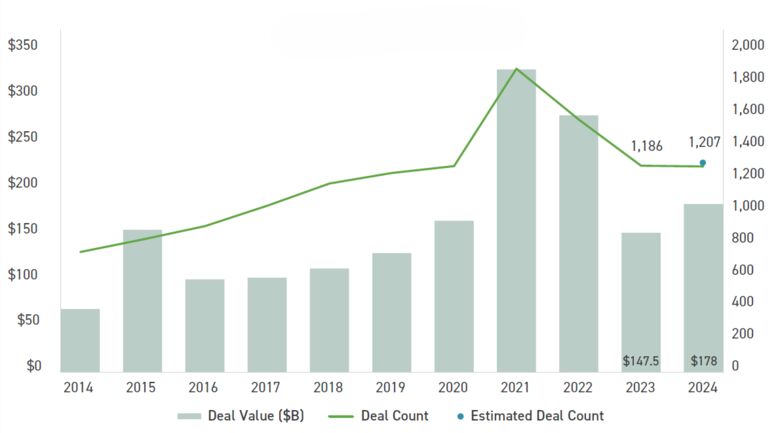

U.S. Technology Private Equity Deal Activity

As of 12/31/2024

Software companies’ ability to create competitive moats, sustain high profit margins and operate with relatively low capital expenditure requirements render them particularly resilient and attractive in a difficult dealmaking environment, as they can boast a quicker recovery than the broader private equity market. As such, the software segment is driving the broader technology sector’s rebound in deal activity. Throughout 2024, software PE deal value reached $134.8 billion, a YoY increase of 32.4% and touted 926 deals, an uptick of 27.5%.

Sectors like data infrastructure continue to attract significant attention. Blackstone’s $16 billion acquisition of AirTrunk (alongside CPPIB) represented one of the largest technology deals of 2024 and another in a string of deals driven by long-term secular themes, including companies’ continued transition to the cloud, growth in the Internet of Things (IoT) space and rapidly growing data needs from AI adoption.

“The technology sector was a bright spot in 2024, where annual recurring revenue SaaS companies shined as a beacon of stability and growth, offering a predictable revenue stream, scalability potential and enhanced valuation through long-term financial visibility and sustainability.”

Private Equity Technology Mega Deals in 2024

| Private Equity Sponsor | Target | Value | Announcement Date |

| Thoma Bravo | Darktrace | $5.3 billion | October |

| Blackstone | AirTrunk | $16.3 billion | September |

| Blackstone/Vista Equity | Smartsheet | $8.4 billion | September |

| Bain Capital | PowerSchool | $5.6 billion | June |

| EQT | Perficient | $3.0 billion | May |

| Advent | Nuvei Corp. | $6.1 billion | April |

| Nova Holdings | Catalent Inc. | $16.5 billion | February |

| Permira | Squarespace, Inc. | $7.3 billion |

January |

|

Source: Cherry Bekaert Private Equity |

|||

It is estimated, for example, that the data demands of generative AI (GenAI) applications could result in a fifty-fold increase in the number of workloads processed worldwide by 2028. Aggregately, 70% of GPs in a recent survey expected an increase in technology deals over the next six months, the most of any sector.

Industrials Sector

Industrials Sector Proved Reactive And Wary Of Macroeconomic Factors

The industrials sector experienced a surge in private equity investments to start the year, driven in part by the anticipation of a reversal of interest rates and cooling inflation. There were an estimated 1,800 PE deals with an aggregate value of $135 billion announced in 2024. Notably, half of all industrial deals involved either a strategic buyer or carve-out transaction in which a private equity portfolio company or a platform served as the buyer.

“Dealmaking in the industrials sector unveils a landscape rich with opportunities driven by capital investments, improving technology, easing financial pressures and a trend towards deregulation, as well as a focus on modernization and expansion efforts, all of which paves the way for transformative growth and sustainable value creation in 2025 and beyond.”

The industrials sector accounted for 21.2% of total deal activity by deal count during the period, a few percentage points lower than 2023 when it made up 24.5%. Much of the decline can be attributed to a sharp drop off in deal activity in Q4, after tracking slightly higher than other major industries for most of the year. Some fund managers, it seems, were inclined to sit on the sidelines in the face of uncertainty around the U.S. presidential election and the delayed, if not tepid, Fed action on interest rates.

