The Financial Accounting Standards Board (FASB) issued nine Accounting Standard Updates (ASUs), and the Government Accounting Standards Board (GASB) issued only one new GASB Statement in 2023. The latest issue of the Rundown features a summary of the new standards issued in the fourth quarter 2023. For summaries of standards issued in the first three quarters, view our previous rundowns here. In addition, we’ve got a comprehensive listing of all standards newly effective for calendar year-end December 31, 2023, for public business entities and private entities. We’ve also added a listing of all standards newly effective for the first quarter for public business entities. Lastly, we provide practice insights helpful for CECL adoption, as well as ASUs you should consider early adopting and further practice insights.

Fourth Quarter 2023 Newly Issued Standards

Improvement to Income Tax Disclosures

Rate Reconciliation

The amendments in this update require that public business entities disclose a tabular reconciliation, using both percentages and amounts, for the following categories within the income tax rate reconciliation:

- State and local income tax, net of federal (national) income tax effect

- Foreign tax effects

- Effect of changes in tax laws or rates enacted in the current period

- Effect of cross-border tax laws

- Tax credits

- Changes in valuation allowances

- Nontaxable or nondeductible items

- Changes in unrecognized tax benefits

Separate disclosure is required for any reconciling item in which the effect of the reconciling item is equal to or greater than 5% of the amount computed by multiplying the income (or loss) from continuing operations before income taxes by the applicable statutory income tax rate. Reconciling items are required to be presented on a gross basis with two exceptions (unrecognized tax benefits and effects of certain cross-border tax laws).

For entities other than public business entities, the amendments in this update require qualitative disclosure about specific categories of reconciling items and individual jurisdictions that result in a significant difference between the statutory tax rate and the effective tax rate.

Income Taxes Paid

The amendments in this Update require that all entities disclose the following information about income taxes paid:

- The amount of income taxes paid disaggregated by federal, state and foreign taxes

- The amount of income taxes paid disaggregated by individual jurisdictions in which income taxes paid is equal to or greater than 5 percent of total income taxes paid

Other Disclosures

The amendments in this Update require that all entities disclose the following information:

- Income or loss from continuing operations before income tax expense (or benefit) disaggregated between domestic and foreign

- Income tax expense (or benefit) from continuing operations disaggregated by federal, state and foreign

The amendments in this Update eliminate the requirement for all entities to:

- disclose the nature and estimate of the range of the reasonably possible change in the unrecognized tax benefits balance in the next 12 months;

- disclose the cumulative amount of each type of temporary difference when a deferred tax liability is not recognized because of the exceptions to comprehensive recognition of deferred taxes related to subsidiaries and corporate joint ventures.

Effective Date and Transition Requirements:

Public business entities: Fiscal years beginning after December 15, 2024

All other entities: Fiscal years beginning after December 15, 2025

Early adoption is permitted, and the amendments can be applied retrospectively or prospectively.

Accounting for and Disclosure of Crypto Assets

The amendments in this update apply to assets that meet all of the following criteria:

- Meet the definition of intangible assets as defined in the Codification

- Do not provide the asset holder with enforceable rights to or claims on underlying goods, services, or other assets

- Are created or reside on a distributed ledger based on blockchain or similar technology

- Are secured through cryptography

- Are fungible

- Are not created or issued by the reporting entity or its related parties.

An entity is required to subsequently measure assets that meet those criteria at fair value with changes recognized in net income each reporting period and present crypto assets measured at fair value separately from other intangible assets on the balance sheet along with the changes in fair value separately from changes in the carrying amounts of other intangible assets in the income statement.

For annual and interim reporting periods, the amendments in this Update require that an entity, including an entity that is subject to industry-specific guidance, disclose the following information:

- The name, cost basis, fair value, and number of units for each significant crypto asset holding and the aggregate fair values and cost bases of the crypto asset holdings that are not individually significant

- For crypto assets that are subject to contractual sale restrictions, the fair value of those crypto assets, the nature and remaining duration of the restrictions, and the circumstances that could cause the restrictions to lapse.

- For annual reporting periods, a rollforward of crypto asset holdings, including additions, dispositions, gains, and losses

- For additions, a description of the activities that resulted in the additions. For any dispositions, the difference between the disposal price and the cost basis and a description of the activities that resulted in the dispositions

- If gains and losses are not presented separately, the income statement line item in which those gains and losses are recognized

- The method for determining the cost basis of crypto assets

Effective Date and Transition Requirements:

All entities: Fiscal years beginning after December 15, 2024, including interim periods within those fiscal years

Early adoption is permitted and the amendments should be applied using the modified retrospective approach through a cumulative-effect adjustment to the opening balance of retained earnings as of the beginning of the annual reporting period in which an entity adopts the amendments.

