Private Equity Dealmaking Shows Improvement but Falls Short of Expectations

Key Observations

- Banks have returned to the M&A lending market and are recapturing market share from nonbank lenders who moved in during their absence.

- While the U.S. Federal Reserve (Fed) has not instituted any rate reductions, the competition in leveraged finance sector is resulting in more favorable terms—both in terms of rates and covenants—than what was in place 12 months ago.

- Both Limited Partners (LPs) and General Partners (GPs) are finding creative ways to deal with the distribution drought, including undertaking secondary transactions, net asset value (NAV) lending and other structured solutions, such as shifting allocations and taking on more leverage.

- Dry powder levels remain elevated as bid-ask spreads continue to narrow.

- By deal count, technology, healthcare, energy and industrials were the most active sectors.

- Since the lows of 2022, public equity markets have not only posted rebounds but have been on an all-out bull market run. This trend has not extended to private company valuation, which notoriously lag public market valuation changes. The current lag has been more prolonged than in past cycles which is adversely impacting exit activity across the private equity (PE) sector.

Overview

After two consecutive years of declines, there was optimism for a pick-up in deals and exits in 2024. The first quarter (Q1) of 2024 was anything but a rebound and, in fact, posted a sharp drop-off in activity. The second quarter (Q2) showed much of the same until deal activity spiked late in the quarter, resulting in aggregate deal value topping $325 billion on more than 4,000 transactions to close out the first half of 2024 (H1). Despite the initial slowdown, this represents the best six-month stretch since 2022, when deal activity began its two-year slide.

PRIVATE EQUITY DEAL ACTIVITY

While dealmaking hasn’t yet kicked in as many forecasted at the beginning of the year, it is expected 2024 will finish in positive territory from a year-over-year (YoY) perspective.

The mergers and acquisitions (M&A) market is still struggling with valuation pressures driven by a higher-for-longer interest rate environment and the hangover from surging inflation experienced in 2022. Even though the Fed has yet to change its monetary policy and begin any rate reductions, industries such as technology, industrials, professional services and healthcare are continuing to receive PE attention. Deals in these sectors are on pace to outperform the pre-pandemic “normal” by a relatively wide margin (2,000+ deals). There is a wide belief the M&A market has come through a bottom of sorts and is on a recovery course, as mild as it might be.

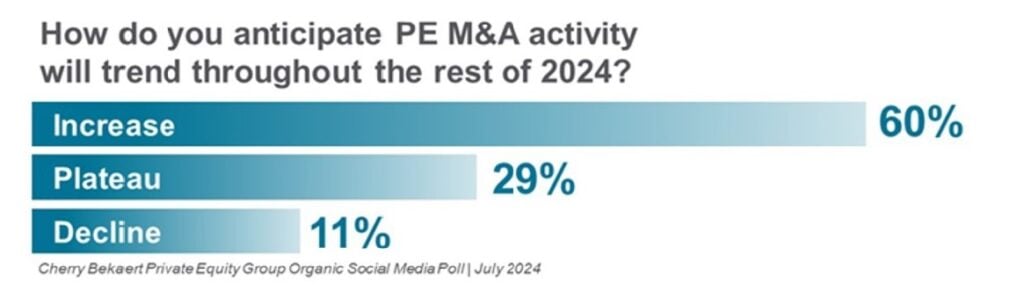

In a recent poll conducted by Cherry Bekaert’s Private Equity group, an overwhelming majority of respondents indicated they thought deal activity would trend upward throughout the rest of 2024. Only a small fraction of respondents pointed to an anticipated decline for the balance of the year.

