One certain aspect of COVID-19 is the massive cloud of uncertainty it overcasts on many facets of the U.S. economy. The pandemic has dealt an enormous blow to the labor markets, consumer spending, and business investments. As a result, the Federal Reserve projected in early June a 6.5% contraction in the 2020 U.S. GDP1 — a grim outlook that could in fact be best-case scenario should a second coronavirus wave break out. A further indication of the dire economic conditions arose with the International Monetary Fund (“IMF”) recently stating it thinks global GDP will shrink by 4.9% during 20202, downgrading its estimate from April of a 3% decline.

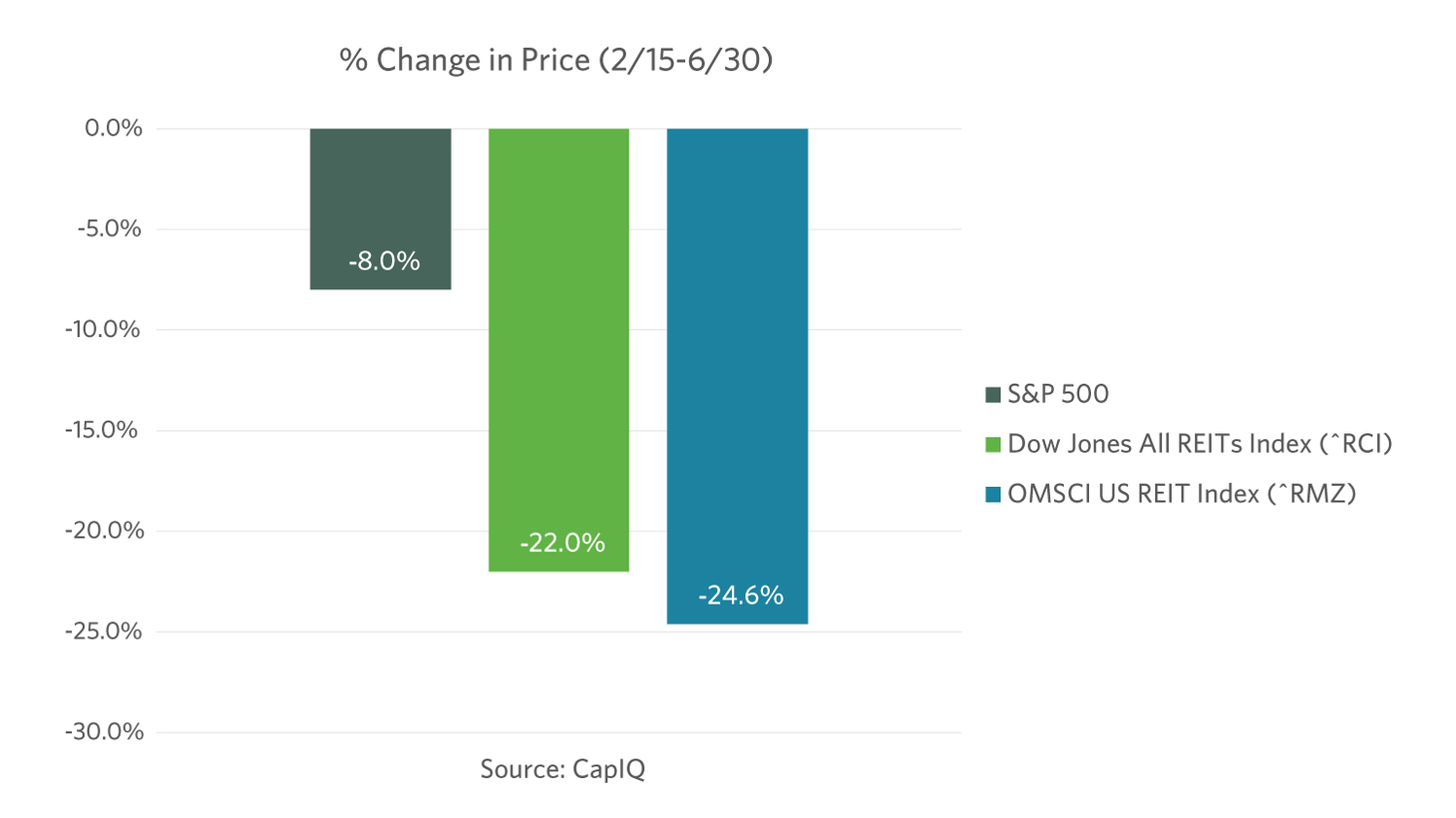

The real estate industry, in particular, has been impacted tremendously — hospitality, retail, office, housing, and restaurants have all been part of the economic segments hit the hardest during the pandemic. In fact, as shown below, while the overall market (“S&P 500”) has regained, through June 30, most of the price loss during the sharp COVID-19 economic shock of March/April, REITs have lagged behind. While the S&P 500 has exhibited an impressive comeback (from down -33.6% to -8.0%), the REIT indices have struggled to climb back from their low points of -43.2% and -44.1%, posting a modest recovery to the level of -22.0% and -24.6%, respectively.