Improvements to Reportable Segment Disclosures

Public entities are required to provide segment disclosures. Extant segment disclosure requirements only require disclosure about a segment’s revenue and measure of profit or loss, there generally is limited information disclosed about a segment’s expenses and, therefore, investors have provided feedback supporting enhanced expense disclosures. The ASU does not change how a public entity identifies its operating segments, aggregates those operating segments, or applies the quantitative thresholds to determine its reportable segments.

The amendments in this update require that a public entity:

- Disclose the category and amount of “significant segment expenses” that are “regularly provided” or are “easily computable” from the information provided to the chief operating decision maker (CODM) and included within each reported measure of segment profit or loss.

- Disclose, an amount for “other segment items” by reportable segment and a description of its composition. The other segment items category is the difference between segment revenue less the significant segment expenses disclosed and each reported measure of segment profit or loss.

- All annual disclosure requirements must be met for interim periods too.

- Clarify that if the CODM uses more than one measure of a segment’s profit or loss, then a public entity may report one or more of those measures. However, at a minimum the measure of profit or loss that is most consistent with GAAP should be disclosed. In addition, each measure must be reconciled to the consolidated financial statements and “significant segment expense” and “other segment items” for each measure must be disclosed. Moreover, an entity must disclose comparison to the prior year measure for each measure disclosed.

- Disclose the title and position of the CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss.

- Require that a public entity that has a single reportable segment provide all the disclosures required by the amendments in this Update and all existing segment disclosures in Topic 280.

- Recasting is required if segment information regularly provided to the CODM is changed in a manner that causes the identification of significant segment expenses to change.

Under extant guidance, public entities are only required to disclose certain expenses (e.g., interest expense and depreciation) if they are included in the measure of segment profit or loss. For example, even though selling expenses may be included in an entity’s measure of segment profit or loss, extant guidance did not require public entities to disclose selling expenses. Under this Update, if selling expenses are determined to be a significant segment expense that is regularly provided to the CODM, then public entities must disclose.

Practice Insights:

What is “significant” and what is the definition of “regularly provided”?

The ASU does not define the term “significant” or “regularly provided.” The Board has stated that and entity should “consider relevant qualitative and quantitative factors” and the SEC has stated that “regularly provided” could be less than a quarter (e.g., annual). Moreover, the information need only be provided to the CODM, the CODM does not have to use the information in order for it to trigger disclosure. Furthermore, the information required to be disclosed need to be explicitly stated but if it could be “easily computable” from the information provided.

What does “easily computable” mean?

The Update requires disclosure of information that is “regularly provided” to the CODM whether that information is explicitly stated or it “easily computable” or is “expressed in a form other than actual amounts, for example, as a ratio or an expense as a percentage of revenue.” For example, if the CODM is provided segment revenue and gross margin %, then COGS is easily computable and if COGS is considered a significant segment expense, then it should be disclosed.

Allocation of overhead expenses

Allocation of overhead expenses may be a significant segment expense, however, the method used to allocate overhead expenses should be disclosed.

Other Segment Items:

Other segment items is a catch-all that reconciles each segment’s revenue less disclosed significant expenses to that segment’s profit and loss measure. For example,

| Segment A | |

| Revenue | 100,000,000 |

| COGS | 80,000,000 |

| Sales & Marketing | 10,000,000 |

| Other Segment Items* | 7,500,000* |

| EBITDA | 2,500,000 |

* Other segment items include legal and professional costs, bad debt expense and goodwill impairment.

Single Reportable Segment:

Perhaps the biggest change relates to entities with a single reportable segment. A public entity that has a single reportable segment is required to provide all disclosures required by segment guidance. This means that even if an entity does not identify any reportable segments, it must disclose:

- Significant segment expenses

- Other segment items

- Measure of profit or loss that the CODM uses (e.g., EBITDA) to allocate resources, including a reconciliation of the measure(s) to the financial statements

When this information is already disclosed elsewhere (e.g., line items in financial statements), then the public entity should disclose the measure of profit or loss used by the CODM, information about all significant expenses that are regularly provided to the CODM and included within that measure, and any other segment items whose line items could differ from those that are currently presented on the face of the income statement.

Implementation:

Public entities, including those with a single reportable segment, should perform the following steps after identifying reportable segments:

- Identify Chief Operating Decision Maker(s) (CODMs);

- Review what financial information (e.g., CODM packages, or segment information regularly provided to the CODM through different means such as dashboards);

- Develop a policy for what constitutes “significant segment information.” For example, setting a percentage of revenue (e.g., 10%) or total expenses might be a reasonable policy. We believe there is a rebuttable presumption that the expense categories used for the consolidated financial statements would also be considered significant for most, if not all, segments.

- Determine what information is “easily computable.”

- Monitor for changes in what the CODM(s) receive between periods.

