By proactively embracing California and the SEC’s new carbon reporting rules, businesses can not only achieve compliance but also contribute to a more sustainable and resilient future.

As the global community grapples with the increasing threat of climate change, governments and regulatory bodies around the world are adopting mandates to help mitigate their overall environmental impact. In fact, most nations in the developed world, including the U.S. and China, have announced a goal of getting to net zero carbon equivalent emissions by 2050.

Globally, the near-term goal is to cut carbon emissions by 50% by 2030 to limit global warming to 1.5 degrees Celsius, or 2.7 degrees Fahrenheit. In this landscape, California has emerged as a true trailblazer by recently passing new, ambitious carbon reporting rules aimed at promoting sustainability and reducing greenhouse gas emissions for certain companies. The SEC has followed California’s lead and published their mandate as well.

Organizations impacted by these new regulations need to quickly gain a firm understanding of their legal reporting requirements so they can achieve compliance in this jurisdiction. Yet, at the same time, companies can also view this as an opportunity to both grow their businesses and brand while also contributing to a greener future.

“There are tangible business benefits to measuring and reporting emissions,” says Gabriela Payne, Senior Manager, Risk & Accounting Advisory Services. “Proactive companies that have started managing their carbon reporting journeys early are gaining a competitive advantage. They are securing shelf space with retailers, increasing revenue-generating opportunities, and securing access to a lower cost capital.”

A Closer Look at California’s New Carbon Reporting Rules

In October 2023, California enacted two significant pieces of climate legislation: Senate Bill 253 (SB 253), also known as the Climate Corporate Data Accountability Act, and Senate Bill 261 (SB 261), which is focused on climate-related financial risk reporting. These measures will have substantial implications for certain businesses operating in California—particularly those with annual global revenues at or above $1 billion and $500 million, respectively.

These carbon reporting rules build on the state’s overall ambitious climate goals, as outlined in the California Global Warming Solutions Act (AB 32). These regulations mandate that companies accurately measure and report their greenhouse gas emissions so that stakeholders, including investors, consumers and the general public, can better understand a company’s environmental impact.

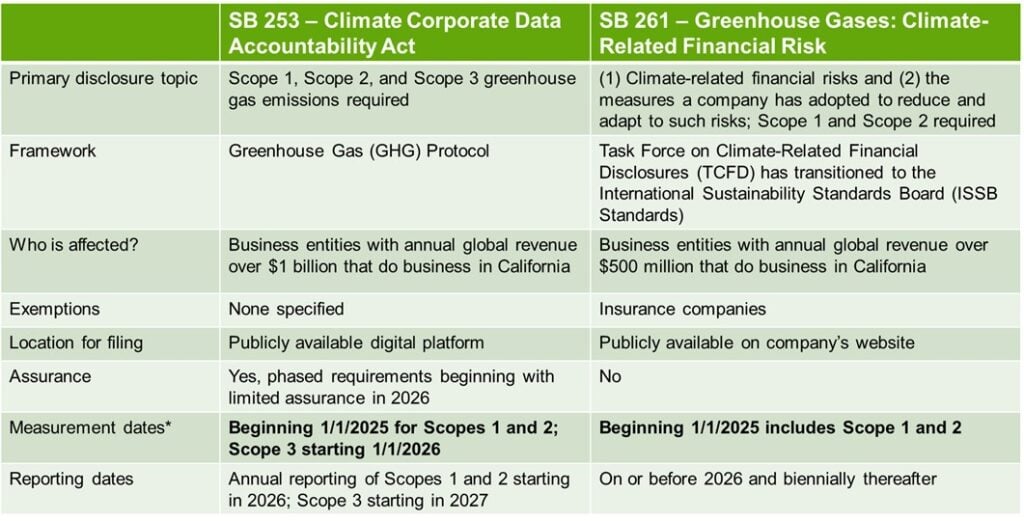

Impacted organizations will need to identify and measure direct and indirect greenhouse gas emissions associated with their operations, including emissions from Scopes 1, 2 and 3, covering everything from on-site fuel combustion to supply chain activities. Below, in Exhibit 1, we outline the key requirements for both SB 253 and SB 261. Exhibit 2 takes a closer look at the definitions of these three different scopes.

Exhibit 1: Key Attributes of the California Climate Disclosure Laws

Exhibit 2: Classifications of Emissions Defined

Scope 1: Direct emissions from the reporting company’s owned facilities and other operations. For example, emissions from consuming combustible fuels for a fleet of vehicles.

Scope 2: Indirect emissions from the use of energy which typically comes from local utility provider.

Scope 3: Indirect emissions not captured in Scopes 1 or 2 that can be attributed to upstream activities (from production and transportation of goods) or downstream activities (from transportation to customers).

Timeline for Compliance: Prepare for Reporting on 2025 Activities in 2026

Impacted companies will need to begin reporting in January 2026. Although that may seem a long way off, planning and preparation should begin now. You’ll need to have your reporting systems in place so you can begin collecting emission data in 2025. A timeline for compliance is outlined in Exhibit 3. By the end of 2024, you will need to have an effective digital infrastructure in place to achieve compliance against the timelines outlined in the legislation.

“Carbon disclosures are not a one-time obligation, but rather an ongoing responsibility. Failure to comply with the reporting requirements can result in financial consequences.”

– Jason Hodell, Cherry Bekaert’s Industrial Manufacturing & Consumer Goods Leader.

Exhibit 3: Timeline for Compliance

Achieving Compliance in Four Phases

Obtaining accurate and comprehensive emissions data—and having the capability to analyze that data—is the key to achieving compliance in this landscape now and into the future. This information is also critical for identifying areas for improvement and establishing realistic future emission reduction targets.