Banks Adjust to Higher-For-Longer Interest Rate Environment

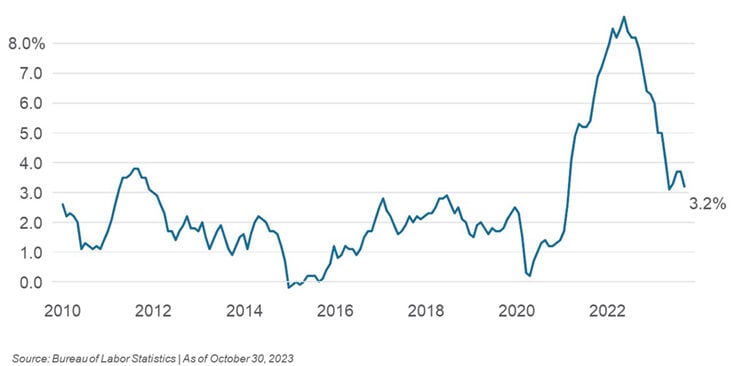

As inflation cooled over the course of 2023 and throughout 2024, it was expected the Fed would begin a series of rate cuts by mid-year. While the Fed has not yet changed direction, banks have returned to the world of M&A lending. This has resulted in a higher level of competition between banks and private credit funds. Competition in the lending market has benefited borrowers with more favorable credit terms and slightly lower interest rates than what was in place a year ago.

ANNUALIZED CHANGES IN CONSUMER PRICE INDEX

12-month percentage change, seasonally adjusted, Consumer Price Index, all items

Federal Reserve Chair Jerome Powell recently indicated the Fed was moving closer to a rate cut decision, while also maintaining a position that he was not ready to declare a victory over inflation. There is building sentiment that the Fed may have waited too long to course correct and is jeopardizing a soft landing and potentially pushing the U.S. economy into a recession in the second half of 2024.[1] A single misstep in Fed policy could easily trigger a recession, making the next several months a critical period for the central bank.

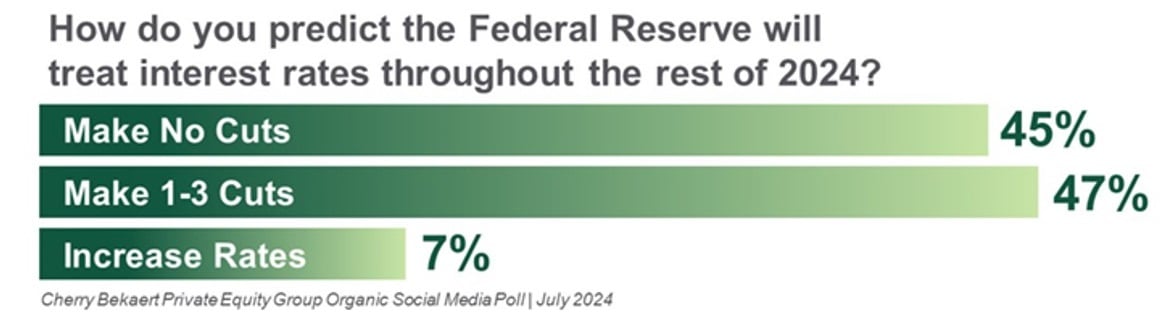

Cherry Bekaert’s Private Equity group also polled respondents on the likelihood of an interest rate cut in 2024. Forty-seven percent of respondents expected at least one rate cut, whereas only 7% anticipated a rate increase.

In the face of unprecedented high rates that even the most experienced managers haven’t seen in their careers, the industry would certainly receive a passing grade if rated on performance. In the first six months of the year, private equity dealmaking experienced an acceleration, notwithstanding the relatively high interest rate environment. Domestic PE was up nearly 45% through the end of June, defying the persistent macro challenges. Add-on deals continue to account for a significant percentage of overall deal activity.

Private equity is still sitting on record amounts of dry powder. At nearly $1 trillion, dry powder accumulation has largely been the chief driver of deal activity over the past few cycles. This has left many feeling confident that, as inflation subsides and interest rates tick downward, deployment of this massive capital could produce a surge in dealmaking.