Effective Date and Transition Requirements:

Public business entities: Fiscal years beginning after December 15, 2023, including interim periods within fiscal years beginning after December 15, 2024.

All other entities: Not applicable.

The amendments in this Update should be applied retrospectively and early application is permitted.

List of Newly Effective Standards This Busy Season

Calendar Year-end Public Companies

The following ASUs are effective for public companies for calendar year 2023:

- ASU 2016-13*: Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments

- ASU 2017-04*: Simplifying the Test for Goodwill Impairment

- ASU 2018-12**: Accounting for Long-Duration Contracts

- ASU 2022-05**: Transition for Sold Contracts

- ASU 2021-08: Accounting for Contract Assets and Contract Liabilities from Contracts with Customers

- ASU 2022-01: Fair Value Hedging – Portfolio Layer Method

- ASU 2022-02: Troubled Debt Restructurings and Vintage Disclosures

- ASU 2022-04: Disclosure of Supplier Finance Program Obligations

- ASU 2022-06: Reference Rate Reform Scope & Deferral of Sunset Date

Calendar Year-end Private Companies

The following ASUs are effective for private companies for calendar year 2022:

- ASU 2016-13*: Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments

- ASU 2017-04*: Simplifying the Test for Goodwill Impairment

- ASU 2022-02: Troubled Debt Restructurings and Vintage Disclosures

- ASU 2022-04: Disclosure of Supplier Finance Program Obligations

- ASU 2022-06: Reference Rate Reform Scope & Deferral of Sunset Date

ASUs Effective for 1st Quarter 2024 Public Companies

- ASU 2020-06*: Debt-Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity

- ASU 2022-03: Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions

- ASU 2023-01: Common Control Leasing Arrangements

- ASU 2023-02: Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method

- ASU 2023-05: Recognition and Initial Measurement of Joint Ventures

Practice Insight for Newly Effective Standards

Current Expected Credit Losses

For private entities and SRCs, prior to the adoption of CECL, impairment of financial instruments was recognized once a loss became probable (i.e., “incurred credit losses”). For example, a loan receivable becoming significantly overdue. CECL eliminates the probable recognition threshold and requires an estimate of the expected losses over the life of the financial instrument to be recorded at the time the instrument is initially recorded. CECL also states that an entity shall not rely solely on the past to estimate losses. An entity shall consider if historical information should be adjusted to reflect current conditions and forward-looking data such as expected GDP, unemployment rates, property values, commodity values or other factors that are associated with credit losses for that type of financial instrument. In addition, CECL requires an entity to evaluate financial assets that share similar risk on a collective basis, rather than individually.

PRACTICE INSIGHTS:

Not Just Financial Institutions

There is a common misconception that CECL only impacts financial institutions. While CECL impacts financial institutions more acutely, CECL will impact virtually all entities. The most common example of this is trade receivables. Trade receivables are financial instruments and thus CECL must be applied to them. For entities that currently do not have a general reserve applied to all receivables, regardless of their delinquency status, the adoption of CECL will most likely result in an increase in the allowance for uncollectable accounts. This is true even if the entity has historically not experienced any write-offs. This is because CECL requires an entity to consider some possibility of default, even if that risk is remote.

Difficult to Assert Zero Allowance

While an entity may have no history or expectation of a loss for a particular customer, corporate bond default studies demonstrate that there is always a risk of default, even for highly rated customers. We and other firms believe that it will be challenging for an entity to assert a zero expected credit loss. ASU 2016-13 included an example (326-20-55-48 Example 8) of when a zero expected credit loss might be appropriate. That example assessed that a zero expected loss might be appropriate for an entity that invested in U.S. treasuries. Although the example states that it is not only applicable to U.S. treasuries, the example included several criteria that U.S. treasuries met, but are not present in most other financial instruments and thus would suggest that under CECL, most receivables would require some amount of allowance.

For example, the entity in Example 8 concluded that its U.S. treasuries had a zero expected credit loss because U.S. treasuries:

- Receive a consistently high credit rating by rating agencies

- Have a long history with no credit losses

- Are explicitly guaranteed by a sovereign entity, which can print its own currency

- Have currency that is routinely held by central banks, used in international commerce and commonly viewed as a reserve currency

What we have seen in practice is that in certain limited situations, the trade receivable allowance might not be zero but is immaterial. For example, if an entity has historically experienced limited or no losses, currently there are no material significantly past due accounts, the current customer type and aging is similar to historical experience, customers are large financially stable institutions where there is no indication of inability to pay, and similar public entities have immaterial allowances. For example, in the pharmaceutical industry many public entities are reporting an immaterial allowance. This is because they meet many of the aforementioned criteria including the fact that often the only receivables are due from the “Big 3” wholesale distributors, which are large financially stable institutions and there is no indication of inability to pay

Mostly Likely Allowance Methodology for Trade Receivables

ASU 2016-13 does not require a specific methodology but does provide examples of several different methodologies. We believe that for short-term trade receivables the most appropriate methodologies are likely to be either the Loss Rate Method or the Aging Analysis.

