Introduction

Throughout 2023, private equity faced a litany of challenges as it navigated a mini banking crisis, increasing capital costs, and an intractable valuation gap between buyers and sellers, all while facing enhanced regulatory scrutiny. The cumulative impact resulted in a steep decline in overall deal activity.

Despite these headwinds, there were positive opportunities for private equity investors. Some industry segments, such as technology and professional services, showed promise while others, including energy and healthcare, exceeded expectations. Emerging artificial intelligence (AI) advancements spurred activity in the technology sector, while middle-market and strategic transactions, such as carve-outs and add-ons, continued to flourish.

This report explores these and other key dynamics that impacted the private equity landscape in 2023 and the industry’s outlook for 2024.

Key Takeaways:

- A sharp decline in deal volume, increased cost of capital and contracting valuation multiples highlighted challenges across the M&A landscape

- Fallout from early 2023 bank collapses created liquidity concerns for private equity sponsors

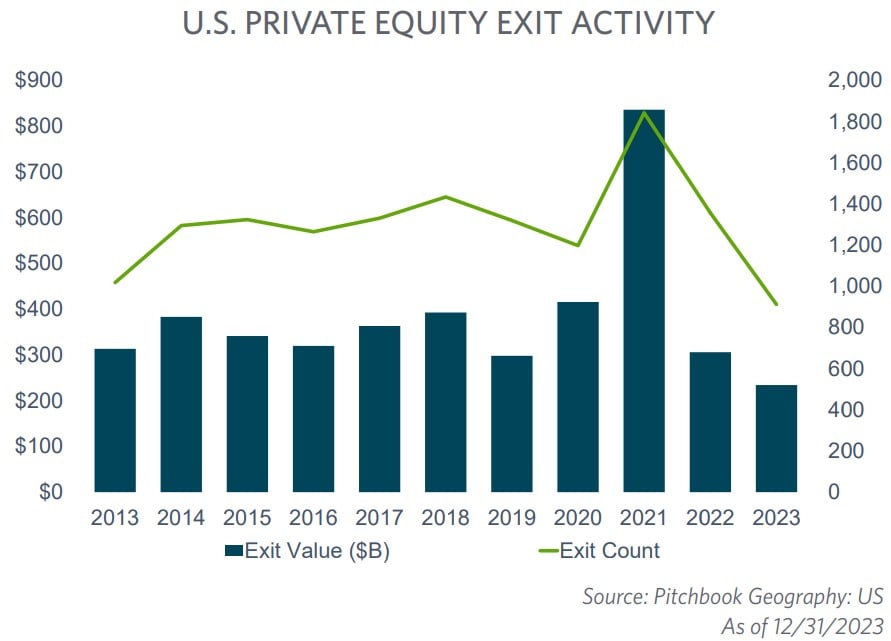

- Economic and operational challenges contributed to longer hold periods and slowed exits

- Regulatory and ESG developments heightened the industry’s compliance requirements

- Bright spots appeared in carve-out and middle-market “buy and build” strategies

- Technology and professional services were key investment sectors

Challenges Across M&A Landscape

Sharp Decline in Deal Volume

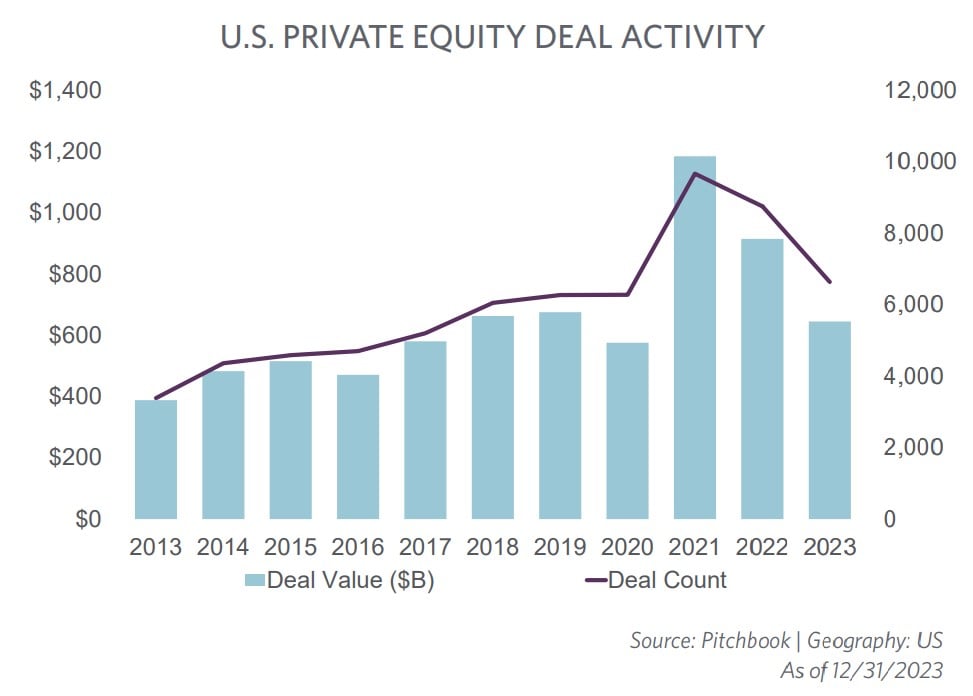

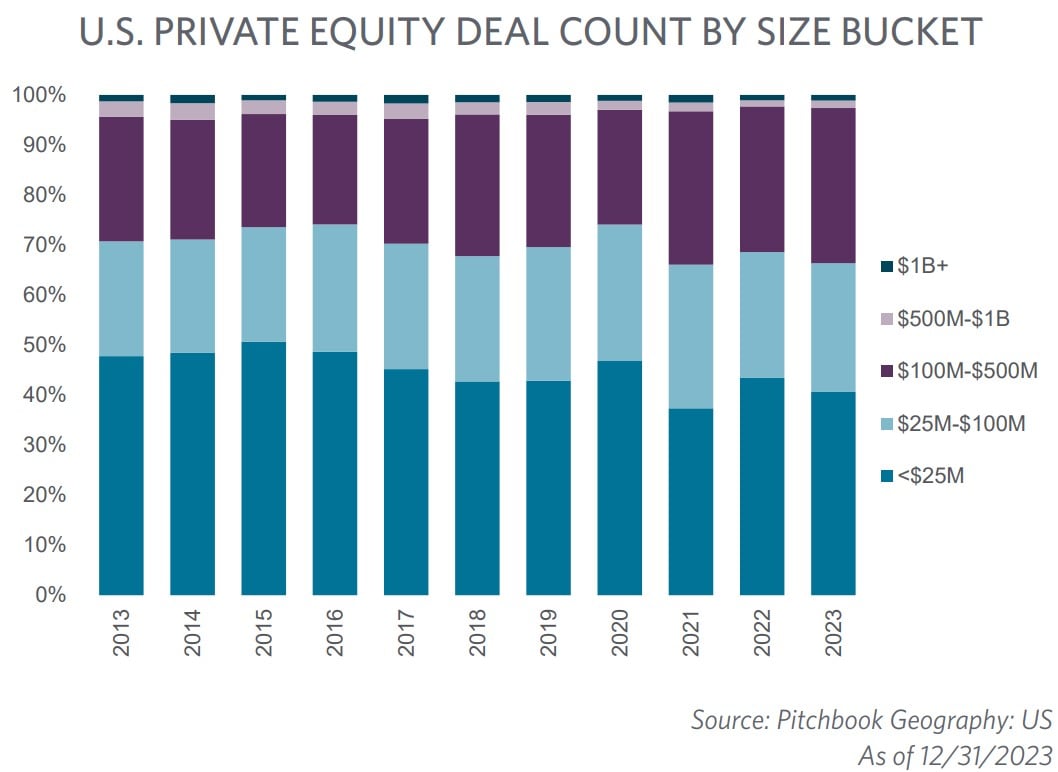

It was well publicized throughout 2023 that deal flow was continuing its downward trend from the previous year. With the books closed, we can now confirm that, for the second year in a row, deal activity is trending down, falling 24% by volume and a whopping 30% by value compared to 2022. The M&A environment is now grappling with its most prolonged level of declining activity since the great financial crisis. Notably, the number of deals completed in 2023 was 20% higher than 2019, prior to the COVID-19 pandemic disruption. However, for the first time since 2021, the aggregate deal value dipped below the 2019 pre-pandemic high water mark. So, while deals continued to close in 2023, on average, those deals were smaller than what we have seen over the prior five years.