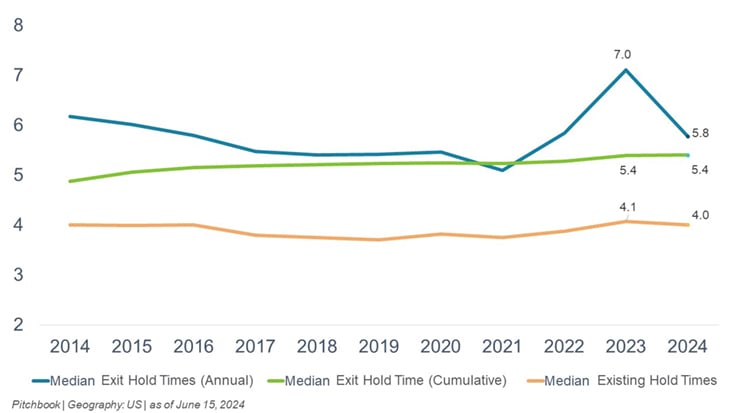

Exit Activity Ticks Upward, Doesn’t Maintain Pace with Demand

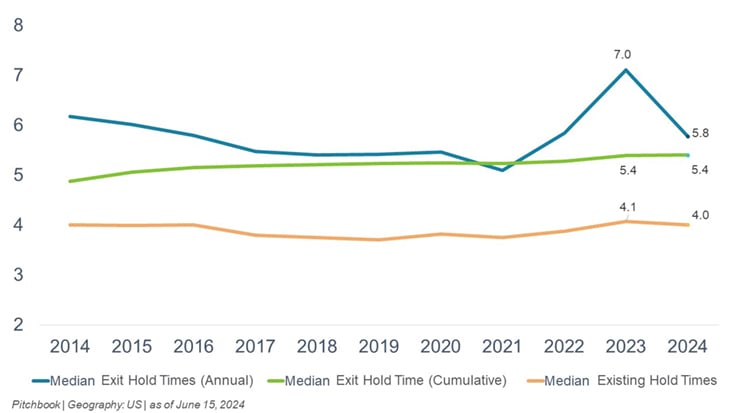

The median holding period of U.S. private equity investments reached an all-time high in 2023 at seven years. While the exit volume increased moderately in H1, funds are still holding on to portfolio companies for a median period of four years, longer than the historic average of 3.2 years.

U.S. PRIVATE EQUITY EXIT ACTIVITY

Aggregate exit volume was essentially on par with last year’s activity, with a modest 15% increase by value YoY. While this is a good sign that maybe private equity has found the bottom, it hardly indicates that the industry is on the road to recovery. Since exit activity peaked in 2021, it has since fallen significantly, and GPs have struggled to exit their investments and return capital to investors.

The exit slump is having a measurable impact on funds’ ability raise new capital and keep investors happy. Finding ways to distribute paid-in capital back to LPs has a become a key focus of fund managers, recognizing that their ability to move the needle in this area can provide a competitive advantage.

MEDIAN PRIVATE EQUITY COMPANY HOLD TIMES (YEARS)

Looking ahead, there is a belief we are in a growing exit bubble but, if economic conditions were to improve and interest rates decline, a race could unfold for a new wave of private equity assets potentially coming to market with a resurgence of sponsor-to-sponsor and sponsor-to-strategic exit transactions.

GPs and LPs Creatively Manage Distribution Drought

With portfolio companies becoming increasingly long-in-the-tooth, GPs and LPs are actively seeking alternative solutions to the liquidity problem, an essential component that keeps the investment cogwheel spinning. Private equity is nothing if not resourceful, so it is not surprising to see the sector respond so adeptly to the decade-low capital distribution levels.

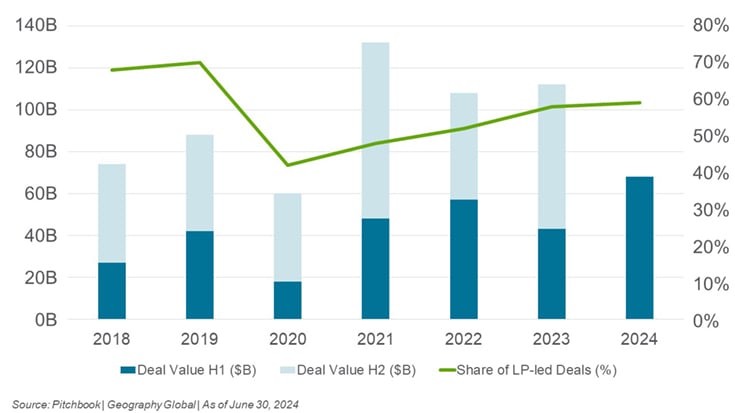

Beyond improving operations within their portfolio companies to drive value, GPs are increasingly utilizing the secondary market to manage liquidity and exit timelines. They have looked to single-asset continuation funds as a source of liquidity, which represent more than 50% of overall GP-led activity over the last 12 months.