Two New Allowances Are Required

CECL is effective for non-public business entities (including SRCs) for fiscal years beginning after December 15, 2022, using a modified retrospective approach. For calendar year-end entities, this means:

- They will need to compute their allowance (e.g., Trade AR allowance) under CECL’s expected credit loss model at year-end 2023 and at year-end 2022.

- If material, the change to the December 31, 2022 allowance should be recognized through a cumulative effect adjustment to retained earnings.

This transition approach means assessing the current conditions and reasonable and supportable forecasts for two periods in the year of adoption, not just one.

How to Compute Historical Loss Rate

For many entities, the most difficult part of adopting CECL will be computing the historical loss rate. ASU 2016-13 does not require a specific methodology but does provide examples of several different methodologies and for short-term trade receivables we believe the most appropriate methodologies are likely to be either the Loss Rate Method or the Aging Analysis.

Loss Rate Method

Summary:

A historical loss rate for each “pool” of financial assets with similar risk characteristics is computed. This historical loss rate is then the starting point and adjusted for current conditions and “reasonable and supportable forecasts” in determining the ending allowance.

Data Needs:

- Total credit sales for the historical period

- Total write-offs related to credit sales for that historical period

- The above information disaggregated by pools of similar risk characteristics

Example:

Pooling: Entity A has pooled trade receivables by type of customer (e.g. size, credit rating, industry, etc.) noting they had similar risk characteristics.

Lookback length of time: Management notes that AR turnover is 6 and thus 2 years of data should be sufficient to capture enough cycles to achieve mean regression.

Lookback period: Management noted that it experienced an unusually high amount of write-offs during 2020 and 2021 due to the pandemic, which management believes are outlier periods and not indicative of future performance. Therefore, management selected 2019 and 2022 as its historical look-back period.

Based on the above assumptions and inputs, management prepared the following calculations:

| Credit Sales of Customer Type A: | ||

| Credit sales | 2019 | 165,000 |

| Credit sales | 2022 | 135,000 |

| 300,000 (A) | ||

| Write-Offs of Customer Type A: | ||

| Write-offs | 2019 | 9,000 |

| Write-offs | 2022 | 13,500 |

| 22,500 (B) | ||

| Historical Loss Rate for Customer Type A | 7.50% = B / A | |

The 7.5% would be the historical loss rate and the starting point for determining the CECL allowance after adjusting for current conditions and reasonable and supportable forecasts.

Aging Method

Summary:

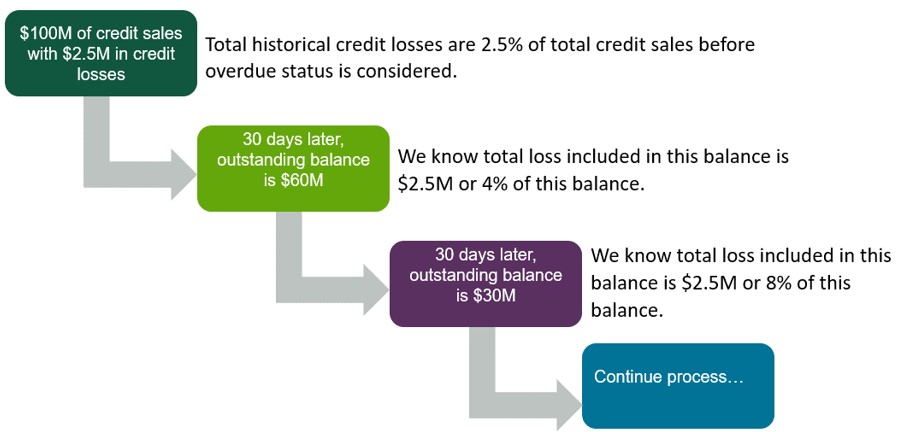

The aging method is similar to the Loss-Rate Method; however, receivables are pooled by aging status in addition to any other categories (e.g., customer type, industry, etc.) that management concludes are appropriate. This requires the entity to construct a migration analysis for credit sales during the historical period but results in a more accurate assessment of expected credit losses.

Data Needs:

- Total credit sales for the historical period

- Ability to determine when those historical credit sales were paid (e.g. w/in 30, 60, 90 days, etc.)

- Total write-offs related to credit sales for that historical period

- The above information disaggregated by pools of similar risk characteristics

Example:

Pooling: Entity A has pooled trade receivables by aging status noting receivables within each aging category had similar risk characteristics.

Lookback length of time: Management notes that AR turnover is 6 and thus 2 years of data should be sufficient to capture enough cycles to achieve mean regression.

