The location of a business has a significant impact on operational efficiency, market access and growth potential. Understanding the benefits of certain locations is key to making informed decisions about business success and expansion.

Tax credits and incentives are valuable tools for businesses looking to expand or grow in economically distressed areas. These tax incentives can provide access to funding, resources and other benefits that can help businesses reach their ambitions for growth. By leveraging tax credits and incentives, companies can attract resources that may not have been available otherwise, creating opportunities for growth and development in communities that may have been previously overlooked.

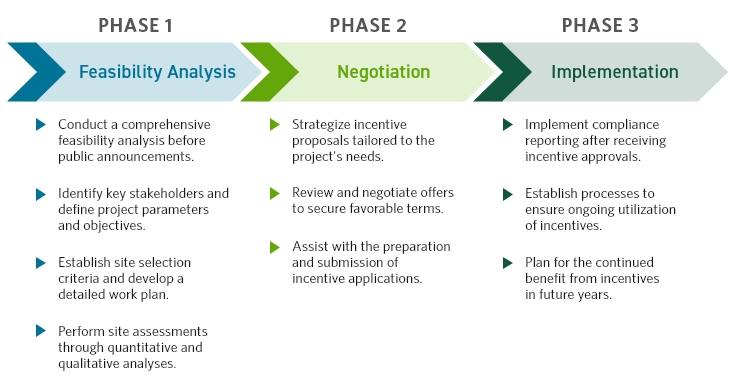

Site Selection Process

Before any public announcements are made, the first phase of the site selection process involves a feasibility analysis. Followed by negotiation of the amount and terms of incentives available, implementation and compliance reporting. Businesses must identify key stakeholders, define project parameters and objectives, identify site selection criteria, and develop a work plan to perform site assessments, including quantitative and qualitative analyses.

The negotiation phase involves strategizing incentive proposals, reviewing and negotiating offers and assisting with applications. In the final implementation phase, after the business receives incentive approvals, a compliance reporting process will be established to ensure ongoing utilization of incentives for future years.

Why Is Location Important for a Business?

Location matters when it comes to capital planning, capital raising and tax advantages. Various external factors described below can tip the scale in favor of one location over another.

New Markets Tax Credits

New Markets Tax Credits (NMTCs) are designed to encourage investment in low-income communities and provide businesses with access to funding that can help them expand and grow in eligible communities. NMTCs can be used to finance a wide range of asset types, including owner-occupied real estate, equipment and working capital for new construction or rehabilitation of existing properties.

Federal Historic Tax Credits

Federal historic tax credits are designed to encourage the rehabilitation of historic buildings and can provide businesses with a tax credit of up to 20% of their qualified rehabilitation expenses. These tax credits can be used to offset federal tax liability or sold to generate equity for the project.

State Historic Tax Credits

State historic tax credits are similar to federal historic tax credits but are administered at the state level. These credits can provide businesses with a tax credit for rehabilitating historic buildings and can be used to offset state tax liability or sold to generate equity for the project.

Other State Tax Credits

In addition to state historic tax credits, many states offer other tax credits and incentives to businesses, including brownfield remediation, new markets tax credits, job creation tax credits and investment tax credits, all of which can be used to offset state tax liability or generate equity for the project.

Statutory credits are also available to qualified businesses in the manufacturing, warehousing and distribution, processing, technology, research and development (R&D) and agriculture industries. Employment-related credits require a minimum number of jobs to be created, while investment-related credits are often calculated as a percentage of the asset costs.

Training credits are also available for businesses that provide training and development opportunities for their employees. These incentives are offered through both federal and state tax programs, providing various levels of financial support to businesses.

Opportunity Zone Equity

Opportunity Zones are designated areas that need economic development. Investors in Opportunity Zones can receive tax benefits for investments made in these areas, and businesses can leverage Opportunity Zone Equity to finance projects and investments in these locations to help drive economic growth and development.

Your Guide Forward

Cherry Bekaert's Tax Services team can assist businesses with evaluating strategic business location decisions and state and local-specific tax credits to identify available opportunities and develop strategies for community engagement. By working with our tax professionals, businesses can optimize tax savings, reduce costs, enhance competitiveness and unlock unparalleled advantages for long-term success.