Contributors: Eitan Neumark, Dominic Julian

The DTC Wave

Direct-to-consumer (DTC) companies have created a momentous wave in retail, upending traditional retail by satisfying shoppers’ desires for convenience, personalization and quality. The numbers speak for themselves: In 2023, there will be an estimated $151 billion in DTC e-commerce sales in the U.S. and there are currently an estimated 22,000 DTC companies, mostly in clothing, apparel, accessories and lifestyle goods. An estimated 81% of U.S. consumers believe they will make at least one DTC purchase by 2023.

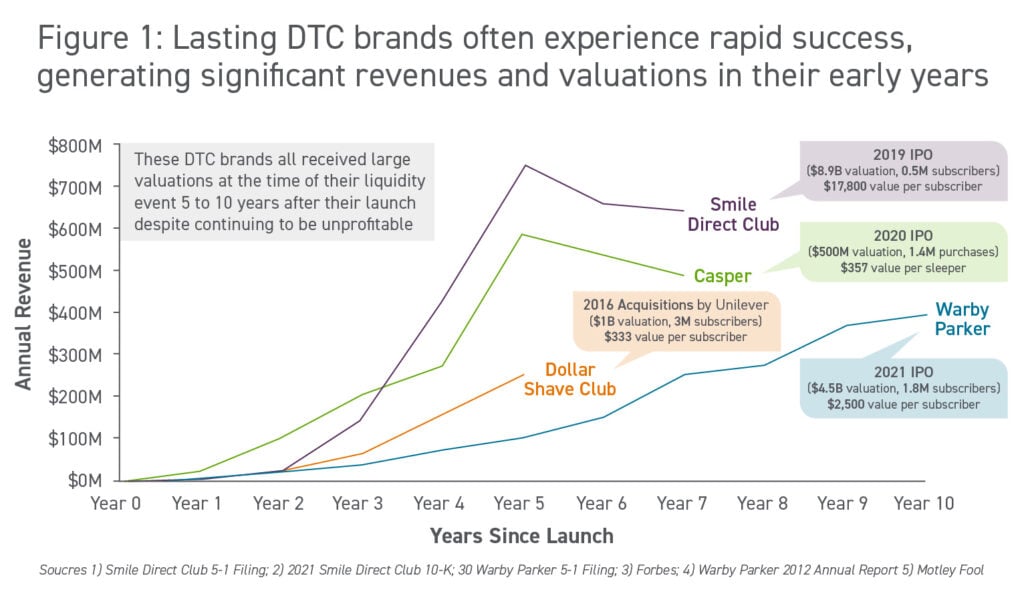

Despite economic uncertainty, the DTC wave remains hot. As an example, Parade, a women’s underwear startup, has recently been valued at $200 million, just three years after launch. Parade is just a recent success story of brands experiencing rapid success, following in the footsteps of well-loved brands that received large valuations within five to 10 years of launching.

Even traditional companies have evolved their mindset. Pepsi grew e-commerce sales in 2021 to $4 billion, driven by two new DTC websites launched in May of 2020. Direct sales accounted for more than 40% of Nike’s 2021 revenue after they slashed 50% of their wholesale accounts over the past four years.

Key partners have capitalized off this wave and enabled companies to maintain focus. Gorgias, a provider of customer service tools for e-commerce, and Veho, seeking to reinvent last-mile delivery, have been valued at $710 million and $1.5 billion, respectively. Even Instacart is getting into the game, with their nationwide launch of “Big & Bulky,” a fulfillment capability that enables same-day and scheduled delivery for large items, helping retailers offer more of their catalogs online.

Challenging Headwinds

Despite the excitement around DTC, brick-and-mortar will continue to be a pillar of retail, as some consumers remain skeptical of DTC. 43% percent of U.S. consumers did not plan to shop at a DTC brand during the 2021 holiday season, and 70% of fashion purchases are made offline.

Meanwhile, the current economic conditions are putting pressure on all retailers. Warby Parker is slashing jobs as inflation takes a toll on fashion. Target’s stock was downgraded on concerns that discretionary category risks could pressure valuation.

DTC brands looking to survive an impending recession need to focus on reducing waste, improving margins, and, as always, strengthening the customer experience. The direct line-of-sight to customers can be vital to better understand evolving customer preferences, to pivot and tailor product offerings more rapidly, and sharpen the focus on services that matter. These challenges ultimately create an opportunity for brands and retailers to weather the storm through DTC.

Winning in DTC: Seven Strategic Choices

T&Co by Cherry Bekaert has researched over 40 companies that have ventured in DTC and found that the most successful ones were very explicit in addressing these seven critical choices:

- What customers should we focus on and what are their needs?

- What is the right mix of products and services to expand the addressable market?

- Which digital and physical channels and channel partners will maximize reach?

- How should the experience be crafted to win and delight customers across their journey and create loyalty?

- Which business model will generate revenue at suitable margins?

- How can we build agility in the operating model to adjust our offering based on feedback?

- Who are the right partners to leverage to move more quickly in the space?

Several DTC success stories highlight the multiple paths companies can take as well as why some encounter roadblocks. Warby Parker began as an online-only retailer and expanded beyond online operations to solidify their market standing and reach new customers. Casper innovated the customer shopping experience for a bulky product by turning portable trailers into “mobile nap units,” enabling customers to try before they buy online. Smile Direct launched a successful, valuable, and innovative product and then built out a partner network to expand product reach. Bonobos proved that an alternative approach to utilizing physical retails could gain customer loyalty without encroaching on online DTC goals. Pepsi and Nike show that DTC is not just a space for upstarts–even legacy brands can increase sales by turning directly to individual customers.

Key Takeaways: Six Winning Themes

Brands can win in DTC despite challenging economic conditions. DTC can help maintain a direct line-of-sight to customers, develop tailored offerings, generate loyalty through service, and position companies for future growth as the economy turns around. Overall, there are six winning themes for DTC:

- Be a mission driven brand to disrupt the conventional player.

- Understand a customer’s lifetime value vs. their cost of acquisition.

- Expand beyond the initial product to dive customer loyalty and differentiation.

- Engage with customers and make them feel part of something bigger than the product.

- Find the right partners to enable ambitions and co-exist with your operating model.

- Build agility into the operating model to test, learn and respond to changing needs.

Guiding You Forward

T&Co by Cherry Bekaert is comprised of strategists and consultants that help organizations see market trends before the competition to anticipate the needs of customers and take advantage of new untapped growth opportunities. Our professionals develop unique strategies and innovation processes to create sustainable, industry-breaking profitable growth.

Contact our Strategic Growth & Innovation team today.