U.S. Industrials Private Equity Deal Activity

As of 12/31/2024

Many of the macro challenges that impacted the sector in 2023 continued in 2024. Higher-for-longer interest rates, a persistent valuation gap between sellers and buyers, and credit and liquidity challenges all combined to curb the sector’s full potential. However, at year’s end, the prevailing sentiment among investors was upbeat and optimistic. This renewed economic confidence could lead to increased deal activity.

While it may be too soon to know what the full impact of the Trump administration’s tariffs policy will be on the industrials M&A landscape, many anticipate that the lapse or redaction of incentives from the Biden-era Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law will translate to more industrials and energy-adjacent assets coming to market from strategics and some private equity-backed sellers. Easing regulatory oversight will likely also lift financial performance metrics, which, when combined with potentially lower interest rates, could result in a more robust industrials deal market.

Healthcare Sector

Healthcare Deal Activity Poised for Resurgence

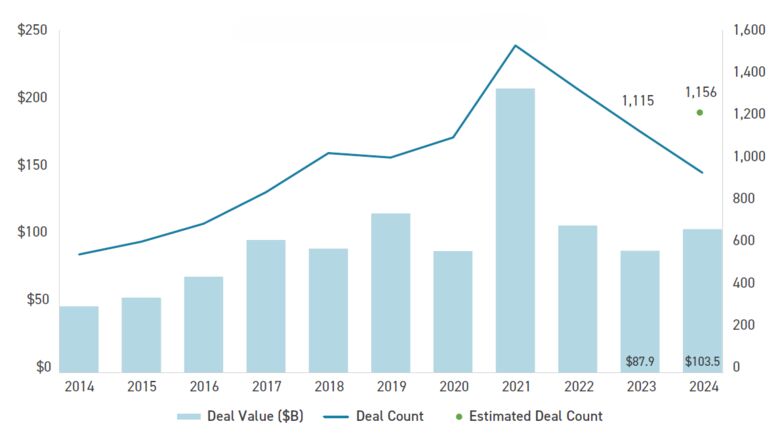

In 2024, private equity activity in U.S. healthcare soared to an estimated $104 billion. After late-reporting fund activity is accounted for, 2024 aggregate deal value is expected to be the second-highest deal value total on record.

Deal volume across the healthcare industry generally appears to have steadied despite headwinds. The general sentiment is that buyers have adapted to the current interest rate environment and are gritting their teeth and pressing forward — especially private equity investors who need to deploy their dry powder.

This surge was propelled by an increase in the number of large deals. In total, five transactions exceeded $5 billion, compared with two deals in 2023 and only one in 2022. Unlike past years, 2024 activity had fewer add-on deals, but larger platform acquisitions served as the foundation for a higher level of capital investment in the healthcare space.

U.S. Healthcare Private Equity Deal Activity

As of 12/31/2024

As noted in Cherry Bekaert’s 2024 mid-year report, PE’s investment in healthcare has seen increased regulatory scrutiny at both the state and federal levels, which has had a chilling effect on healthcare deal activity in the U.S. This increased scrutiny primarily surrounds the growing number of states proposing pre-closing notice requirements in connection with transactions involving management services organizations, including those that are PE-backed.

While regulatory concerns have certainly left many on their heels, investors were able to take a momentary sigh of relief after Oregon House Bill 4130 failed to pass in early 2024. This bill would have put heavy limitations on private equity investment in the state of Oregon.

“The ripple effect of easing healthcare regulations resonates in the private equity realm, fostering a landscape ripe with innovation, expansion and strategic investments, shaping a future where transformative growth and improved care delivery coexist harmoniously.”

All eyes quickly shifted to California and the state’s passage of Assembly Bill 3129 by the Senate Health Committee in June. The bill was eventually vetoed by Gov. Gavin Newsom in September. If enacted, the California bill would have granted sweeping approval power to the state’s attorney general for certain healthcare transactions involving private equity groups or hedge funds. The stated goals of the proposed legislation were to address healthcare practice acquisitions by private equity groups and hedge funds that, in the view of legislators, could lead to negative outcomes for consumers.

Currently, 15 states have healthcare transaction review laws, each with unique requirements. Typically, these laws mandate the pre-closing submission of detailed filings to state attorneys general or regulatory agencies. Parties must wait for a notice period to expire or receive approval before closing the transaction.