Megadeals Faced Enormous Hurdles

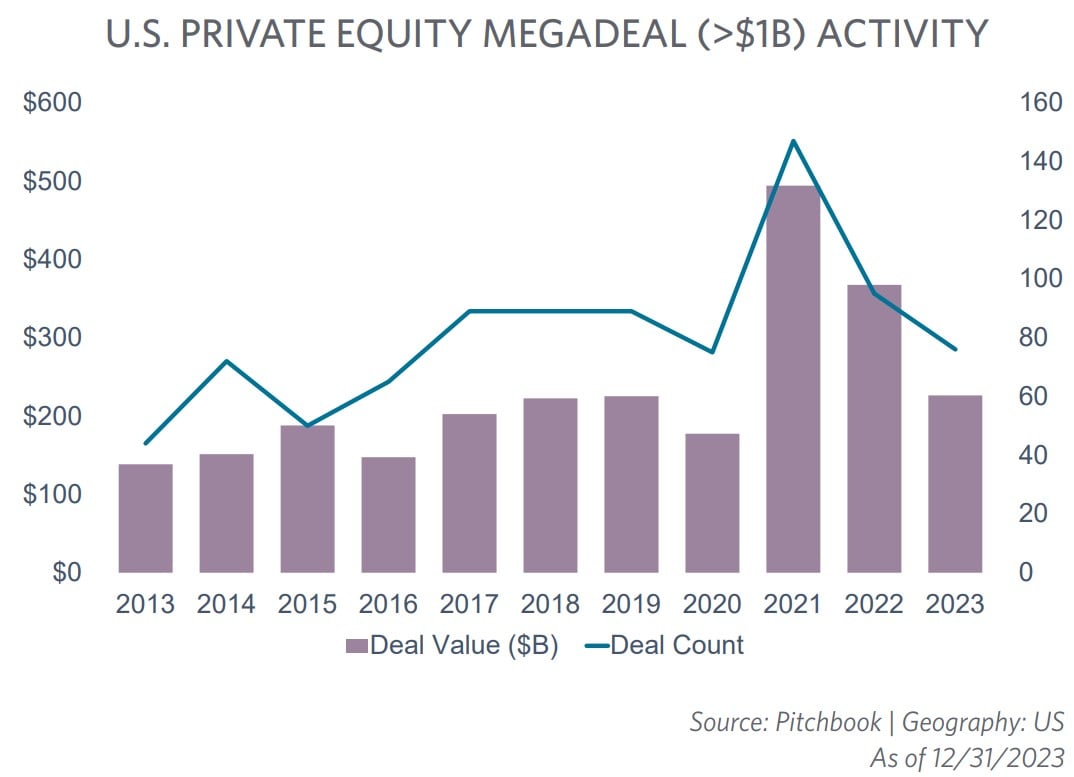

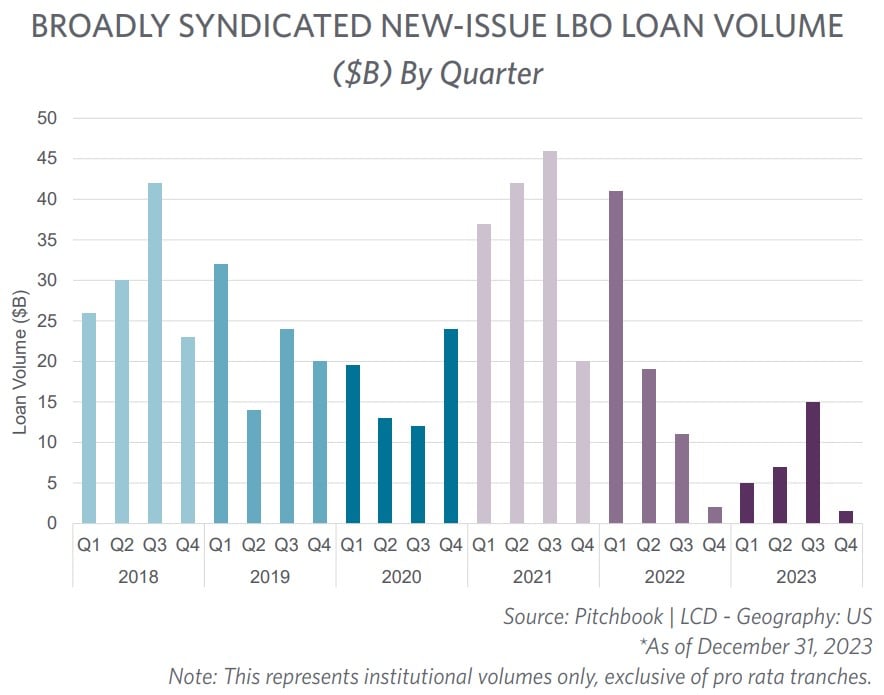

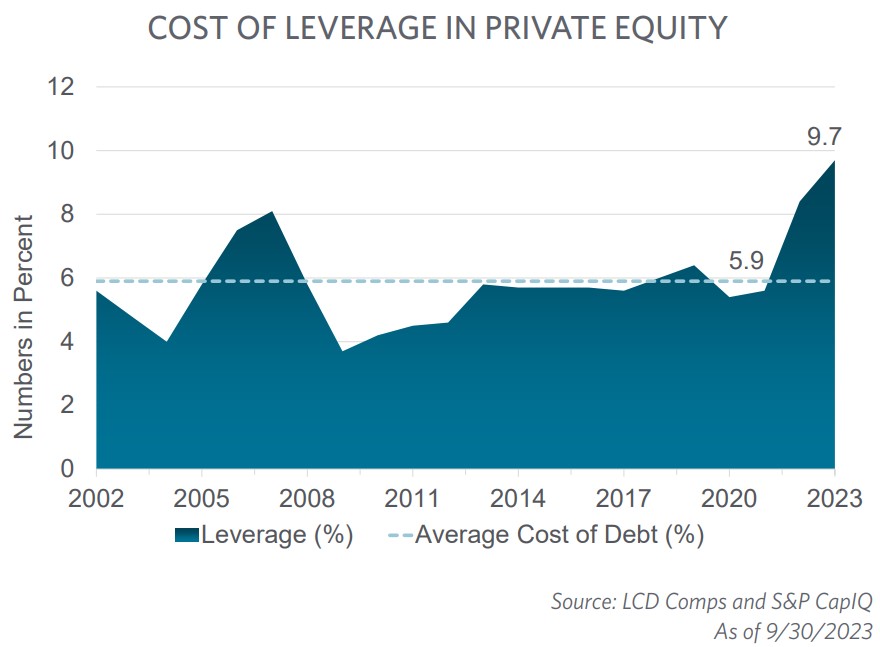

Rising borrowing costs continued to impact private equity’s ability to finance large transactions. Traditional lenders have found themselves stuck with about $40 billion in loans that are now worth less than when they were advanced only a few years ago when that debt cost virtually nothing. While private credit lenders have increasingly stepped up to fill the gap, they too remained cautious on funding large transactions.

