Vehicle electrification remains a hot topic as consumer interest continues to grow. Many incumbent commercial vehicle manufacturers and component suppliers are grappling with how they can best respond to this once-in-a-generation market disruption. These companies will need to find ways to modernize their product offers and business models in the pursuit of maintaining market share. While the path forward is different for every company, our team has found that executives should focus on three key areas: customer value creation, product and technology planning and development, and financial performance and potential.

1. Customer Value Creation: Partner with Customers to Develop End-to-End Solutions

Many fleets have made bold sustainability commitments and goals – while remaining committed to improving total cost of ownership, end-customer satisfaction and their own employees’ satisfaction. To deliver against all these goals, much more than the vehicle’s power-pack will have to change.

No one player has “cracked the case” on an end-to-end electrification solution, but those who focus on first becoming experts in their customers’ end-to-end production processes are the likely winners.

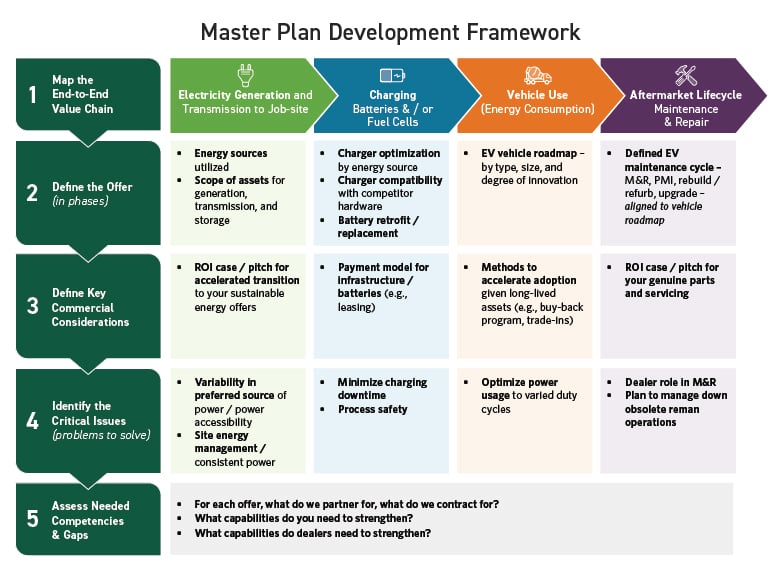

Partnering with customers to understand goals and priorities, and to define jointly how their end-to-end processes can evolve for electrified vehicles, will be key to achieving market adoption. For example: How will electricity be generated and transmitted at the depot, at the jobsite, etc.? How will EV drivetrains impact vehicle uptime and duty-cycle performance (and what compromises may need to be made)? Where will vehicles be charged (at depots, during routes, etc.)? How will vehicles be repaired and maintained to ensure uptime – and by whom?

This range of issues spanning customers’ processes, as well as how manufacturers and suppliers will address these needs, can be tackled with a master plan that clarifies a wide range of issues with flexibility to evolve as more is learned.

2. Product & Technology: Embrace Optionality and Be Willing to Partner in Testing Demonstration Units

With millions of dollars already being invested on new electrification technology and product development, it is understandable that CTOs, R&D leaders and product planners want to “pick a winner”.

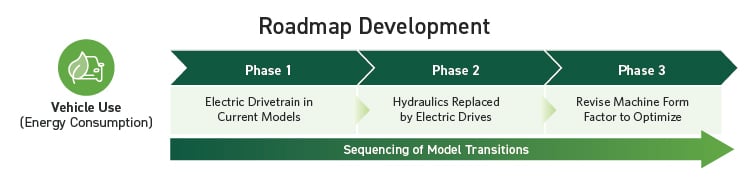

Distinct vocations with disparate duty-cycle requirements – school and transit buses vs. refuse vehicles vs. mining and construction equipment – will necessitate offering a portfolio of different solutions to address distinct customer segment needs and ensure optionality as demand evolves. Managing this complexity requires technologists and product planners to develop roadmaps that integrate the “pull” of the Market (requirements and drivers shared by customers) with the “push” of Technology evolution (capabilities and readiness/feasibility) into a set of Product Plans/Visions and Action Plans that indicate the pace of development and when critical issues will be addressed.

For example, consider the sequencing of upgrading current vehicle models with conventional powertrains into a fully electrified and optimized vehicle architecture. Building in the optionality of multiple technologies and products necessitates embracing customers and ecosystem partners (suppliers, technology affiliates, etc.) in the development process to test and iterate demonstration units and prototypes jointly in concept validation and each target beachhead market, ahead of advancing to the production process and factory validation stage-gates.

3. Financial: Understand How Profit Pools Will Change and Communicate Strategy & Timelines to Temper Investors’ Expectations

Investors recognize that it is imperative to shift to electrified vehicles over the next decade, and they are beginning to recognize what manufacturers & suppliers have known for years: there will not be a one-to-one conversion of profit pools.

Take, for example, aftermarket parts sales, a high-margin annuity that many manufacturers & suppliers rely on to drive earnings performance. Battery electric drive trains require fewer parts and have far less frequent maintenance and repair needs (no oil & filter changes) as compared to conventional internal combustion drivetrains. To offset this decline, a whole new portfolio of services can both strengthen your end-customer relationships and deliver new profitable growth annuities. For example: battery leasing programs, charging infrastructure financing and installation services, maintenance and repair outsourcing services or technician upskilling programs, etc.

The clear reality of the electrification transition in commercial vehicles over the next decade-plus means all commercial vehicle players must develop a response to retain and expand their financial potential to deliver value to shareholders. Given the uncertainty, companies need to communicate their electrification strategy and the timing of how it will unfold, rather than surprising the market (and competitors) with a splashy production-ready launch.

The journey to mass-market EV adoption in commercial vehicle markets is long and far from over. While it comes with many challenges, companies that act quickly and boldly to reimagine how they can position themselves to deliver customer value will be rewarded with favorable perception amongst investors.