Contributors: David Boyd, Senior Manager, Risk & Accounting Advisory Services

The new pay versus performance disclosure within a company’s annual proxy statement is required by the U.S. Securities and Exchange Commission (SEC) Regulation S-K Item 402(v), effective in October 2022, and applicable for proxy statements filed for fiscal years ending on or after December 16, 2022. Item 402(v) impacts most SEC filers, including Smaller Reporting Companies (SRC), who file an annual proxy statement, except for foreign private issuers, multi-jurisdictional disclosure system issuers and others not subject to Regulation S-K.

These new disclosure rules add to preexisting required executive pay disclosures, including those on pay disparity (e.g., CEO vs. Median Pay disclosures). The intent of these disclosures is for companies to demonstrate the relationship between executive team performance as compared with their compensation actually paid.

Item 402(v) of Regulation S-K requires companies to present a table disclosing executive compensation and key financial performance metrics for the past five fiscal years. This includes total compensation, compensation actually paid to top executives, total shareholder return (TSR) of the company, TSR of its peer group, net income and a chosen financial performance measure linked to executive compensation.

The following is an example of the table required by the standard.

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) |

| Year (1) | Summary Compensation Table Total for PEO ($) (2) | Compensation Actually Paid to PEO ($) (3) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers ($) (2) | Average Compensation Actually Paid to Non-PEO Named Executive Officers ($) (3) | Value of Initial Fixed $100 Investment Based on: | Net Income ($) (in thousands) (6) | Company Selected Measure (7) | |

| Total Shareholder Return ($) (4) | Peer Group Total Shareholder Return ($) (5) | |||||||

| 2022 | $ | $ | $ | $ | $ | $TBD | $ | |

| 2021 | $ | $ | $ | $ | $ | $TBD | $ | |

| 2020 | $ | $ | $ | $ | $ | $TBD | $ | |

Note: The footnotes to this table will vary depending on the number of PEO’s and Named Executive Officer’s (NEO) throughout the fiscal year and the adjustments to the compensation “actually paid.”

Impacts for Smaller Reporting Companies

An SRC may provide the pay versus performance information for three years (two in the first year of disclosure), instead of five years.

An SRC is not required to provide the peer group TSR disclosures, the company-selected measure disclosure or the tabular list. For purposes of calculating compensation “actually paid,” SRCs are not required to disclose amounts relating to pension benefits.

However, many SRCs might not have tracked their TSR in the past. Even those that have done so might not have performed the TSR calculations as required by the pay versus performance disclosure rules. Since 2006, SRCs have not been required to provide the “performance graph” that is required by Item 201(e) of Regulation S-K. For most SRCs, the calculation will begin on December 31, 2020, through December 31, 2022. In the subsequent year, December 31, 2023, will be added to the table. Thereafter each year, the oldest year will drop off and the most recent year will be added.

Calculating “Compensation Actually Paid” and Its Challenges

The rules to calculate the SEC’s definition of “compensation actually paid” are complex. The full listing of SEC rules to define “compensation actually paid” are included within 17 CFR 229.402(v)(2)(iii) [1] and include adjustments to defined benefit plans, actuarial pension plans, stock awards and option awards.