As a result, sponsors seeking funding for megadeals—from both traditional and private credit lenders—were being asked to pay higher yields and offer more protections. And while fund managers have been very creative in navigating the financing problem (in some cases financing deals with only equity), it has proven far more challenging when it comes deals above $1 billion.

In recent months, however, banks have successfully sold off tens of billions of leveraged-buyout debt that was gumming up their lending operations, and this has spurred hopes that the credit markets are beginning to normalize. For now, middle-market deals—cheaper to finance and easier to execute—appear poised to continue its dominance into the foreseeable future.

Contracting Valuation Multiples

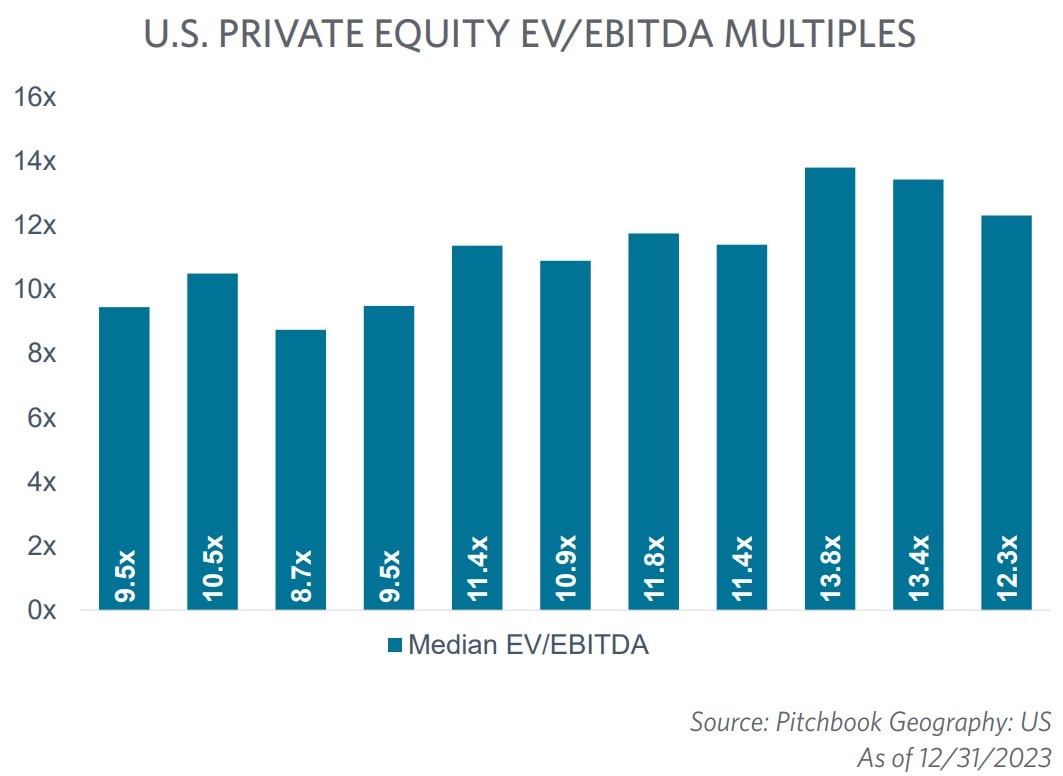

In addition to declining deal volumes, private M&A multiples continued to regress in 2023. Despite fluctuations over the past 12 months, EBITDA multiples have aligned more with the historical levels experienced between 2017 and 2020 and point to a progression to full-on correction mode. At 13.5x, 2021 was the peak year for middle-market private company valuations, but today that number is trending closer to the historical average of 11.4x. Now the question is whether multiples have plateaued, are heading further south or are on the rebound.

Capital Cost and the Fallout From Early 2023 Bank Collapses

The first half of 2023 was, to put it mildly, an interesting time in the fund finance market. The failure of Silicon Valley Bank (SVB), Signature Bank, First Republic Bank and others—all notable lenders in the fund finance space—sent fund borrowers scrambling to navigate covenants and restrictions in their credit facilities with these banks and search for alternative credit sources. The fallout from these events has resulted in longer term implications on the credit aspect of deal markets. While an all-out banking contagion event did not materialize, traditional senior lending sources, nevertheless, pulled back from funding M&A loans to support M&A—particularly large platform deals. The limited credit that was available to fund deals came at a much more expensive price point.

Deal makers are coming to grips with the higher-for-longer interest rate environment. Credit scarcity, coupled with its higher cost, is significantly increasing a borrower’s cost of capital, meaning more things must go right during the investment cycle to generate the expected rates of return to investors. These factors caused many fund managers to take a more cautious approach to capital deployment in 2023.

Operational Challenges Facing Private Equity Fund Managers

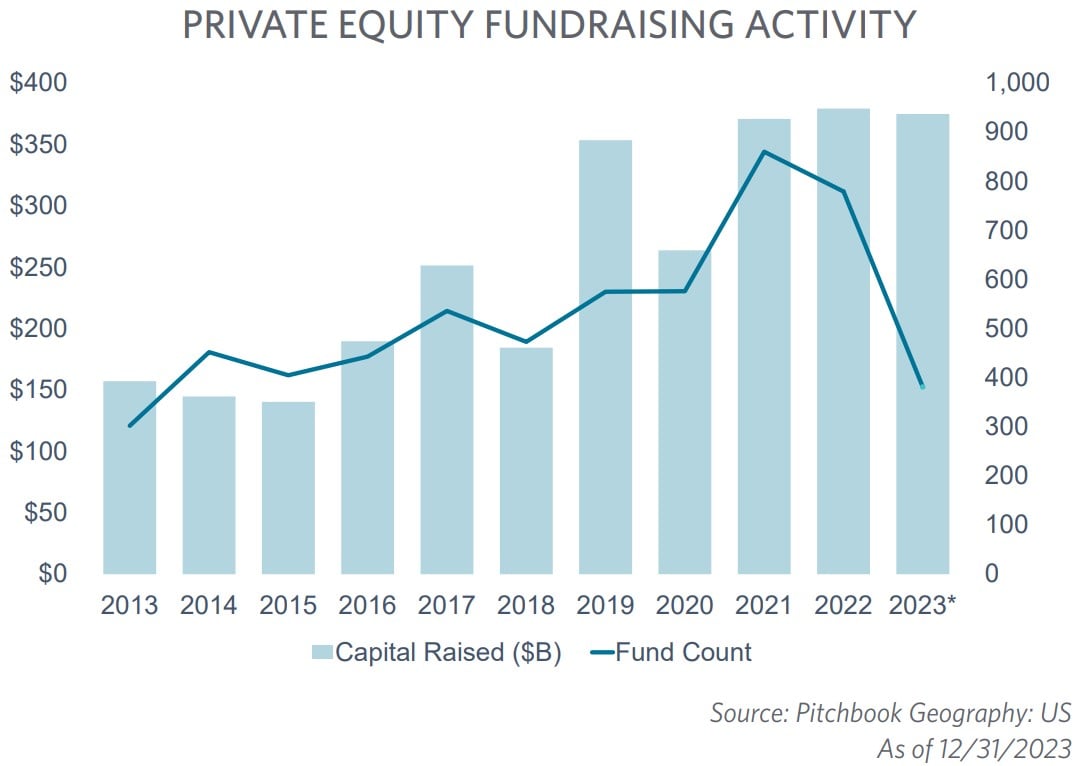

As a general malaise overtook deal markets, many fund managers also faced an array of operational challenges, including fewer exits (which contribute to longer portfolio company hold periods), slower fundraising for both new funds and next generation funds, and rising capital costs—all resulting in moderated growth expectations.