While most transactions are approved, some receive conditional approval, requiring adherence to ongoing requirements such as annual reporting and maintaining staffing levels. These reviews can significantly prolong transaction timelines, often by several months. Additionally, parties must submit substantial and potentially sensitive documents, which may become public.

With at least two state-level regulatory wins and the election of President Donald Trump, who is viewed as generally less hawkish on federal regulations, the regulatory pressure on the sector appears to be waning.

Other Sectors To Watch: Predicted Bright Spots in Private Equity

Consumer and Residential Services: Roll-Ups Provide Opportunity for Investors

Consistent with private equity’s specialization strategy to gain deeper industry-specific operating expertise and thus improving valuation over time, fund managers are pursing fragmented sectors ripe for consolidation. With many small and mid-sized independently operated companies, the consumer and residential services industry fits this mold.

Within this sector, PE investors see opportunities to consolidate these smaller players, achieve economies of scale, make transformative investments in technology and create larger, more efficient operations.

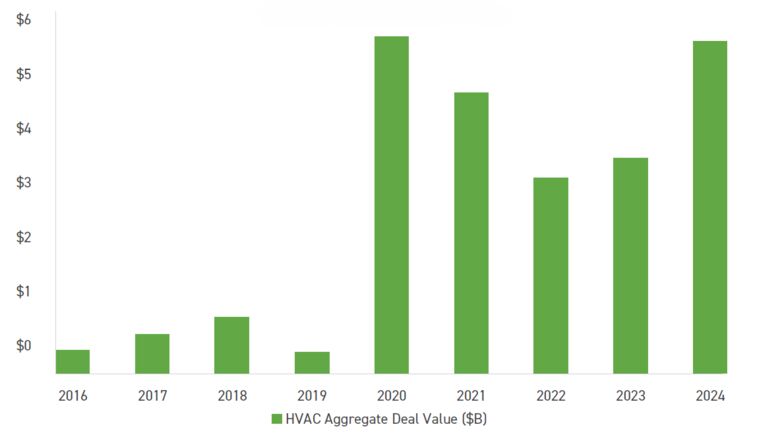

Companies operating in sectors such as heating, ventilation and air conditioning (HVAC), plumbing, electrical, pest control, landscaping, pool services (collectively referred to as field service businesses) and the like all exhibit the attractive characteristics that drive the private equity roll-up initiative.

Five years ago, only a limited universe of buyers were interested in these businesses, whereas today the interest has exploded. There are now three times as many buyers with active investments in the field service sector, and many more anticipated to join the growing chorus.

HVAC Private Equity Aggregate Deal Value

As of 1/31/2025

U.S. Consumer and Residential Field Services Private Equity Deals Since 2014 (By Number)

As of 1/29/2025

Additionally, strong cash flows generated from maintenance or service contracts mimic annual recurring revenue (ARR) associated with software companies. When combined with owners who often delay technology investments, private equity investors can further drive profitability with moderate advancements to achieve greater returns with less effort. The growing trend of smart buildings and IoT in the construction industry will also continue to influence the HVAC sector. Private equity investors may see potential in companies that are paving the way to integrate smart technologies into HVAC systems.

“Private equity investments in HVAC and other consumer services offer a promising blend of steady demand, technological advancements, and sustainable energy trends, creating a hotbed of opportunities for growth and value creation in 2025.”

Private equity investments in field service businesses are expected to remain strong in the coming year. The increasing focus on energy efficiency and sustainability is anticipated to drive demand for innovative technologies and solutions, which may trigger add-on acquisitions of companies developing cutting-edge products and services.

Professional Services: Stable & Predictable Revenue Streams Drive Interest

Private equity investors continue to show a keen interest in the professional services sector, including CPA, wealth management and consulting firms. They are drawn to the same key factors noted in the consumer services context: steady and predictable cash flow, scalability, consolidation of a fragmented market, specialized expertise and potential for technology-driven innovation.

While PE has typically avoided investing in people-based industries, recent advancements in technology have driven optimization and mechanization to boost output without additional human capital. With several investment cycles under its belt, private equity has demonstrated its ability to professionalize business operations to boost value accretion.