Lookback period: Management noted that it experienced an unusually high amount of write-offs during 2020 and 2021 due to the pandemic, which management believes are outlier periods and not indicative of future performance. Therefore, management selected 2019 and 2022 as its historical look back period.

Based on the above assumptions and inputs, management prepared the following calculations:

Step 1: Construct a Hypothetical Aging Using Credit Sales and When Amounts are Subsequently Paid

| A | B | = A - B | |

| Category | Credit Sales | Amount Paid | “Balance” |

| 0 days past due | 100,000,000 | 40,000,000 | 60,000,000 |

| 1-30 days past due | 60,000,000 | 30,000,000 | 30,000,000 |

| 31-60 days past due | 30,000,000 | 12,500,000 | 17,500,000 |

| 61-90 days past due | 17,500,000 | 7,000,000 | 10,500,000 |

| 91-120 days past due | 10,500,000 | 5,000,000 | 5,500,000 |

| > 120 days past due | 5,500,000 | 3,000,000 | 2,500,000 |

| Written-off | 2,500,000 | - | 2,500,000 |

The beginning figure (0 days past due) is the total credit sales for 2019 and 2022. Then each subsequent aging category is equal to this amount less amounts already paid. See formulas within. Conceptually these amounts represent the “balance” in each aging category for credit sales over a period of time.

B = This represents amounts paid within the noted aging category. For example, $40M of credit sales was paid before the related receivable was past due, $30M was then paid when the related receivable was 1-30 days past due, and so forth. An entity will need to analyze its data to determine how long it took to collect all of its receivables (i.e. a migration analysis).

Step 2: Compute Historical Loss Rate by Aging Category

| D | |||

| Category | Balance | Write-offs | Loss Rate |

| 0 days past due | 100,000,000 | 2,500,000 | 2.50% |

| 1-30 days past due | 60,000,000 | 2,500,000 | 4.17% |

| 31-60 days past due | 30,000,000 | 2,500,000 | 8.33% |

| 61-90 days past due | 17,500,000 | 2,500,000 | 14.29% |

| 91-120 days past due | 10,500,000 | 2,500,000 | 23.81% |

| > 120 days past due | 5,500,000 | 2,500,000 | 45.45% |

D = The logic for dividing total write-offs by the outstanding balance for each aging category can be explained by following the loss allowance as it moves through the different aging categories as shown below.

The loss rates computed in the table above would be the historical loss rates and the starting point for determining what CECL allowance after adjusting for current conditions and reasonable and supportable forecasts.

As you can see, computing the historical loss rate requires a good bit of work and is not always intuitive.

Standards Not Yet Effective*, But That You Should Consider Early Adopting

*Not yet effective for private entities

- ASU 2018-12: Accounting for Long-Duration Contracts

- ASU 2022-05: Transition for Sold Contracts

- ASU 2020-06: Debt-Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity

- ASU 2021-08: Accounting for Contract Assets and Contract Liabilities from Contracts with Customers

- ASU 2022-01: Fair Value Hedging – Portfolio Layer Method

- ASU 2022-03: Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions

- ASU 2023-01: Common Control Leasing Arrangements

- ASU 2023-02: Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method

A brief summary and practice insights for the most notable ASUs…

Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity

Adoption of this amendment will simplify the accounting associated with certain financial instruments with characteristics of both liabilities and equity and amends certain disclosure requirements. The Update eliminates the beneficial conversion (BCF) and cash conversion model reducing the number of accounting models available for convertible debt instruments and convertible preferred stock, which is aimed to result in fewer embedded conversion features being separately recognized from the host contract when compared to current GAAP. Additionally, the Update makes certain changes to EPS guidance.

Entities that will see the most impact from early adopting are those who:

- Hold convertible instruments with beneficial conversion or cash conversion features.

- Hold contracts in their own equity, specifically freestanding instruments and embedded features that are accounted for currently as derivative liabilities.

Specifically, for entities that hold contracts in their own equity, the ASU removes the following conditions that were required in order for equity classification:

- Settlement must be in unregistered shares

- There is no requirement in the contract to post collateral.

- No counterparty rights rank higher than shareholder rights

Effective Date and Transition Requirements:

Public business entities (excluding SRCs): Fiscal years beginning after December 15, 2021, including interim periods within those years

All other entities (including SRCs): For fiscal years beginning after December 15, 2023, including interim periods within those years

The amendments in this Update should be applied using either the modified or full retrospective method. Early adoption is permitted, however, all private entities, regardless of whether they early adopt this Update or not, should consider this ASU’s clarification that freestanding financial instruments potentially settleable in an entity’s own stock are required to be assessed under ASC 815-40 Contracts in Entity’s Own Equity, regardless of whether the instrument meets the definition of a derivative.