Facing longer hold periods, fund managers and new funds could not afford to take a “wait-and-see” approach. Instead, they are becoming increasingly focused on growth and optimization strategies, such as digital transformation, which can drive longer-term improvements in financial performance. Looking ahead, investors are optimistic that these business process improvements will better position their portfolio companies for a successful exit once deal markets begin to rebound. However, the delayed impact of recycling sale proceeds into new investments and new funds likely will not be fully realized for several more years.

Fundraising in 2023 posted mixed results. While fundraising reached record levels for megafunds, overall fundraising was down compared to a year ago. Furthermore, a significant portion of the overall capital raised was concentrated among a handful of megafunds. In fact, 50% of private equity capital raised in the U.S. was attributed to only 17 funds. Middle- market funds, on the other hand, experienced a more even result. Differentiated return strategies combined with less dependency on leverage has allowed middle-market funds to continue attracting capital commitments more consistently. This has allowed middle-market general partners (GPs) to raise capital at levels similar to 2022. Given the challenging environment and declines in fundraising in other private market segments, the 2023 results for middle-market fund managers should be considered a win.

“While fundraising in 2023 posted mixed results, middle-market funds experienced a relatively even outcome. Differentiated return strategies combined with less dependency on leverage has allowed middle-market funds to continue attracting capital commitments more consistently than larger funds.”

— Scott Moss, Managing Partner | Private Equity and Transaction Advisory Leader

Regulatory Developments Kept Private Equity on Its Toes

The polarization around Environmental, Social and Governance (ESG) and carbon accounting has intensified, resulting in a patchwork of wildly different state legislation. On the other hand, ESG-mandated assets (defined here as professionally managed assets, in which ESG issues are considered in selecting investments or shareholder resolutions are filed on ESG issues at publicly traded companies) are on track to represent half of all professionally managed assets globally by 20241. Between a growing demand for increased sustainable investing from stakeholders and an inconsistent regulatory landscape, fund managers are forced to proceed nimbly with their ESG strategy.

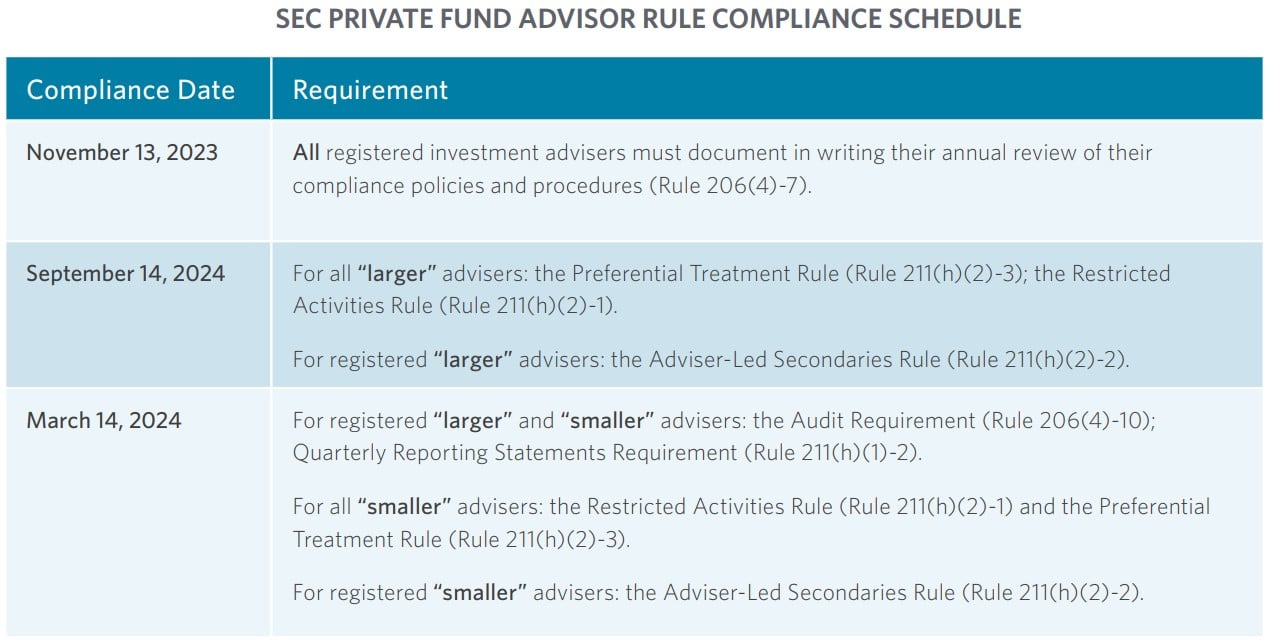

Another area of focus for private equity fund managers is the increased scrutiny on the industry by the Securities Exchange Commission (SEC) that continued to take aim at private fund advisers in 2023, with significant rule changes and compliance requirements. In this environment, caution rules the day for both sponsors and investors.

“The SEC has taken aim at the alternative investments sector with a slate of new rules and compliance requirements which they say are designed to protect investors by increasing transparency, competition and efficiency in fund market. The challenge for fund managers will be meeting these new disclosure obligations without significantly impacting their bottom line.”

— G. Todd Batchelor, Partner | Assurance Services

SEC Adopts New Private Fund Adviser Rules

In August, the SEC adopted new and amended rules (Rule) that significantly increased the regulatory burden on private funds. Among other things, the Rule:

- requires registered private fund advisers to prepare and distribute a quarterly statement disclosing information on fund performance, fees and expenses, as well as certain compensation or other amounts paid to the adviser;

- mandates all advisers subject to the Audit Rule obtain an annual financial statement audit of the covered private funds they advise from an independent, PCAOB-registered CPA;

- prohibits providing certain types of preferential treatment that have a material negative effect on other investors, unless disclosed to current and prospective investors;

- requires private fund advisers to obtain and distribute a third-party valuation or fairness opinion to all investors; and

- prohibits engaging in certain activities and practices that are contrary to the public interest and the protection of investors, unless they provide certain disclosures to investors, and in some cases, receive investor consent.

The Rule, in many respects, would transform the relationship between private fund managers and investors. However, last November a host of industry trade groups filed a lawsuit in federal court seeking to overturn the Rule, arguing it unlawfully restricts the longstanding, widely used business arrangements of private funds and their investors.

The groups claim that: the Rule exceeds the SEC’s statutory authority; the agency failed to provide the public a meaningful opportunity to comment on the final Rule; it did not perform an adequate cost-benefit analysis; and that the Rule is arbitrary, capricious and otherwise unlawful. If the challenge is successful, in whole or in part, it may embolden similar challenges that could potentially curtail the SEC’s aggressive rulemaking streak.