Financial Statement and Tax Impact

Can the real estate sector experience a recovery similar to that of the overall market in the near term? Hard to predict of course, especially under such tumultuous market conditions, but many financial experts expect the inherently lagging real estate industry to report potentially significant impairment losses for REITs and real estate funds, whose current fiscal year includes the prospective effects of COVID-19 as a “triggering event”, in accordance with the Financial Accounting Standard Board (“FASB”) Accounting Standards Codification (“ASC)” ASC 360 Property, Plant, and Equipment.

Moreover, unfavorable markdowns are expected for entities holding various types of investments in real estate deals, typically in the form of debt positions and fractional ownership interests (i.e., preferred/common units or general/limited partner interests) and meeting the criteria of an investment company under ASC 946 Financial Services-Investment Companies. Under ASC 946, investment companies are required to report their assets at fair value3 and mark to market as of each of their financial reporting dates with the change in fair value flowing through the income statement.

But there is a silver lining — unfavorable and distressed economic conditions combined with a high-degree of financial markets uncertainty support lower valuations for estate and gift tax planning purposes, which typically involve a host of investments in real estate properties and deal structures — frequently favored as investment vehicles by high net-worth investors.

Impairment Testing — Long-Lived Real Estate Assets

Unlike indefinite-lived intangible assets (i.e., goodwill), long-lived assets (i.e., property, plant, equipment, and finite-lived intangible assets) are not subject to annual impairment testing but rather, in accordance with ASC 360-10-35, when “triggering” events or changes in circumstances indicate the underlying net carrying amounts may not be recoverable. COVID-19 has and may continue to take its toll on real estate values and therefore it is imperative for real estate entities to consider potential impairments.