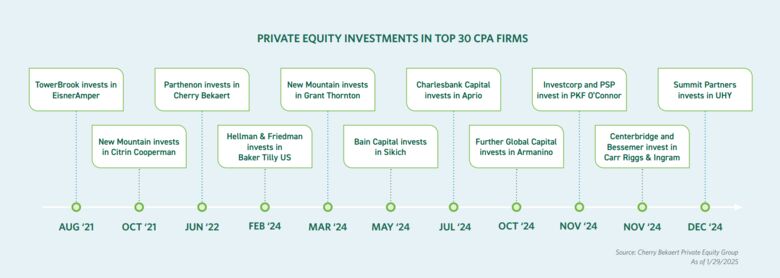

Overall, investments in the professional services industry have increased significantly in recent years, despite macro challenges, but investments in CPA firms are particularly notable. Since 2021, the landmark year of private equity’s splash in the tax and accounting sector with TowerBrook Capital Partners’ investment in EisnerAmper, PE firms have bought stakes in 11 of the top 30 U.S. accounting firms. Key 2024 activity in this sector includes:

- Aprio announces strategic growth investment from Charlesbank Capital Partners.

- Armanino accepts minority investment from Further Global.

- Baker Tilly US partnered with Hellman & Freidman in the largest PE investment into CPA firms, only to be surpassed three months later.

- Carr Riggs & Ingram secured strategic investment from Centerbridge Partners and became the youngest firm in the top 30 to receive PE funding.

- Cohen & Co announces a strategic investment from Lovell Minnick Partners.

- Grant Thornton received strategic investment from New Mountain Capital and surpassed the Baker Tilly deal to become largest PE/CPA firm investment to date.

- Sikich secures $250 million minority investment from Bain Capital.

- UHY announced growth investment from Summit Partners to support expansion.

While the timeline above illustrates investments in some of the largest CPA firms, it is worth noting platform investments have also trickled down to smaller firms as well. For example, Broad Sky Partners’ investment in Smith + Howard and Unity Partners’ investment in Prosperity Partners (formerly NDH), a Chicago-headquartered account firm.

By the end of 2025, more than half of the largest 30 U.S. accounting firms will have either sold an ownership stake or part of their business to private equity investors, up from zero in 2020,” said Allan Koltin, chief executive at advisory firm Koltin Consulting Group.

In October, Armanino LLP accepted a minority investment from Further Global Capital Management, the largest U.S. firm to date to sell a minority position, after Illinois-based Sikich secured its own minority investment from Bain Capital earlier that month. Additionally, in August of 2023, BDO USA established an Employee Stock Ownership Plan (ESOP), giving employees a stake in the business and making BDO the first large public accounting firm to implement an ESOP.

Private equity investments in CPA firms have not been limited to the U.S. In January 2025, Inflexion, a British PE firm, made a strategic investment in Baker Tilly Netherlands exemplifying the global nature of these transactions.

These investments paired with a plethora of strategic add-on acquisitions have allowed private equity firms to expand their portfolio company industry depth, client base, diversify service offerings and expand geographic reach, all while creating increased profitability and growth opportunities.

Early in 2025, New Mountain Capital announced the sale of Citrin Cooperman to Blackstone. This marked the first of the second turn events for the original round of CPA firms to receive a private equity investment. This transaction was purportedly valued at approximately $2 billion and marks the first significant exit in the sector. This solidified the underlying investment thesis of investing in CPAs, confirming that there is an exit avenue.

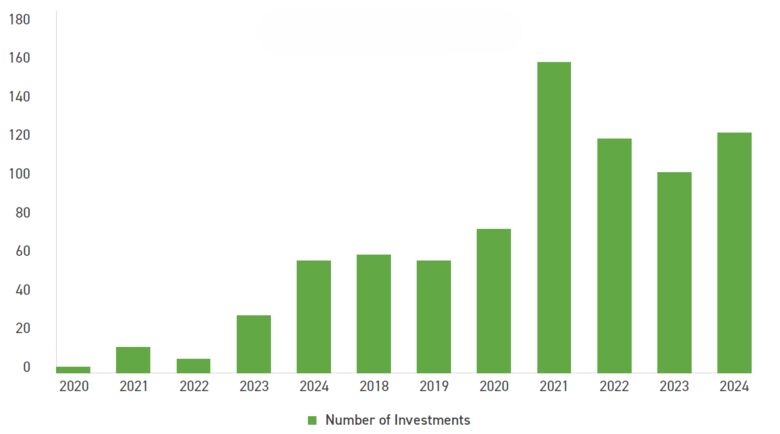

Artificial Intelligence and Machine Learning: Evolving Technologies Drive Global Change

Across industries, AI and machine learning (ML) are fundamentally transforming business operations and driving innovation. Private equity platform investments in AI and ML experienced a substantial surge over the last decade, with peak investment in 2021. The graph below shows the yearly number of private equity and venture capital platform and add-on investments in GenAI.