However, barring any stay of the Rule pending the outcome of the litigation, sponsors will be expected to comply with the new rules as laid out below, including the documentation of annual reviews of compliance policies and procedures.

Learn more: SEC Proposes Significant Regulatory Changes for Investment Advisers and Private Funds

ESG and Carbon Reporting Create Unique Challenges

Institutional investors and governments increasingly demand sustainability answers. Carbon reporting suddenly is a “checklist item” for new funds by large investors, mandatory for UN PRI membership, and forced by the State of California and the U.S. Federal government. Private equity funds are aiming to create smart greenhouse gas and carbon reporting programs while minimizing operational distractions and costs for portfolio companies.

“Carbon reporting is suddenly a ‘checklist item’ for new funds by large investors, mandatory for UN PRI membership, and forced by the State of California and the Federal government. The challenge for GPs will be creating smart greenhouse gas and carbon reporting programs while minimizing operational distractions and costs for portfolio companies.”

— Jason Hodell, Partner | Industrial and Consumer Goods Practice Leader

In October, two California laws mandating carbon disclosure were signed by Governor Gavin Newsom—the Climate Corporate Data Accountability Act (SB 253) and Climate- Related Financial Risk Act (SB 261). With this, California officially created carbon accounting obligations in the U.S. affecting thousands of corporations. Specifically, SB 253 requires all U.S.-organized companies with global revenues exceeding $1 billion and “doing business in California” to begin measuring and reporting their emissions based on the formal greenhouse gas protocol (Scope 1, 2 and 3).

SB 261 requires all public and private entities doing business in California with total annual revenue of at least $500 million to publicly report their climate-related risks and efforts to address them. The broad reach of the laws makes carbon reporting both national and inclusive of mandatory Scope 3 reporting, which will be a challenge for portfolio companies with significant supply chain calculations.

It is not entirely clear if investment companies will be forced to consolidate revenue among all portfolio companies (which, in some cases, could bring them within the purview of the California laws), but the statute does specifically call out a “partnership, corporation, limited liability company or other business entity.” More guidance on this is forthcoming.

Compliance requirements for SB 253 are as follows:

- Beginning in 2026 (for reporting year 2025), reporting entities are required to annually report their Scope 1 and Scope 2 greenhouse gas emissions. Scope 1 emissions are defined as all direct greenhouse gas emissions that stem from sources that a reporting entity owns or directly controls, regardless of location, including, but not limited to, fuel combustion activities. Scope 2 emissions are defined as indirect greenhouse gas emissions from consumed electricity, steam, heating or cooling purchased or acquired by a reporting entity, regardless of location.

- Then, beginning in 2027, reporting entities must also report their annual Scope 3 emissions, which are defined as indirect upstream and downstream greenhouse gas emissions, other than Scope 2 emissions, from sources that the reporting entity does not own or directly control and may include, but are not limited to, purchased goods and services, business travel, employee commutes, and processing and use of sold products.

Preparing for Scope 3 reporting is expected to be a major challenge for most companies and will require detailed planning and effort. Comprehensive Scope 3 reporting will require all the affected companies to gather similar data from their supply chains, thus potentially impacting thousands of other middle- market and smaller companies throughout the U.S.

Bright Spots In 2023 Private Equity M&A

Carve-Out Transactions Continued at Record Pace

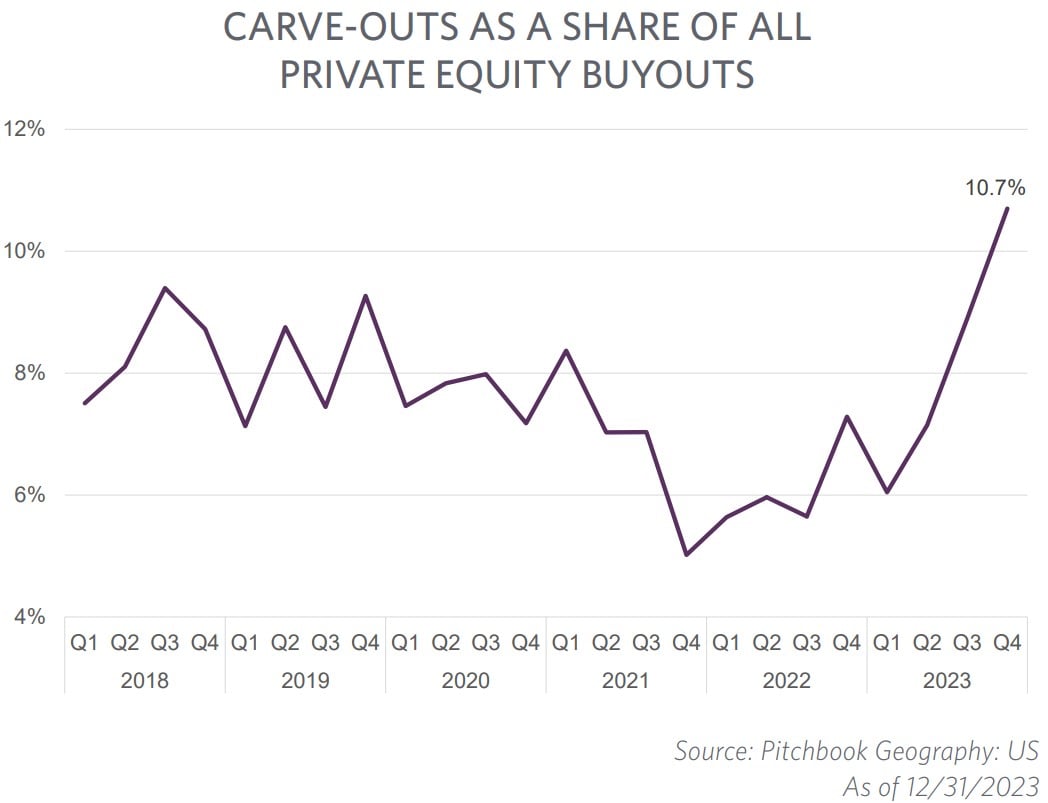

As we highlighted in our 2022 report, there was an expectation that carve-outs would rise in 2023 as corporations sought opportunities to raise cash from divesting non-core business segments in the face of persistent macro pressures. This forecast held up as carve-outs made up a significant portion of completed M&A activity. In general, business separation transactions saw a rise in their share of overall deal mix and carve-out transactions accounted for its highest portion of LBOs in nearly a decade.