SECONDARY DEAL VALUE HITS NEW RECORD IN H1 2024

In search of liquidity, LPs are also selling their stakes in the secondary market. LP-led deals comprised a majority of the 2023 secondary market, both by transaction value (56%) and number of transactions (50%). LP-led secondaries are expected to continue as LPs try to reduce their exposure to illiquid assets and redeploy into new PE deals or other growing strategies, such as private credit or infrastructure.

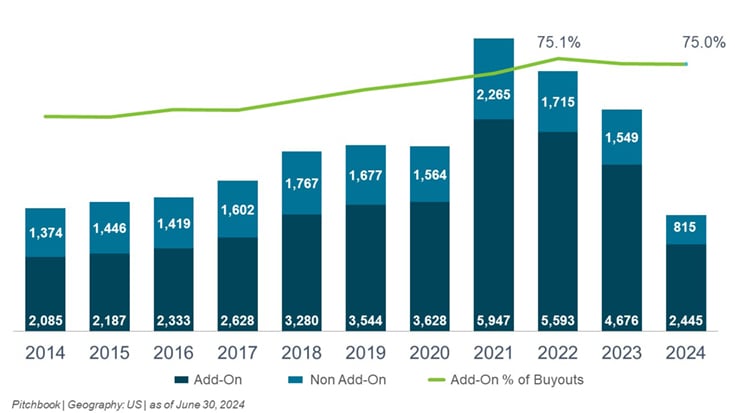

Add-on Deals Continue as Portfolio Growth Strategy

Add-on acquisitions accounted for 75% of all buyouts in H1, a trend that has continued in earnest in recent years. These deals highlight PE’s focus on expanding portfolio companies more quickly by acquiring complementary businesses that can enhance portfolio capabilities and improve the underlying value.

ADD-ONS AS A SHARE OF ALL PRIVATE EQUITY BUYOUTS

Since the onset of the interest rate hikes in March 2022, add-on acquisitions have become pivotal in maintaining momentum during a period marked by tightened credit conditions and heightened market volatility.

Typically involving smaller capital outlays, these transactions have allowed PE sponsors to continuously invest capital in smaller, more manageable deals. This is an effective strategy in a difficult debt financing climate, which often limits the execution of larger platform buyouts. And because add-on targets are typically valued at a lower valuation multiple relative to the initial purchase multiple of the acquirer, there is accretive portfolio value almost immediately upon acquisition, even before any operational improvements or integration levers are pulled.

Technology Has Been a Mixed Bag with Software Driving Growth

Technology M&A has been the top choice for dealmakers over the past twelve months, particularly in Q4 2023 when the sector accounted for 27% of total deal value, a trend that has persisted so far in H1. While this year’s aggregate deal value of tech deals is running behind the 2023 pace, the number of deals completed or announced is well ahead of last year’s number. A total of 253 deals were announced in Q2 2024, representing a 20.7% increase over the Q1 2024 and 40% increase YoY.

PRIVATE EQUITY ACTIVITY IN THE U.S. TECHNOLOGY SECTOR

One of the most significant trends shaping the tech M&A landscape in 2024 is the increasing prominence of, and demand for, artificial intelligence (AI) and AI-based solutions. This demand has not only driven innovation but has fueled M&A activity. The AI sector deals increased by 433% in Q1 2024 compared to the previous quarter, and 260% compared to Q1 2023.

Acquirers are increasingly interested in mission-critical software and subsectors that improve profitability and efficiency, such as AI, data analytics and business process improvement. This has resulted in an overperformance in the software segment as software deals recovered from record lows in 2022. Deal value in Q2 reached $22.2 billion, up 55% over Q1 and 7.6% YoY.

Looking ahead to the second half of 2024, several factors are expected to drive deal activity in the prevailing macro environment, including software company transactions, which constitutes over 57% of all deals in the technology-focused PE space. In the context of new investments, public software company valuations have stabilized and are still trading below their historical mean. At present, there is a wide dispersion in valuations, with AI-focused companies trading significantly higher and smaller firms trading lower. This suggests there may be companies with turnaround potential, which could benefit from a leveraged buyout transaction.

