Contributors: Jennifer Moran, Manager, Audit & Attestation

The Office of Management and Budget (OMB) released the 2023 Compliance Supplement (Supplement) in May of 2023. This version of the Supplement is effective date for fiscal years beginning after June 30, 2022. Below we highlight the most impactful federal program specific changes and changes in submission of your single audit results.

Federal Program Specific Changes

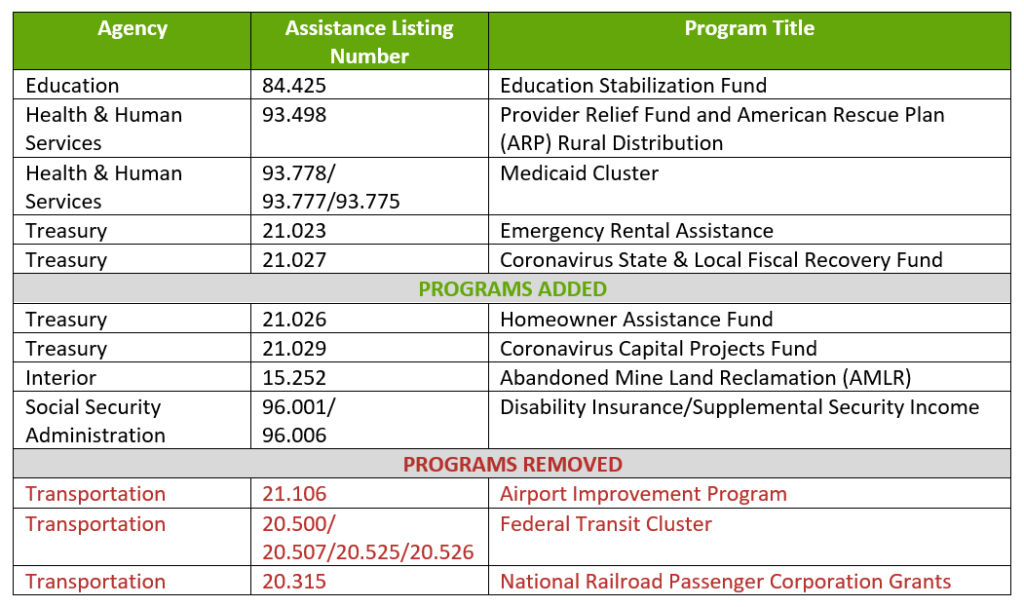

The 2023 Compliance Supplement saw noteworthy changes in a few areas. Most impactful of these include an update to programs designated as “higher risk”, the decoupling of the Highway Planning and Construction Cluster, eleven new programs being added to the supplement, and continuation of the Alternative Compliance Examination Engagement option related to the Coronavirus State & Local Fiscal Recovery Fund (ALN #21.027).

Higher Risk Programs Update

Highway Planning & Construction Cluster Decoupling

Formerly, assistance listing numbers (ALN) 20.205/20.219/20.224/23.003 were identified as a cluster to be considered as one program for major program evaluation and testing under Uniform Guidance. The 2023 Supplement has decoupled this cluster, whereby each program now stands on its own, to be evaluated and tested separately under the Uniform Guidance criteria.

Eleven New Programs

Department of the Interior

- 15.252 – Abandoned Mine Land Reclamation (AMLR) Grants

Department of Transportation

- 20.327 – Railroad Crossing Elimination

- 20.532 – Passenger Ferry Grant Program, Electric or Low-emitting Ferry Pilot Program, and Ferry Services for Rural Communities Program

- 20.533 – All Stations Accessibility Program

- 20.534 – Community Project Funding Congressionally Directed Spending

- 20.708 – Natural Gas Distribution Infrastructure Safety and Modernization Grant Program

United States Treasury

- 21.011 – Community Development Financial Institutions Capital Magnet Fund

- 21.012 – Native Initiatives Program

- 21.024 – Community Development Financial Institutions Rapid Response Program

- 21.025 – Community Development Financial Institutions Small Dollar Loan Program

- 21.032 – Local Assistance and Tribal Consistency Fund

Agency Program Requirement Changes

Changes were made to several agency program requirements. Programs affected by changes are listed in Appendix V of the Supplement. It is also noteworthy that because of COVID-19, there are still some waivers in effect to traditionally required elements of programs. Included in this category are USDA Waivers which can be found at supplement 10.000, HUD waivers throughout the 14.xxx programs, and waivers in the Education programs at 84.xxx. Even with long existing programs, best practice is to familiarize yourself with the requirements of the relevant compliance supplement.

Alternative Compliance Examination Engagement – Coronavirus State & Local Fiscal Recovery Fund (ALN #21.027)

Many recipients of Coronavirus State & Local Fiscal Recovery Fund monies have found they are now required to have a single audit for the first time. In response to this, the OMB has allowed for an alternative approach for eligible recipient of these funds. This alternative approach is meant to reduce the burden of a full single audit on both recipients and practitioners. There are certain criterium that must be met to qualify for this option which are identified in the agency program requirements within the Supplement, under the Other Information section, and in Part 8, Appendix VII – Other Audit Advisories.

General Services Administration taking over Federal Audit Clearinghouse

Historically, the Federal Audit Clearinghouse (FAC) has maintained the government-wide database of single audit results and related federal award information; served as the repository for single audit reports; and distributed single audit reports to federal agencies. On October 1, 2023, the provider will change from FAC to the U.S. General Services Administration (GSA). At that time, all submissions will need to be made through the new FAC hosted by GSA, including all single audits for entities with 2023 FYE dates. Any draft not fully submitted to the Census FAC before September 30, 2023, may need to be completely re-started at the new GSA FAC. The FAC Web site and up to date information on the transition is at www.fac.gov. For fiscal periods ending between January 1, 2023, and September 30, 2023, the 30-day requirement that the single audit report be submitted to the FAC has been waived. These audits will be considered on time if submitted within nine (9) months of the entity’s fiscal year end.

The AICPA has estimated that the number of non-federal entities needing single audits, and therefore utilizing the Compliance Supplement, has almost doubled due to COVID-19 and other funding. If you are new to this funding, it is important that you select both auditors and advisors that are familiar with the myriad of rules and requirements that come with this funding.

Cherry Bekaert is one the largest providers of single audits in the country, performing almost 200 annually. Our Government and Public Sector advisory practice provides end-to-end grants management solutions for a wide variety of non-federal entities across the country.

If you’re in need of a single audit or assistance with your federal funds, please contact us.