Learn more: How Carveouts Differ from a Typical Acquisition

Private Credit Played a Big Role in the Lending Market

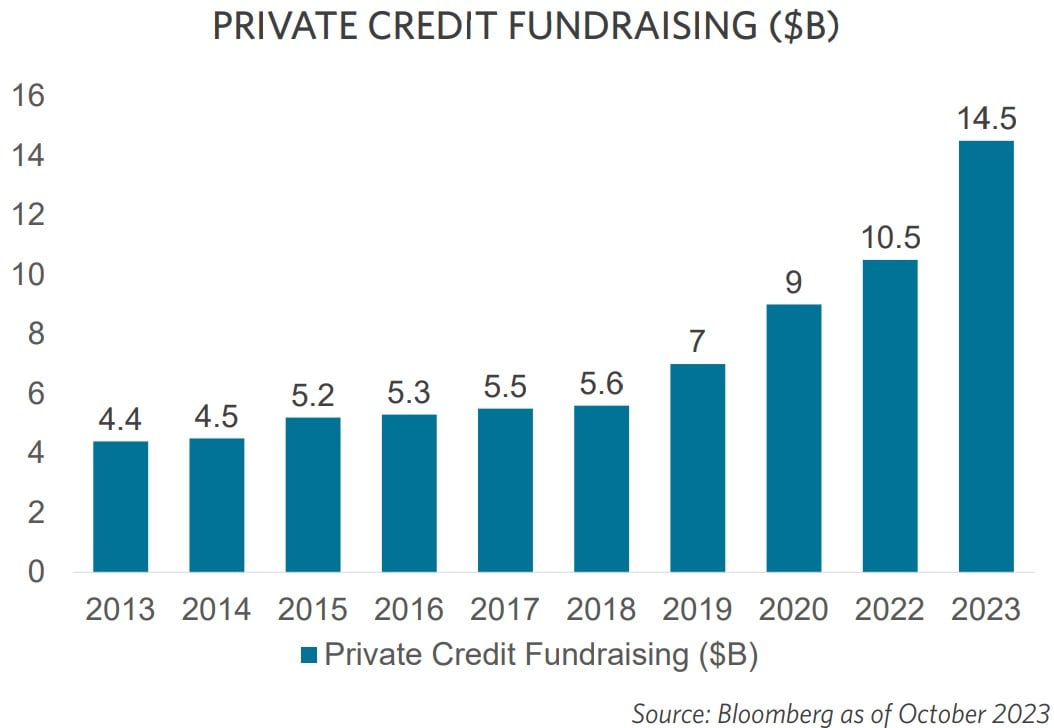

With traditional lender sources reducing debt funding, direct lending and co-investments, along with innovative deal structures all helped to fill the financing gaps caused by the pullback in syndicated debt financings. The global private credit market has grown to more than $1.5 trillion and is anticipated to reach $2.3 trillion by 2027, according to data published by Preqin2.

Private equity sponsors have been and will continue to be the primary drivers of private credit consumption. This is based on the sector’s ability to provide flexibility tailored to the borrower’s needs in terms of transaction size, transaction type and deal timing. As interest rates spiked during 2023, borrowers were anxious to find ways to conserve cash.

Private credit lenders allowed borrowers to pay interest with more debt, known as payment in-kind (PIK) interest. PIK interest has most commonly been used to manage stressed credit situations. However, private credit funds have also been issuing PIK-from-the-start loans to finance interest costs and even cover lender fees. PIK is a feature not commonly available in other parts of the traditional credit market, representing a prime example of the marketplace flexibility offered by these lenders.

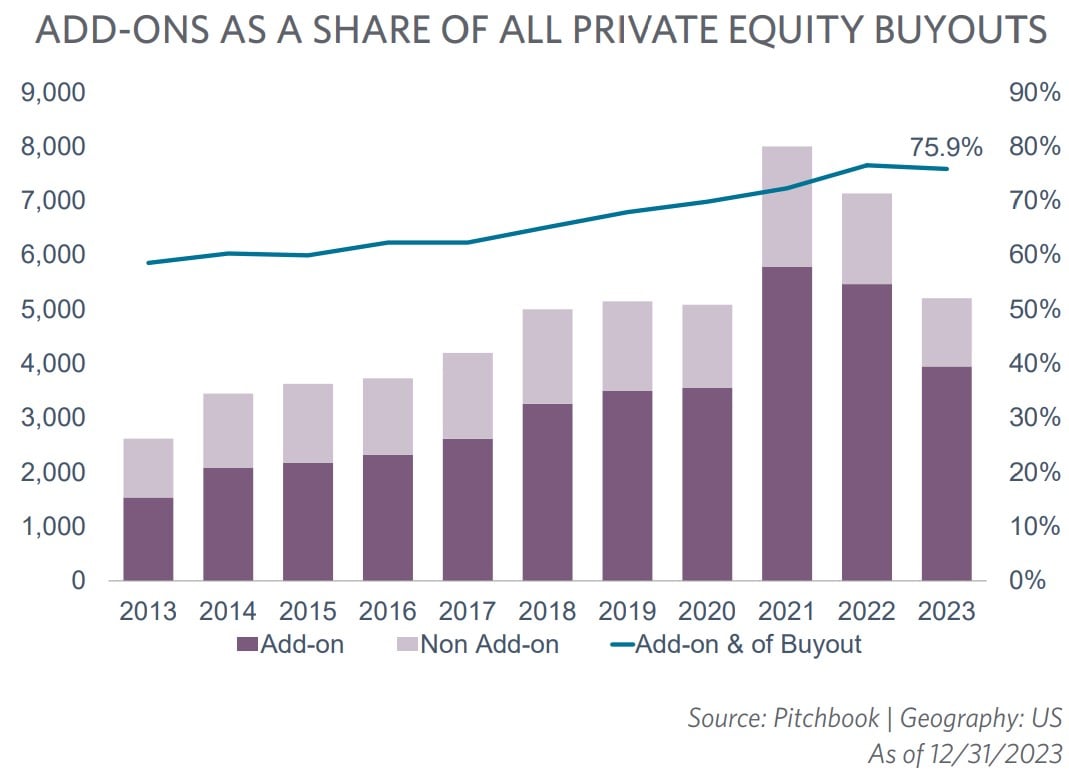

Middle Market Shows Resiliency Through “Buy and Build” Strategies

While the middle-market sector (i.e., deals between $100M and $500M) was not totally immune from M&A stagnation, the sector did manage to produce declines of only 19% compared to the broader M&A market. Unlike megadeals, where the main contributor to declining deal flow was limited access to debt, middle-market lending is in ample supply. Middle-market companies were able to reduce cost across their operations, including financing, to boost revenue and earnings growth which are the strongest they have been in two years. This suggests there is a strong pipeline of quality companies ready to enter the M&A market once deal activity begins to rebound.

Add-on deal activity is one of the contributors to the fact that the middle market’s share of all private equity buyouts is posting its best year yet. The coupling of a higher cost of debt and lower debt availability has led many private equity firms to increase equity contribution and focus more on the execution of add-on deals for their existing companies. As add-on deals continued to pile up in 2023, it acted as a shock absorber to overall middle-market M&A. Sectors that are experiencing a wave of add-on deals include trade services (HVAC, electrical, plumbing, etc.), medical services (dental, orthopedic, ophthalmology, etc.) and professional services (CPA, consulting and wealth management firms).