As technology continues to steadily evolve, strategic partnerships, acquisitions and investments will play a crucial role in driving innovation and expanding market reach and value creation.

Industrial Sector Shows Resilience in the Middle-Market

In what proved to be a challenging year for most sectors, the industrials sector showed durability in 2023 and continues to do so in 2024. Despite volatility in the markets and input price fluctuations, the industrials sector proved to be a bright spot as private equity firms increased their focus in the sector, resulting in high levels of M&A activity, particularly in the middle market.

PRIVATE EQUITY ACTIVITY IN THE U.S. INDUSTRIAL SECTOR

Private equity firms that may have remained on the sideline awaiting more economic stability or declining interest rates, might be closer to re-entering the market than ever before. The Fed raised rates seven times in 2022 and four times in 2023. It has not raised rates so far in 2024 but has signaled at least one rate cut before year end. These changing dynamics have shifted the outlook in favor of an increase in PE transactions in the sector.

Another factor driving M&A in the sector is the more than $2 trillion in new federal subsidies for some industrial subsectors, including semiconductors, electric vehicles and infrastructure. Total spending on industrial, manufacturing and infrastructure reached approximately $2 billion last year, 71% higher than the previous year.

Geopolitical tensions, supply chain disruptions and changes in consumer behavior have also prompted many industrial companies to adjust aspects of their business strategies. As macro and microeconomic risks are weighed and the cost benefit shrinks, many companies have begun reshoring their networks, bringing manufacturing capabilities closer to home. While this strategy softens margins in the near term, the payoff shows up in better predictability and control, a key component for valuation purposes.

Looking ahead, the industrials sector is expected to see a steady pace of deal activity throughout the remainder of 2024, supported by divestitures and other transformative transactions. Despite continued market challenges, including a high interest rate environment and regulatory concerns, both buyers and sellers are increasingly turning to middle-market M&A to drive further growth and value creation.

Private Equity Investments in Healthcare Face New Challenges

Private equity’s interest in the healthcare sector has been driven by trends in demographics and technology, as well as the fragmented nature of the healthcare services industry and overall economics. These industry trends include an aging population, technological advancements in patient care and operational tools and recession-resilient qualities.

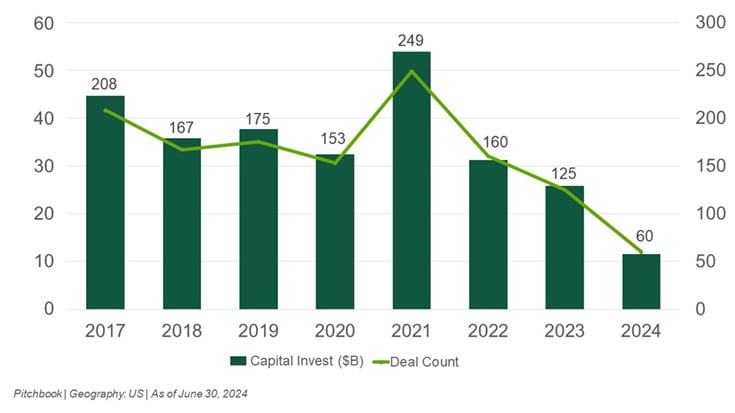

Private equity has invested nearly $1 trillion in healthcare since 2006, transforming the massive U.S. healthcare system, consolidating various subsectors, and driving innovation and change. However, last year was the second year of consecutive decline for PE dealmaking in healthcare overall since its peak in 2021.

PRIVATE EQUITY ACTIVITY IN THE U.S. HEALTHCARE SECTOR

The healthcare services subsector is one of the largest drivers of healthcare investment activity for PE funds. The sector has faced some of the same macro challenges that have plagued other sectors in recent years. Private equity investments in healthcare services fell 59% in 2023, totaling only $7.26 billion, the lowest annual value in three years. This downward trend continued into 2024 with the number of deals dropping by roughly 23% in H1 2024 when compared to H1 2023.