“All reporting is data driven,” says Joe Haehner, Partner, Risk & Accounting Advisory Services. “You will need to develop a data strategy that defines where this information will come from, what systems you will use to prepare reporting, and how much of it can be automated. This will require a solid initial Sustainability Compliance Assessment, which will not be done overnight, unfortunately.”

With the understanding that your data strategy sits at the center of this journey, we break down the four key phases that emerge from there:

- Measure your emissions. The first step is to understand your current carbon footprint, including your own emissions profile and that of your full supply chain. This can be achieved by automating data gathering to both understand your current benchmark and define future goals.

- Analyze your emissions. Once you understand your current emissions profile, you can easily identify target areas for improvement and determine specific steps to efficiently reduce emissions in the future.

- Report emissions and goals with stakeholders. With the work completed around data collection and analysis, it is time to communicate that information to your stakeholders. With clarity around risks and opportunities, transparency and timely reporting are critical.

- Set clear goals to reduce your carbon footprint. Once you have firmed up the processes around the ongoing collection of emissions data, you can leverage science-based targets to set realistic goals to reduce emissions going forward.

Many forward-thinking companies view carbon reporting as an opportunity to align with broader sustainability strategies. “Once you have an assessment of your carbon footprint, this is where the project becomes a bit more fun,” said Hodell. “This is when you start digging into your processes, raw materials, and supply chain components and finding real opportunity to make meaningful change.”

For almost all materially sized companies carbon reporting is becoming an eventuality.

Technology Investment to Meet the Current Challenge and Achieve Future Goals

Meeting the requirements of California’s carbon reporting rules necessitates investment in technology and innovation. With that in mind, corporate emissions dashboards are critical. Companies should also explore advanced carbon accounting software, data analytics tools as well as the appropriate carbon calculator to streamline their data collection and analysis processes. Further, the addition of automation capabilities not only helps to improve accuracy but it also reduces the administrative burden associated with ongoing compliance needs.

Preparing for these carbon reporting rules is not a one-time effort but an ongoing commitment to reporting. Companies should regularly assess their emissions data, reassess reduction goals, and adapt strategies based on changing regulatory landscapes and emerging best practices.

New Regulations Can Translate into Future Opportunity for Growth

California’s new carbon reporting rules present both challenges and opportunities for companies operating within the state. By proactively embracing these regulations, businesses can not only achieve compliance but also contribute to a more sustainable and resilient future. From robust data collection to strategic integration with sustainability initiatives, organizations that invest in carbon reporting infrastructure are well-positioned to thrive in this evolving business landscape.

The SEC’s Rules Released for Climate-Related Disclosures

The U.S. Securities and Exchange Commission (SEC) recently finalized new climate-related disclosure rules that define how public companies should disclose climate-related risks. The rules are more lax than those originally proposed two years ago and are somewhat similar to those of SB 261 in California. The rules call for phased compliance dates for registrants based on filer status.

Although the U.S. Court of Appeals subsequently halted the new climate-related disclosure rule, we recommend that all companies proceed with planning for compliance with the assumption that this will move forward. We will be monitoring the rules and will provide updates as they become available.

Learn more about the SEC rules

“We can be the one-stop-shop—from developing the compliance strategy and doing the initial assessments to helping with implementation, initial and ongoing compliance and developing an audit trail for any third party that might come in.”

– Joe Haehner, Partner, Risk & Accounting Advisory Services at Cherry Bekaert.

How Cherry Bekaert Can Help

Our combined services approach to sustainability and carbon reporting brings together the skills and expertise you need to achieve compliance today and into the future. “You really don’t want to have multiple organizations involved because that gets incredibly difficult to manage,” added Hodell. Our capabilities, backed by certified public accountants, include:

- Carbon Accounting & Reporting

- Carbon accounting platform facilitates verification and audit traceability

- CPA experience in multiple ERPs to efficiently gather data, reducing time and cost

- Life Cycle Assessments

- FSA Credentialed CPAs

- Digital Transformation

- Data and technology requirements management for carbon systems

- Real-time tracking calculators and dashboards

- Official Solution Partners of Salesforce NetZero and Microsoft Sustainability

- Tax Credits & Incentives Advisory

- Obtain credits to finance your renewables projects

- Alternative Energy Tax Credits

- New Markets Tax Credits

- R&D Tax Credits

- Cost Segregation Services

- Site Selection Services

- Obtain state and local tax credits for your new projects

- Obtain economic benefits for expansion, job creation and training, R&D activities, and other qualifying expenditures

Cherry Bekaert can help to accelerate and optimize your compliance program requirements, assisting with carbon calculations and developing your strategic roadmap to lower costs, mitigate risk, improve sustainability performance and drive savings. Our knowledgeable team of energy professionals are ready to guide you in identifying emission sources, enter data, and consolidate your emissions across all your facilities and supply chain partners.

Related Insights

- Article: Carbon Accounting Frequently Asked Questions (FAQs)

- Alert: SEC Finalizes Climate Disclosure Rules: Enhancement and Standardization of Climate-Related Disclosures for Investors

- Article: Yes, Carbon Neutrality Can Drive Profitability

- Article: Regionalization and Carbon Neutrality Strategies Positively Impact Manufacturers

- Case Study: Going Green: How a Manufacturer Can Drive Profits While Reducing Carbon Footprint

- Article: IRS Continues to Issue Guidance for Implementing Clean Energy Tax Credits

- Webinar: California’s Climate Disclosure Laws Are Coming: What it Means for Your Company and How it Can Be a Competitive Advantage