Technology Sector, Spurred by Developments in AI, Shows Positive Signs

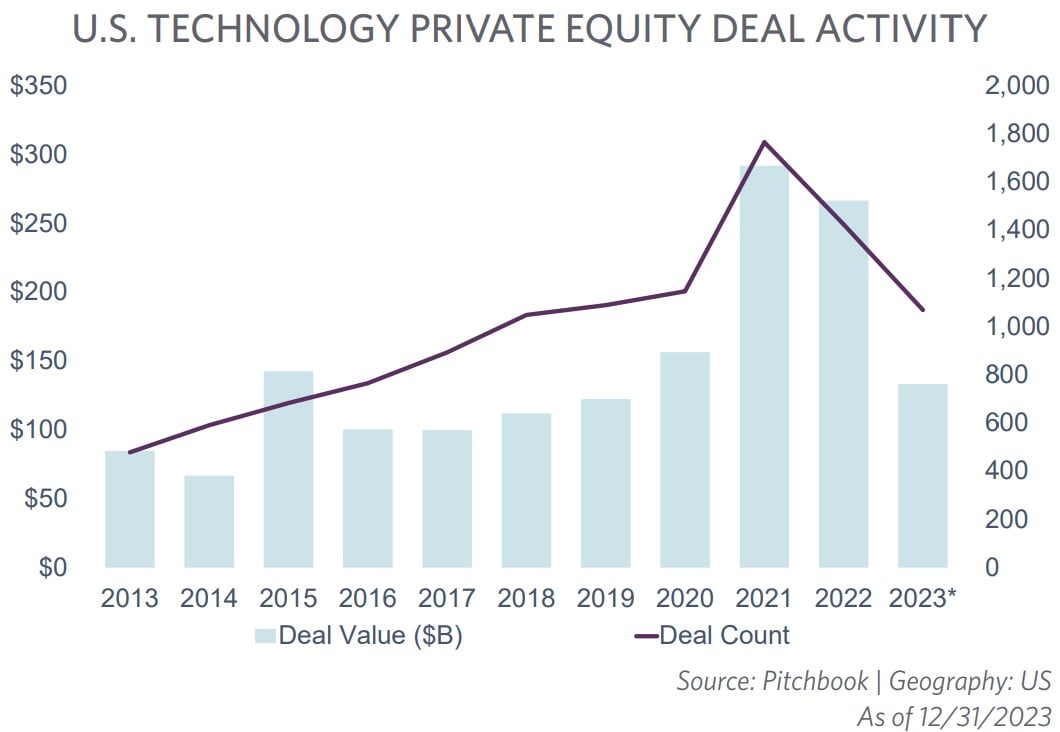

From a sector perspective, technology continues to be a key area of focus for private equity dealmaking, despite prolonged macro challenges. As the year came to an end, however, there were reasons to be optimistic. While technology deals declined 18% from 2022, smaller deals showed an upward trend with 368 deals completed in Q4 2023, representing a significant increase of 43.2% compared to the previous quarter and a steady growth of 9.8% compared to Q4 2022.

The technology sector was rocked early in the year with the March 2023 failure of SVB, widely recognized as the lender and deposit institution of choice for both start-up and mature technology companies. The collapse marked the second largest bank failure in U.S. history after the 2008 failure of Washington Mutual and was seen as a sign of trouble for the broader technology sector. However, the U.S. government’s swift response and emergency measures helped to restore confidence in the banking system, stabilizing the market and avoiding contagion.

The SVB collapse notwithstanding, investors remained attracted to the industry’s long-term secular growth story, its relative resilience in the face of macro headwinds, and the growing integration of technology in sectors such as healthcare, finance, industrials, energy and others. Investors are exploring verticals including anything-as-a-service (Xaas), TransitTech, HealthTech, RPA, advanced CloudTech and AI/ machine learning (ML).

AI/ML are notably the standout sectors within technology M&A over the last 18 months. Microsoft, Google, Salesforce and Amazon Web Services have all made moves into AI and committed significant investment dollars to the space through either acquisitions, establishment of joint ventures or funding internal development efforts.

Technology developers in the AI/ML sector are focused on creating chatbots and personal assistants, deploying and orchestrating large language models, and maintaining model architecture. This includes OpenAI and its ChatGPT service along with Anthropic’s Claude. The hype in these kinds of generative AI sectors stands in contrast to the general-purpose middleware segments like audio, video and content creation; a sector where many venture capital firms see opportunity.

“In the past year, technology companies’ growth and profitability stalled as interest rates rose and investors stopped funding ‘growth at any cost.’ Nonetheless, the pipeline is now flowing again, and we expect private equity investments to increase in the sector in 2024.”

— Sean Geoghan | Partner, Deal Advisory Services

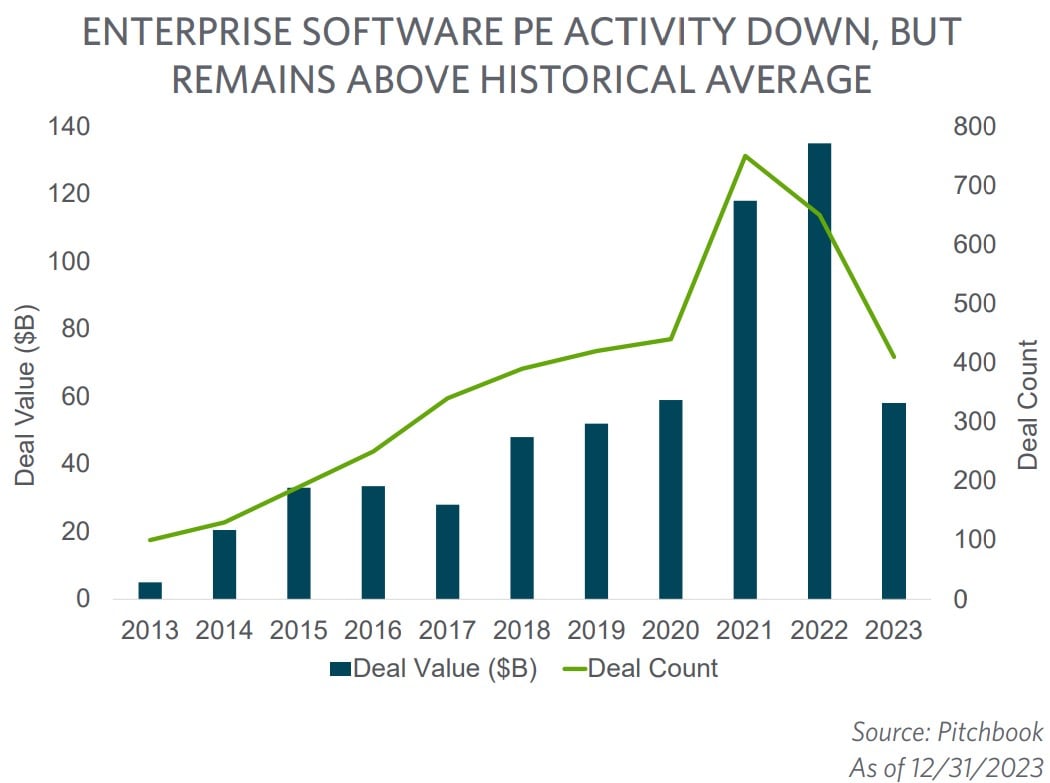

Technology software companies with a “recurring revenue” business model remained a notable area of focus for private equity investors. As software valuations declined sharply as part of a broader technology sell-off that emerged in 2022, sponsors launched a number of public company buyouts targeting the space. The most notable examples include Silver Lake and the Canada Pension Plan Investment Board’s $12.5 billion acquisition of Qualtrics; Clearlake Capital and Insight Partners’ $4.4 billion acquisition of Alteryx; and Blackstone’s $4.6 billion acquisition of Cvent.

Cisco’s $28 billion offer for the enterprise cloud protection company, Splunk, was the biggest enterprise software deal in 2023, but that deal was an outlier in terms of deal size. 2023 saw a sharp decline in the aggregate value of software M&A activity as buyers were less willing to bet on future growth, resulting in significantly smaller ratios of enterprise value to revenue, as compared to 2022.

With nearly $140 billion in deals, 2022 was a high-water mark for software private equity. The aggregate deal value plunged in 2023, but remained slightly above the historical average. According to Pitchbook, investors remained relatively active in 2023 with nearly $60 billion total value through the first three quarters, with a decline of about 30% in deal count when compared to the record activity seen in 2022. Yet, relative to the pre-pandemic average of 2017 to 2019, 2023 was up 18.3% by value and 15% by number of deals.