The value of PE and venture capital-backed investments in GenAI companies more than doubled in 2024, defying the slump in overall M&A activity. Funding in GenAI exceeded $56 billion in 2024 and almost doubled the funding in 2023 when GenAI companies attracted approximately $29 billion.

While the overall total value of the investments grew, the record funding amount supported fewer companies than the previous year, indicating a trend of investors consolidating around select winners. There were 171 rounds of investment in GenAI in 2024, down from 273 in 2023. Additionally, the average funding round size in 2024 soared to $407 million, compared to $133 million in 2023 and $33 million in 2022.

Private Equity Investment in AI & Machine Learning

As of 1/21/2025

Private Equity and Venture Capital Investments in GenAI

As of 1/21/2025

The GenAI market is expected to continue its torrid pace in 2025 and beyond as emerging markets such as India, Singapore and China enter the fray, competing fiercely with Silicon Valley. In late December, DeepSeek, a small Chinese start-up, unveiled a new GenAI system it claimed could match the capabilities of cutting-edge chatbots from companies like OpenAI and Google, using a fraction of the highly specialized computer chips that leading U.S. GenAI companies have relied on to train their systems. This is widely seen as a warning shot to the industry and the arrival of China as a legitimate AI competitor.

The U.S. government and the Trump administration have since announced up to $500 billion in private-sector AI infrastructure investments over the next four years. In a White House briefing soon after taking office in January, Trump said OpenAI, Softbank and Oracle are planning a joint venture called Stargate that will build “the physical and virtual infrastructure to power the next generation of AI,” including data centers around the country. To start, the companies will invest $100 billion in the project, with plans to pour up to $500 billion into Stargate in the coming years. The project is expected to create 100,000 U.S. jobs, according to the president.

Private Equity 2025 Outlook

- Private equity heads into 2025 with a degree of optimism, as both macroeconomic and regulatory conditions are generally expected to be more favorable for dealmaking. Driving this optimism is a convergence of favorable conditions: an easing monetary cycle, tighter credit spreads, relaxed regulation, pent-up dry powder and buoyant public equity markets.

- There is increasing pressure to exit as portfolio companies are beginning to grow long in the tooth. As more and larger funds approach the end of their life, financial sponsors face increasing pressure to return money to their LPs.

- Trump’s second term is expected to soften the regulatory environment, which will spur growth. Private equity and its acquisition strategies were a key focus for U.S. antitrust agencies during the Biden administration. The Trump administration is generally expected to be more amenable toward M&A.

- Near-record high levels of deployable capital, sponsors seeking liquidity events, and an improving macroeconomic environment are all combining to create the most optimistic outlook on dealmaking in five years.

- There are expectations for near-record levels of both PE and strategic investment in the energy sector to include the upstream, midstream and downstream sectors of oil and gas.

- The prospect of 10,000 deals and $1.0 trillion in aggregate transaction value in 2025, a feat that would top 2021’s record activity, is not entirely out of the question. However, exit challenges, an all-out tariff war and potential tax policy changes remain a serious threat.

- Increased competition in the direct lending market, combined with a return in bank underwriting spurred by lowering interest rates, will create an open credit market for sponsors.

- We expect 2025 to be a busy year for private equity dealmaking, with opportunities for sponsors to reap rewards from being nimble and creative in executing thoughtfully structured deals.

Your Guide Forward

If you have any questions about the 2024 private equity year-end report and how these trends and predictions could affect your firm, Cherry Bekaert’s Private Equity Industry professionals stand ready to assist. Our seasoned team is here to help guide you throughout the investment lifecycle, while keeping your private equity funds’ and portfolio companies’ specific business needs in mind.