PRACTICE INSIGHTS:

A fair value determination might still be necessary

The new disclosure requirements created by ASU 2020-06 are often overlooked and they could thwart some of the perceived benefits. ASU 2020-06 requires the following additional disclosures for convertible instruments:

- Condition or events that may cause conversion or changes to conversion terms

- What party controls conversion rights

- Fair value disclosures be presented at the individual convertible instrument level rather than in aggregate

Requiring the fair value of convertible instruments be disclosed indirectly means that although a BCF or cash conversion feature might not be separately accounted for, the costly exercise of determining their fair value is not alleviated.

Private entities beware

For some private entities, the most consequential but easily overlooked impact of this ASU is that it clarifies that all financial instruments that are freestanding and potentially settleable in an entity’s own stock are required to be assessed under ASC 815-40 Contracts in Entity’s Own Equity, regardless of whether the instrument has all the characteristics of a derivative instrument. Some private entities have taken the view that because their stock is not actively traded (i.e. “readily convertible into cash”) any instrument potentially settleable in their stock did not meet the net settlement criterion required under the definition of a derivative. Thus, any such instrument would not have to be analyzed under ASC 815-40 at all or that if the instrument was analyzed under ASC 815-40 and found to not meet the equity classification criteria, it would not be subsequently remeasured at fair value like other derivative liabilities because it did not meet the definition of a derivative. This ASU clarifies that any freestanding instrument, regardless of whether the instrument would meet the definition of a derivative, must be assessed under ASC 815-40 and if found to either not be considered indexed to the entity’s own stock or did not meet the equity classification criteria, then said instrument must be classified as a liability and remeasured at fair value at each reporting period.

This concern was explicitly mentioned in Basis for Conclusions paragraph 103 as follows:

A few comment letter respondents observed that the fair value requirement may include contracts that were previously not measured at fair value. The Board acknowledges that because of a lack of guidance, there may be a population of these instruments that are currently being accounted for at cost and, therefore, an entity should transition to fair value measurement under the amendments in this Update. The Board concluded that this amendment mostly affects freestanding instruments issued by private companies. For example, a freestanding warrant on the share of a private company may not meet the definition of a derivative because it requires physical settlement or cannot be net settled because the underlying equity is not readily convertible to cash.

This clarification could result in some private entity instruments that were previously not classified as a liability and/or remeasured subsequently at fair value to be classified as a liability and remeasured subsequently at fair value. This could result in restatements and/or costly valuations of those private entities.

Accounting for Contract Assets and Contract Liabilities From Contracts With Customers

Don’t “lose” revenue in a business combination.

Prior to the adoption of ASU 2021-08, whenever a business combination occurs, the acquirer is required to account for any pre-existing contract assets and liabilities related to revenue contracts acquired from the acquiree in accordance with ASC 805 Business Combinations, which requires the contract assets and liabilities be measured at fair value. Often this results in “lost revenue” because the fair value of deferred revenue is generally measured using the “cost build-up approach,” which estimates the costs incurred to satisfy the performance obligation, plus a normal profit margin. For entities with low variable costs to provide services to additional customers or for entities forced to defer revenue for services that have largely already been performed due to accounting rules (e.g., not distinct), this can result in a significant reduction or “haircut” to acquiree’s carrying value of deferred revenue. This is particularly impactful to the technology, software and telecommunication industries. When significantly reduced to fair value, deferred revenue is subsequently recognized into revenue and the originally recorded revenue is “lost.” The amendments in this Update require that an acquirer recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with Topic 606. At the acquisition date, an acquirer should account for any contract asset or liability related to a pre-existing revenue contract of the acquiree in accordance with Topic 606, as though the acquirer had originated the contract. Generally, this should result in an acquirer recognizing and measuring the acquired contract assets and contract liabilities consistent with how they were recognized and measured in the acquiree’s financial statements. However, there may be circumstances in which the acquiree’s carrying value would not be used such as:

- The acquiree did use Generally Accepted Accounting Principles (GAAP)

- The acquirer is unable to assess or rely on how the acquiree applied Topic 606

- There were errors identified in the acquiree’s accounting

- Changes are required to conform with the acquirer’s accounting policies

Importantly, the amendments in this Update do not affect the accounting for other assets or liabilities acquired in a business combination (e.g., refund liabilities, customer-related intangible assets, intangible assets for off-market terms, etc.).

Effective Date and Transition Requirements:

Public business entities: For fiscal years beginning after December 15, 2022, including interim periods within those fiscal years.

All other entities: For fiscal years beginning after December 15, 2023.

The amendments in this Update should be applied prospectively to business combinations occurring on or after the effective date of the amendments.

Early application is permitted, including adoption in an interim period. An entity that early adopts in an interim period should apply the amendments retrospectively to all business combinations that occurred during that fiscal year and prospectively to all future business combinations.

Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions

This amendment does not change current GAAP but rather clarifies those principles when measuring fair value and reduces the diversity in practice. The amendments in this Update clarify that if an equity security has contractual sale restrictions, this is not to be considered part of the unit of account and is therefore not considered when measuring the security’s fair value, which is often referred to as a liquidity discount for lack of marketability (“DLOM”) which can require a costly valuation.

Disclosure Changes:

The amendments in this Update require an entity that holds equity securities subject to contractual sale restrictions to disclose the following:

- The fair value of equity securities subject to contractual sale restrictions reflected in the balance sheet

- The nature and remaining duration of the restriction(s)

- The circumstances that could cause a lapse in the restriction(s)

PRACTICE INSIGHTS:

DLOM might still be required.

It is often misunderstood that this ASU eliminates the need for ever obtain a DLOM. This ASU only applies to contractual restrictions that are not part of the characteristics of the underlying equity security but rather only applies to contractual restrictions that are based on who holds the equity security. For example, a lockup on shares of a publicly traded company that recently completed an IPO would be considered a contractual restriction on the holder of the security, and no discount for the lock up would be allowed under this ASU. This is a change from the way many entities currently account for this type of restriction. In current practice, many investment companies calculate a discount on the publicly traded price of the security when determining fair value of a share under a lock-up agreement. This discount would no longer be allowed under the new guidance. Juxtapose this to restrictions on shares issued through a private placement or other unregistered shares (e.g., Rule 144) that are legally restricted from being sold until they have been registered or the conditions necessary for exemption from registration have been met. This restriction would be considered a characteristic of the underlying equity security and therefore should be part of the unit of account. Therefore, this characteristic would be considered in measuring the fair value of the security and a DLOM would be applied.

Effective Date and Transition Requirements:

Public business entities: For fiscal years beginning after December 15, 2023, including interim periods within those fiscal years.

All other entities: For fiscal years beginning after December 15, 2024, including interim periods within those fiscal years.

Early adoption is permitted for both interim and annual financial statements that have not yet been issued.

Investment company under Topic 946: The amendments in this Update should be applied to those applicable equity securities executed or modified on or after the date of adoption. Those equity securities executed before the date of adoption should continue to be accounted for under the accounting policy applied before the adoption of the amendments until the contractual restrictions expire or are modified.

All other entities: The amendments in this Update should be applied prospectively, with any adjustments recognized in earnings and disclosed.

Leases (Topic 842): Common Control Arrangements

Terms and Conditions to Be Considered

Background: Under the old lease standard (ASC 840), entities were required to classify and account for a lease on the basis of economic substance, which is not necessarily the same as the written terms, especially when there is a related party relationship between the lessee and lessor. Under the new lease standard (ASC 842), entities are required to classify and account for leases on the basis of legally enforceable terms and conditions, which could be written or oral. Stakeholders observed that determining the legally enforceable terms and conditions of a common control arrangement can be difficult and costly because often the terms are not written, or have expired, and/or they are not on terms and conditions that reflect an arms-length transaction. Many stakeholders believed that determining the legally enforceable terms and conditions for those arrangements could necessitate obtaining a formal legal opinion, which would be overly burdensome.

Changes: The amendments in this Update provide a practical expedient for private companies to use only the written terms and conditions of a common control arrangement when determining whether a lease exists and, if so, the classification and accounting for that lease. If no written terms and conditions exist and if the entity has not documented the existing unwritten terms and conditions upon adoption of ASC 842 or lease commencement, then an entity is prohibited from applying the practical expedient and must evaluate the legally enforceable terms and conditions, which may include unwritten terms and conditions.

The terms and conditions practical expedient may be applied on an arrangement-by-arrangement basis.

The terms and conditions practical expedient is available to entities that are not:

- Public business entities

- Not-for-profit conduit bond obligors

- Employee benefit plans that file or furnish financial statements with or to the U.S. Securities and Exchange Commission (SEC).

Entities adopting the terms and conditions practical expedient concurrently with adopting the new lease standard are required to follow the same transition requirements used to apply Topic 842. All other entities are required to apply the terms and conditions practical expedient either:

- Prospectively to arrangements that commence or are modified on or after the date that the entity first applies the practical expedient; or

- Retrospectively to the beginning of the period in which the entity first applied Topic 842 for arrangements that exist at the date of adoption of the practical expedient.

Accounting for Leasehold Improvements

Background: In addition to the above changes, the Update also amended how leasehold improvements under common control leases are amortized. Both the old and new lease standards generally require leasehold improvements to be amortized over the shorter of the remaining lease term or the useful life of the improvements. Stakeholders noted that often times leases under common control are short-term (e.g., month-to-month) and amortizing leasehold improvements over a period shorter than the expected useful life of the leasehold improvements may result in financial reporting that does not faithfully represent the economics of those leasehold improvements.