Despite a somewhat optimistic narrative around deal mechanics and easier financing conditions heading into 2024, the persistent valuation gaps between buyers and sellers, and signs that the Fed will hold interest rates higher, have continued to temper activity.

Other external factors, such as the Change Healthcare’s cybersecurity breach in February and increased regulatory scrutiny, have also added additional headwinds. According to Pitchbook analysts, heightened antitrust scrutiny from state and federal regulators is also having a chilling effect on healthcare dealmaking.

Along with promulgating stricter guidelines for M&A reviews, the Federal Trade Commission and Department of Justice, along with Department of Health and Human Services, have launched multiple recent antitrust inquiries, including one into “corporate greed in healthcare.”

Meanwhile, several states have moved to curtail PE acquisitions in the healthcare industry. For example, a new deal review process in California went into effect in April, which, along with delaying deal timelines, also threatens to publicize once-private financial and operational information regarding the companies involved.

“The regulatory environment is creating considerable uncertainty around what deals are subject to review and how strict those processes might be, chilling overall investments.”

– Michael Ludwig | Partner and Cherry Bekaert Healthcare Deal Advisory Leader

Much of the scrutiny of private equity has focused on the firms buying up physician practices and undergoing “roll-ups,” where firms acquire and merge multiple small businesses into one larger company. Now, firms are having difficulty exiting those investments due to a lack of interested buyers amid the regulatory crackdown, Pitchbook found.

However, healthcare’s reputation as a resilient sector for PE investment has remained intact over the last 12 months. The argument that antitrust scrutiny will halt private equity investments is undercut by a number of recent mega deals, including Thomas H. Lee Partners’ $2.5 billion management buy-out of Agiliti, the largest disclosed deal in the medical devices industry.

Furthermore, the fundamental tailwinds driving investments in physician practices, like the aging populating, opportunity to scale, labor turnover and a need for improved access and care quality, continue to persist. Other bright spots within healthcare services include cardiovascular care and clinical trial sites, which have managed to attract investments despite the broader slowdown.

In addition, capital raising for healthcare-focused funds nearly doubled last year, despite the generally muted fundraising environment. So, while healthcare PE investing got off to a tough start in 2024, a relatively strong Q2 performance and a significant deal pipeline suggest the sector may be poised for a rebound in 2025 and beyond, even as it adapts to ongoing economic pressures and regulatory challenges.

Professional Services Continues Its Evolution

The professional services M&A market has been active and dynamic over the last few cycles. As noted in our 2023 Year-in-Review and 2024 Outlook, dealmaking in this sector was a bright spot in an otherwise challenging year.

Funds have typically stayed away from investing in people-based industries. However, a confluence of market dynamics has turned that around — namely, advancements in technology that drive optimization, as well as PE’s ability to professionalize business operations through specialization. The result has been increased deal activity in the sector, particularly in areas such as certified public accountant (CPA), wealth management, consulting, architecture and engineering, as well as trade or home business services.

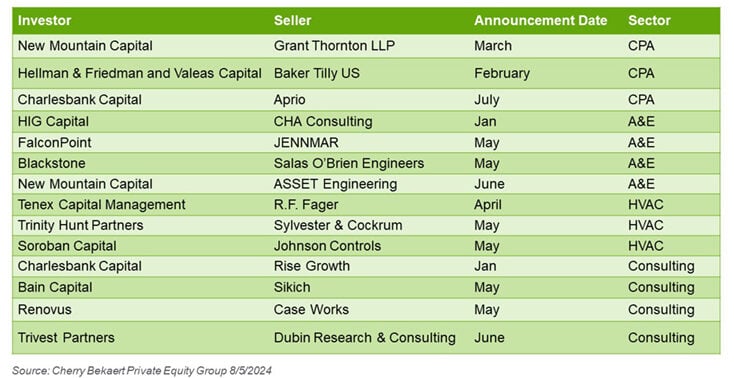

In the first half of 2024, we have seen a mix of M&A and strategic partnerships within the professional services sector. Companies are seeking to expand their service offerings, reach new markets and enhance their capabilities through buy-and-build strategies. In May, we saw a group led by New Mountain Capital invest in the U.S.-based non-audit unit of Grant Thornton. Earlier in the year, Hellman & Friedman and Valeas Capital Partners invested in Baker Tilly U.S., which, at the time, was the largest PE investment in the U.S. CPA sector to date.