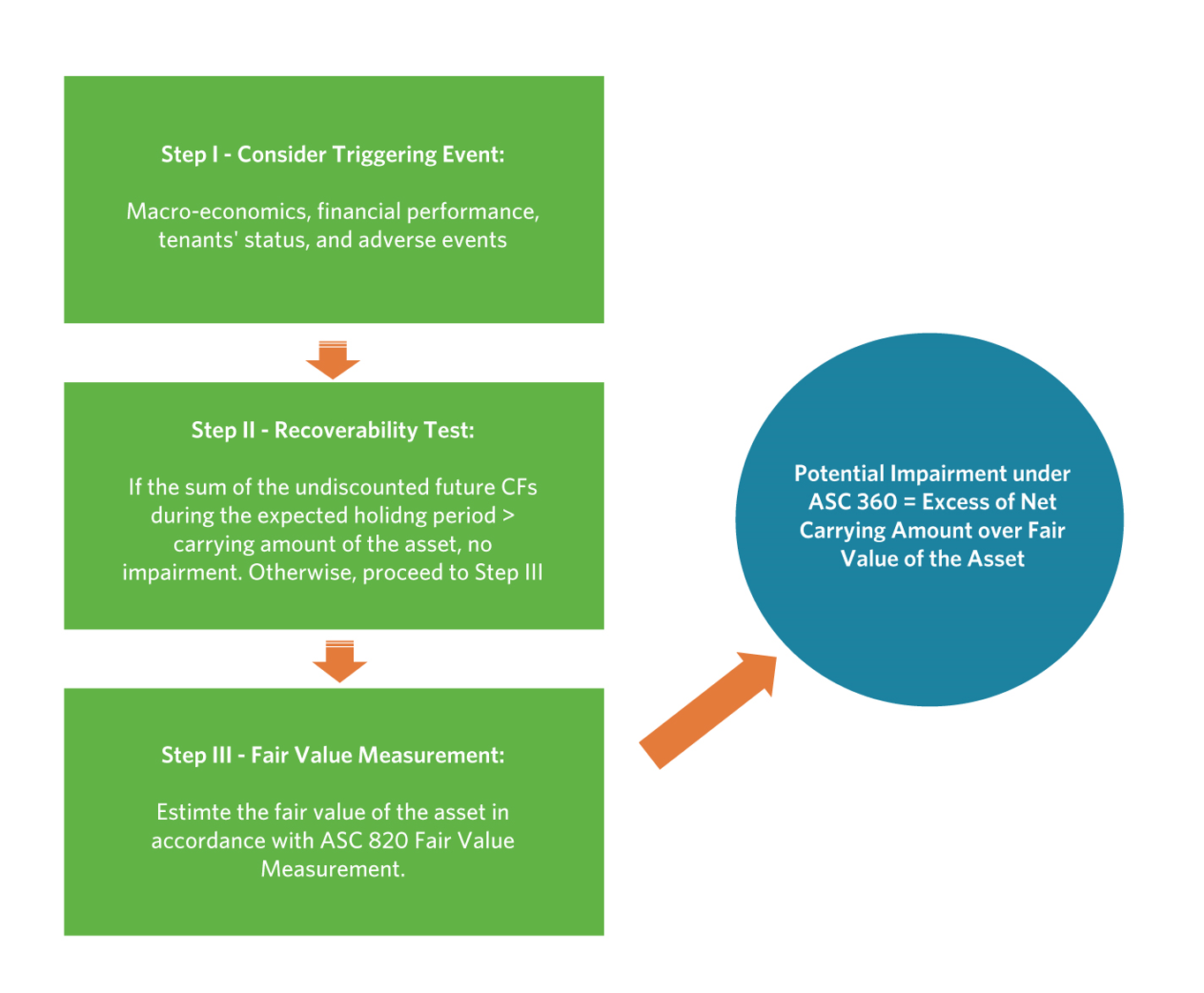

COVID-19 and the potential for interruption of cash flows, for example, may be considered a triggering event. The net carrying amount of an asset (or asset group) is not recoverable if it exceeds the sum of the undiscounted cash flows associated with the use and eventual disposition of the asset. If the asset is not recoverable, an impairment loss is recognized representing the excess of the net carrying value of the asset over its fair value. ASC 360 Property, Plant, and Equipment, prescribes a three-step process for impairment testing as follows:

One critical input to the recoverability test (Step II) and fair value measurement (Step III) is the expected holding period at the asset level. ASC 360 stipulates that this assumption must be the remaining life from the perspective of the owner and accordingly, even though the remaining economic useful life of an asset may be in excess of 20 or 30 years, typical for real estate properties, the assumed holding period within the context of Steps II and III could be much shorter. The facts and circumstances surrounding the asset and its operations, all from the owners’ point of view, will dictate this determination.

Potential Savings — Estate and Gift Tax Planning

With the real estate industry lagging behind in its recovery from the COVID-19 economic shock, according to many financial and real estate experts the effects of which will last well into the mid- to long-term future, lower valuations at the real estate property level could lead to significant tax savings — if planned appropriately.

Fair market value of a fractional ownership interest, defined by U.S. Treasury Regulation Section 20.2031-1(b)4, may be significantly different than its pro-rata share of the underlying net asset value (“NAV”) of the entity owning the subject real estate property. The difference in value may be attributable to contractual rights and obligations, priority of distributions, and the lack of control (“LOC”) and lack of marketability (“LOM”) inherent in a fractional interest. Uncertainty in the financial markets along with distressed economic conditions and liquidity glitches may support higher-than-normal LOC and LOM discounts for non-controlling ownership interests in privately held entities.

Current market conditions, low valuations at the asset level, and higher-than-normal LOC & LOM discounts, combined with the current estate, gift and generation skipping tax exemption of $11.6 million ($23.2 million for married couples)5 provide a window of opportunity to maximize savings associated with the transfer of wealth that might normally be subject to estate, gift and/or generation skipping tax. For many closely held business owners, gifting a portion of their business and taking advantage of this unique opportunity can be an incredibly effective way to transfer wealth to the next generation.

How Can Cherry Bekaert Assist

Valuation for financial reporting and tax planning purposes can be complex. Our valuation advisory and tax consulting teams consist of highly experienced professionals. At Cherry Bekaert, we are committed to staying abreast of market conditions and potential opportunities. Our philosophy of making a real difference for our clients begins with building strong relationships with our professionals based on trust, mutual respect, uncompromising integrity and a shared passion for excellence in all that we do. We affirm to you our commitment to ensure timely, quality service delivered by a dedicated team of conscientious professionals.

Related Resources

References

1 The Federal Reserve June 10, 2020 FOMC Projections.

2 The International Monetary Fund, World Economic Outlook Update June 2020 issued on June 24, 2020.

3 In accordance with ASC 820 Fair Value Measurement.

4 Defined as “The price at which property would change hands between a willing buyer and a willing seller, when the former is not under any compulsion to buy or to sell, and both having reasonable knowledge of the relevant facts.”

5 Such exemptions are due to sunset in 2026.