Changes: The amendments in this Update require that leasehold improvements associated with common control leases be:

- Amortized over the useful life of the leasehold improvements (regardless of the lease term). However, if the lessor obtained the right to control the use of the underlying asset through a lease with another entity not within the common control group, the amortization period may not exceed the life of the lease with the other party not within the common control group.

- Accounted for as a transfer between entities under common control through an adjustment to equity if, and when, the lessee no longer controls the use of the underlying asset.

The leasehold improvement changes are effective for all entities and all leases under common control.

Effective Dates:

Both the terms and conditions practical expedient and the changes to leasehold improvements are effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years.

Early adoption is permitted for both interim and annual financial statements that have not yet been made available for issuance. If an entity adopts the amendments in an interim period, it must adopt them as of the beginning of the fiscal year that includes that interim period.

PRACTICE INSIGHTS:

Early adoption

Most private entities with common control leases will want to adopt this Update because it will simplify the accounting and reduce cost.

Common control vs. common ownership

Common control is not the same as common ownership. This is a common oversight that has caused problems with other standards that are dependent upon common control such as accounting for variable interest entities under common control. Common control requires that all entities under the common control umbrella are controlled by a single shareholder, which includes any holdings by their immediate family members, or controlled by a group of shareholders who have written agreement to vote in concert. On the other hand, common ownership exists when two or more entities have the same or similar shareholders but no one shareholder controls the entities.

It’s important to note that ASU 2023-01 is only applicable to common control relationships. If a lessee and lessor are not controlled by a common individual or entity, then the Update cannot be applied.

Month-to-Month or “Evergreen” Leases

One of the most common difficulties when applying the new lease standard is how to apply the standard to month-to-month or “evergreen” leases, whether or not the lease is with a commonly controlled entity. The determination of the lease term for month-to-month or “evergreen” lease will depend on what termination or renewal periods are legally enforceable as follows:

|

Period |

Impact on Lease Term |

|

Either party can terminate or choose not to renew |

There are no longer any legally enforceable rights and obligations when both the lessee and the lessor each have the right to terminate or not renew the lease without permission from the other party and with no significant penalty. Therefore, these periods are not within the scope of ASC 842 and should not be included in the lease term. |

|

Only the lessee can terminate or choose not to renew |

Legally enforceable rights and obligations exists and the lessee should consider if these periods are “reasonably certain” (generally considered > 75% likely) to be exercised. If so, then these periods should be included in the lease term. |

|

Only the lessor can terminate or choose not to renew |

Legally enforceable rights and obligations exists and there is a rebuttable presumption that options to renew that are in control of the lessor will be exercised by the lessor for the remaining life of the underlying asset. |

Notice Provisions

A minimum notice requirement is effectively a noncancelable period. For example, if the lease requires a 90-day notice period to terminate, then that lease creates legally enforceable rights and obligations during the 90-day notice period and effectively there would be an enforceable term on a rolling 90-day basis.

What happens if the original/previously estimated lease term for a month-to-month lease turns out to be incorrect?

For example, what happens if the lessee originally believed that a month-to-month lease would only be renewed for 9 months (i.e. meet the short-term lease exception) but in month 9 decides it will be renewed for an additional 9 months (i.e. 18 months in total). If a lessee has determined that the lease term originally/previously estimated should be extended, only the remaining lease term (which includes renewals that were previously not included in the lease term but are now “reasonably certain” of exercise) should be considered. In this example, although the total lease term from the original commencement date is now 18 months, because the remaining lease term is only 9 months, the lease would still qualify for the short-term lease exception. In the basis for conclusion paragraphs, the FASB noted that application of the short-term lease exception could result in, “a lease that ultimately extends for 10 years or more could be structured as a 1-year lease with a series of 1-year renewal options, which could result in the lease never being recognized on a lessee’s statement of financial position.”

Importance of Having Written Agreements or Documentation and Update Frequently

The terms and conditions practical expedient in ASU 2023-01 requires the lease terms to be written or, if unwritten, the terms and conditions should be contemporaneously documented upon adoption of ASC 842 or the lease commencement, if later. If a “month-to-month” lease expires, an entity would find that written terms no longer exist and, therefore, the lease would be disqualified from the practical expedient. However, if the lease is written and renewal clauses are added to avoid the aforementioned consequences, then the lessee must determine what renewal periods are “reasonably certain” of exercise and that could disqualify the entity from the short-term lease exception. Therefore, to both apply the terms and conditions practical expedient and maintain the short-term lease exception, the private company would need to regularly maintain written leases without renewal options controlled by the lessee that could cause the lease term to exceed one year. Accordingly, entities will need to remember to enter into a new lease upon each expiration date.