The home business services sector is another area in which there has been a significant amount of investment activity. This highly fragmented sector, which includes lawn care, pest control, plumbing, damage restoration, and heating, ventilation and air conditioning (HVAC) services, has caught the eye of PE investors. In addition to fragmentation, the sector also has the potential for organic growth and is generally recession resistant.

Technologically advanced industrial applications for HVAC parts and systems have proliferated across the broader sector, bolstering the necessity for continued service, maintenance and repair. This demand has facilitated a robust 12.3% YoY growth in HVAC and other home business services deals with four deals announced or completed in YTD 2024, compared to 57 deals in the prior year period, according Pitchbook.

NOTABLE PROFESSIONAL SERVICES DEALS ANNOUNCED IN 2024

Investments in Insurance Companies Continues Its Upward Swing

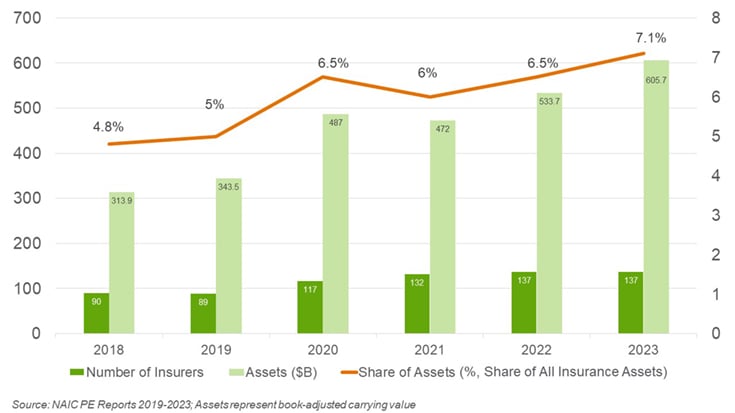

Private capital offers a compelling proposition for insurers: we can invest your premiums and give you a better return. By acquiring insurance assets, PE firms gain direct access to manage the large pools of permanent capital held by insurance companies. This capital, in turn, guarantees assets under management and the associated management fees.

PRIVATE EQUITY-OWNED U.S. INSURANCE COMPANIES

By the beginning of 2024, private equity firms owned approximately $700 billion in insurance assets, or 7.1% of the insurance industry, according to the National Association of Insurance Commissioners.

The sector has drawn in a number of the biggest players, including Apollo, Blackstone, Brookfield, CVC, KKR and others. Among recent deals, KKR finalized its acquisition of the remaining 37% stake in Global Atlantic in January 2024, and in May 2024 Brookfield completed its acquisition of American Equity Investment Life Holding Company — deals that were both announced in 2023.

Despite macro challenges, large insurance brokerages continue to attract investment interest, often because of the potential for consolidation. Overall, insurance brokerage platforms have been good investments and deal valuations have remained high over the last few cycles. In contrast with life and annuity businesses, brokerage investments can be made with a considerable amount of debt, which historically could be at a six- or seven-times EBITDA level.

Notably, in May, Truist Insurance, a subsidiary of Truist Financial Corp. and the fifth largest insurance brokerage in the U.S., was purchased by an investor group led by Stone Point Capital and Clayton, Dubilier & Rice for $15.5 billion, the largest such transaction since the pandemic. Since brokerage businesses continue to be highly fragmented in many jurisdictions, it is expected that more and more deals will come to market throughout the year.

Outlook for the Remainder of 2024

- Expectation that the Fed will cut rates continues to fuel cautious optimism

- Focus on growing EBITDA through portfolio optimization will continue in place of earlier exits

- Increased exits will remain in demand, yet may not move fast enough before year-end to drive meaningful impact

- Sponsor-to-sponsor deals, family office infusion in buyouts and alternative debt structures will continue to serve as sources of capital to keep deals flowing

- Fallout from the November presidential election and potential tax policy implication may speed up or slow down year-end transactions

- Fundraising will continue to be challenging, dependent on the ability to deploy stockpiled dry powder and achieve successful exits