Looking ahead, we expect technology to continue to be an area of focus for sponsors, who increasingly see the sector as a way to gain exposure to broad swaths of the economy, as digitalization and technology permeate an ever-wider range of industries.

Professional Services is In the Midst of a Revolution

In addition to technology, the professional services sector provided cause to be optimistic relative to an otherwise dim M&A landscape. Much of the uplift resulted from aggressive add-on campaigns supporting the platform investment thesis of consolidation opportunities within fragmented segments.

Private equity has emerged as a powerful catalyst for driving transformation, process improvement and growth acceleration for professional services firms. Investments in this sector buck the previously unwritten rule against investing in sectors whose primary asset go down the elevator at the end of the day (i.e., people). However, as investments have begun to take shape and private equity demonstrates its ability to drive transformational growth and improve financial performance in people-heavy businesses, the hesitation has become less concerning. In particular, CPA, consulting and wealth management firms appear to be in the midst of a private equity-backed revolution.

“In the last few years, the accounting industry has caught the eyes of private fund investors due to its high levels of recurring revenue, industry fragmentation and opportunities to scale quickly. With increasing investments into CPA firms, private equity is now transforming the industry at an unprecedented pace.”

— Sidney Glick | Partner, Deal Advisory Services

The accounting industry, for example, is undergoing a sea change in terms of private investments. For much of its existence, audit and tax services have created an insulated environment with high barriers to entry, resulting in steady, but not exactly transformative, growth. However, as competition for revenue and talent has intensified, the industry has needed to diversify service offerings, invest in technology, and consolidate through mergers and acquisitions. Enter private equity. Attracted by the industry’s near recession-proof model, high levels of recurring revenue, fragmentation and scalability opportunities, a mutually beneficial relationship between CPA firms and private equity investors has emerged.

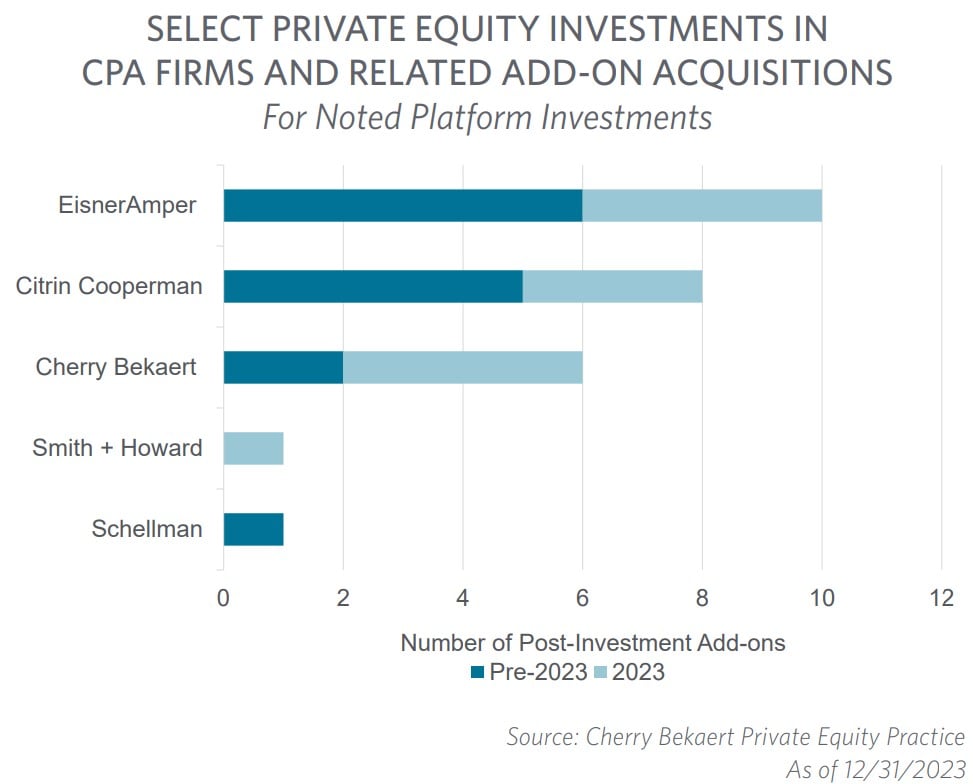

Since TowerBrook’s investment into EisnerAmper, the first in the public accounting sector, other private equity firms have followed suit. While the timeline below illustrates some of the first platform investments, which also involved some of the largest firms, it is worth noting platform investments have already begun trickling down to smaller CPA firms.

By shifting organizational governance, leveraging technology to improve business processes, diversifying service offerings and strengthening talent acquisition and retention, private equity is now transforming traditional accounting firms at an unprecedented pace. Add-on transactions are a key component of value creation in this sector. These follow-on deals allow for new market expansion, development and deployment of new service offerings while capitalizing on synergies to improve financial performance. The firms noted above have collectively completed more than 25 add-on acquisitions since receiving their initial investment from private equity, and almost half of those acquisitions were completed in 2023. This trend is expected to accelerate in 2024 and beyond.

Private equity firms are also transforming other sectors within professional services, including consulting, wealth management, insurance and other financial services. In fact, some of the early private equity investments in the consulting space have already been realized through either a sponsor-to-sponsor or a sponsor-to-strategic exits. This further validates the overall investment thesis and suggests interest in professional services will continue to increase into the foreseeable future.

Private equity buyouts of wealth management firms also continued to grow at a healthy pace. Annual deal volume in 2023 eclipsed 300, a mark first reached in 2021 and the second-highest total to date. Notable private equity investments include The Carlyle Group’s investment in CAPTRUST, Abry Partners’ investment in Prime Capital, and Parthenon Capital Partners’ acquisitions of Titan Wealth Holdings and Choreo, LLC—who has subsequently completed four add-on transactions since the Parthenon investment, including the acquisition of the affiliated wealth management business of BDO USA (its third from a CPA firm).

Private Equity Outlook And Potential 2024 Trends

The ability to forecast private equity industry performance for the upcoming year with any amount of certainty is a challenge, particularly considering how dynamic the market has been over the past three years. However, there are several trends and evolving themes that are expected to unfold over the course of 2024:

- Exits: A hopefully rising exit market will help revitalize M&A and fundraising activity for private equity.

- Artificial Intelligence: As the AI development race rapidly advances, private equity will continue to invest in mature AI and machine learning companies.

- Commercial real estate defaults and more trouble for the banks: As a result of the virtual workplace, predominantly regional banks with large real estate portfolios will continue to face loan defaults and be forced to consolidate.

- Anticipated reduction of interest rates: As inflation cools, it is expected that the Federal Reserve will lower the interest rate multiple times in 2024. While this will alleviate some of the pain to borrowers, we will not see the lows that drove record M&A activity in 2021.

- The rise of ESG to the private sector: More fund managers will demand attention to carbon footprint, diversity of portfolio board members and other ESG regulations already impacting the public and international sectors.

- Election year: Private equity will again learn what administrative pressures may once again heighten or loosen. Carried interest is likely to resurface as a key point of contention as domestic tax policies invariably come into play.

1 Global Sustainable Investment Review 2022 – https://www.gsi-alliance.org/ wp-content/uploads/2023/12/GSIA-Report-2022.pdf

2 Preqin Global Report 2023 – https://www.preqin.com/alternatives-in-2023