Insights

Recent Insights

Article

November 9, 2022

What you need to know as the IRS increases penalties for understatement of taxes in transfer pricing cases, including transfer pricing documentation.

Article

November 9, 2022

Learn more about Microsoft SSPA requirements, how to engage an independent assessment, data protection requirements and how to reach compliance.

11:47

Listen to our podcast as we share exciting Salesforce solutions, trends and key takeaways from Dreamforce 2022.

Article

November 4, 2022

Learn key data areas to focus on and roadblocks that can stand in the way when expanding your business internationally.

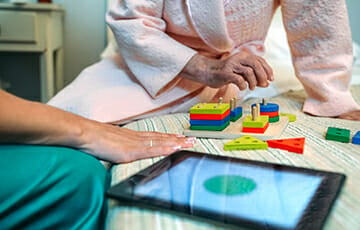

Case Study

October 31, 2022

Learn how we helped the Alzheimer’s Association implement Tableau to improve efficiency and accuracy in reporting and speed to insights.

Newsletter

October 25, 2022

Learn more about the new FASB Accounting Standard Update issued during Q3 of 2022. Get professional insights on other recently effective ASUs.

Article

October 20, 2022

Learn the role of data and analytics, where and how to get started using it & how to interpret the insights to drive successful digital transformation for your business.

Webinar Recording

October 20, 2022

Watch our webinar to understand which states have Pass-Through Entity Tax Elections available and how to determine if your business could qualify.

15:21

Speakers: Neal W. Beggan

Listen to our podcast to learn a few common mistakes that often occur during the development of the annual internal audit plan.

20:10

Speakers: Michael Ludwig, Cameron Smith

Listen to our podcast to learn more about the challenges and opportunities for private equity investors executing MSO/DSO roll-up strategies.