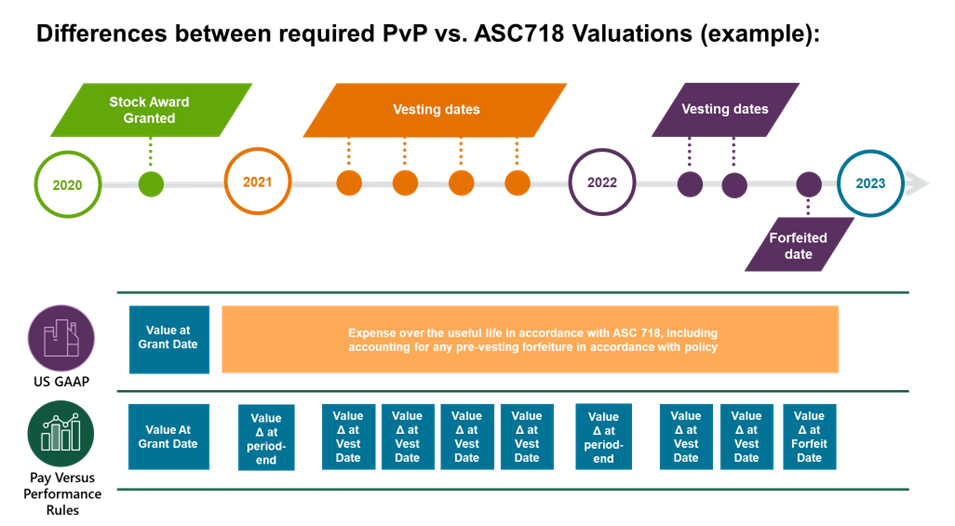

The most common adjustments affects how a company calculates the value of its stock awards. Instead of reporting the value of the stock compensation granted in line with financial statements as required under ASC 718, Compensation – Stock Compensation (ASC 718), the compensation is remeasured to show the impact of the changes in the value of unvested options between their grant date and vesting date for each year. This difference can pose challenges for companies with cliff vesting schedules. The company may need to calculate separate stock award valuations at each vesting date.

The below example shows the differences between the number of required valuations under ASC 718 compared to the pay versus performance rules under SEC Regulations S-K item 402(v). The example further shows a stock award granted during 2020, with quarterly vesting dates from Q1 2020 through Q2 2022, and a forfeiture event in 2022.

[1] Code of Federal Regulations: https://www.ecfr.gov/current/title-17/chapter-II/part-229/subpart-229.400/section-229.402#p-229.402(v)(2)(iii)

Differences Between Required Pay Versus Performance and ASC 718 Valuations

Within this simple example, the number of required ASC 718 valuations for a single grant increases from one under ASC 718, to 10 under the pay versus performance rules. Under a typical stock option scenario, this may require 10 individual and separate Black Scholes calculations, with volatility calculations.

For a company with five NEOs with monthly vesting, this may easily balloon up to over 180 stock option valuations (1/month x 12 months x 3 years x 5 NEOs). In situations where vesting is conditional on performance targets, or where complex valuation methods are used, the valuation may be more time consuming and intricate, requiring specialist valuation approaches, (e.g., Monte Carlo or discounted cash flow methods). Due to the volume of valuations which may be required, companies should ensure that an effective valuation model is used to simplify the review and reduce the potential for errors in the valuation model or underlying assumptions.

Disclosing a Performance Measure

Where required, companies will need to calculate and report a performance measure, which includes GAAP financial performance measures and/or specific non-GAAP KPIs. Companies should ensure that the calculations are supportable by adequate sources. Companies should ensure that they keep an adequate calculation trail to capture, validate and report on the data for their selected measures, their TSR and the TSR of their selected peer group (where required).

Graphing and XBRL Tagging

For companies that are within the pay versus performance requirements and not SRCs, the new rules require the disclosure of the pay versus performance disclosure to be tagged in machine-readable format (XBRL). As compared with 7 pages of the underlying regulations ( S-K 402(v)), the Executive Compensation Disclosure taxonomy is relatively complex at 17 pages. Companies subject to the increased disclosure rules must engage in XBRL filing support well in advance of their filing.

In the era of robo-advisors, these tagged disclosures of performance characteristics are likely to be a driver of automated data mining analyses going forward. It is likely that characteristics of your company’s performance drivers will be automatically incorporated into automated market research. Companies should acknowledge and understand where they diverge from their peers in pay versus performance, for instance, in the selection of key drivers versus your peers – or the rollout of ESG measures to drive performance.

How Can We Help

New filers, or those who are newly subjected to the increased disclosure rules may want to start the process of preparing calculation support and reviewing requirements sooner rather than later. Cherry Bekaert’s Accounting Advisory and ESG Consulting practices leverage valuation, financial reporting and data expertise to assist filers in calculating required proxy disclosures.

If you have any questions, contact your Cherry Bekaert advisor or a member of the Firm’s Risk & Accounting Advisory Services practice today to learn more about how we can effectively assist with more complex situations including accounting for multi-year plans, multiple period vesting conditions and complex valuation methods.