The Federal government has used Working Capital Funds (WCFs) for over 100 years. They established the first revolving fund around 1878 for the Navy.

The ultimate objective of WCFs is to eliminate duplication of services by leveraging economies of scale, streamlining and standardizing business processes, simplifying funding and consolidating acquisition strategies. Lack of line of sight into operations may compromise these objectives and distract from the focus on high-quality service delivery.

Despite their existence for over 100 years, WCFs still consistently face difficult questions:

- Can your operations run without knowing the true cost/rates of goods and services?

- Are you aware if your clients have made timely payments for the products and services you provided?

- Is your operating model recovering the entire cost of operations, and are you allocating overhead accurately?

- Do you have the correct governance model in place to aid in the financial decision-making process?

- Can your financial model adapt to different customers and changes in supply and demand?

WCFs offer great flexibility across a wide range of services provided and customers supported. As a result, total cost visibility is necessary to support continuous improvement in cost and performance in delivery of services. This requires WCFs to convert a wide array of financial, operational and performance data into analytics that provide valuable insights to inform data-driven decision making.

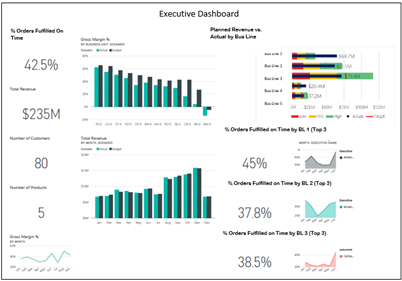

Our WCF Analytics solution provides a direct line of sight into metrics that matter, so that executives and managers can analyze their operations effectively. A sample report from our WCF analytics below provides:

- Overview of products/services sold

- % of orders sold on time (based on agreed upon SLAs)

- Planned revenue vs. actual revenue, etc.

These and other metrics (unobligated balances, carryover, reserves, etc.) will help your operations target and rapidly improve inefficiencies.

Comprehensive WCF Review

Based on our Working Capital Funds experience across the Federal government, we have developed a high-level assessment to evaluate current financial and operational processes and identify opportunities for improvement. We recommend a 60 to 90-day approach to assess your WCF to:

- Confirm that existing financial policies and procedures are complete and comply with applicable laws/regulations/guidelines.

- Review the WCF governance model for adequacy in driving operational efficiency and effectiveness and reinforcing trust with customers and external stakeholders.

- Determine whether costing and pricing methods are fair, reasonable and transparent.

- Analyze WCF budgeting and forecasting processes as well as risk mitigation strategies.

- Create a reporting framework/dashboarding initiatives to keep managers and executives appraised of key performance indicators.

During this high-level assessment, we evaluate performance against an objective list of criteria contained in a scorecard. We also compare performance and key metrics to those of other similar WCFs. The assessment will follow a structured analysis approach, including:

- Current State Analysis

- Gap Analysis

- Recommendation Development

Cherry Bekaert Understands Working Capital Funds

As an industry leader in financial management, our team includes recognized experts in Working Capital Funds, Revolving Funds and Fee for Service agencies. Our team has partnered with the National Academy of Public Administration (NAPA) to develop the first-ever interagency Working Capital Fund Managers symposium, among other landmark initiatives. We welcome the opportunity to discuss our capabilities.

Cherry Bekaert’s proven and repeatable WCF Analytics methodology can:

- Increase transparency in full cost of operations and related overhead.

- Improve cycle times for payables/receivables, DSO/DPO, etc.

- Identify optimum payment cycles.

- Assist with rate stabilization (beginning of FY) and cost recovery (end of FY).